In this video we discuss three things you need to know about your 401k.

This Video Contains:

401k, roth 401k, 401k plan, employer benefits, employee benefits, understanding benefits, employee benefits explained, financial advisor, personal finance, personal finance tips, personal finance for beginners, 401k plan, simple ira, sep ira.

Disclaimers & Disclosures:

This content is for education and entertainment purposes only. Past performance is not indicative of future results. Securities and advisory services offered through Silver Oak Securities, Inc, Member FINRA/SIPC. Silver Oak and Defining Wealth Partners are separate entities….(read more)

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

When it comes to planning for retirement, one of the most valuable tools at your disposal is your 401(k) plan. This employer-sponsored retirement account allows you to save and invest money for your future, providing a tax-advantaged way to build a nest egg. However, understanding how a 401(k) works and utilizing it effectively can be complex. Here are three important things you need to know about your 401(k).

1. Take Advantage of Employer Matching Contributions:

One of the most significant benefits of a 401(k) plan is the potential for employer matching contributions. This means that your employer is willing to match a percentage of the amount you contribute to your retirement account, up to a certain maximum. For example, if your employer offers a 50% match on the first 6% of your salary, and you make $50,000 per year, contributing at least $3,000 would result in an additional $1,500 contributed by your employer. This is essentially free money that can significantly boost your retirement savings.

2. Understand Your Investment Options:

401(k) plans often offer a range of investment options to choose from, which can include stocks, bonds, mutual funds, and target-date funds. It is essential to understand these options and determine the optimal investment mix for your financial goals and risk tolerance. Keep in mind that your investment allocation should be reviewed periodically to ensure it aligns with your changing circumstances. If you’re unsure about which funds to choose or how to diversify your investments, seeking professional advice from a financial advisor may be beneficial.

3. Maximize Your Contributions:

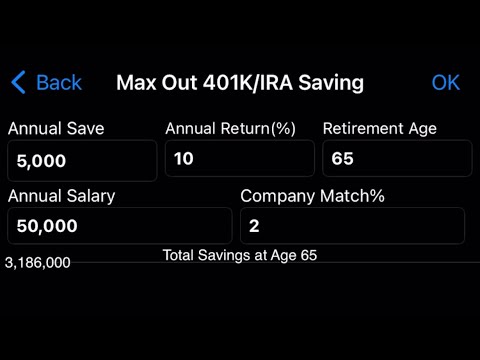

In order to make the most of your 401(k) account, it’s important to contribute as much as you can comfortably afford. The maximum annual contribution limit for 2021 is $19,500 if you are under 50 years old, and $26,000 if you are 50 or older (including catch-up contributions). By maximizing your contributions, you can take full advantage of the tax benefits and compound growth potential that a 401(k) offers. If you are unable to contribute the maximum amount, try to contribute at least enough to receive your employer’s full matching contribution to avoid leaving valuable money on the table.

In conclusion, your 401(k) plan is a powerful tool that can help secure your financial future in retirement. By understanding the basics, such as employer match contributions, investment options, and contribution limits, you can make informed decisions and maximize the potential of your retirement savings. Don’t overlook the importance of your 401(k) and start taking advantage of its benefits today. The earlier you start saving and investing, the brighter your retirement future will be.

0 Comments