A 403(b) savings plan is an employer sponsored retirement plan for employees of school districts, governmental organizations and other 501(c)(3) nonprofit employers. While its counterpoint for employees of private employers, the 401(k) plan, is similar, there are some distinct differences are worthy of discussion.

In this video, MemberMinds host Tom Nugent talks with Richard Ford, Chief Marketing Officer at PlanMember. They discuss:

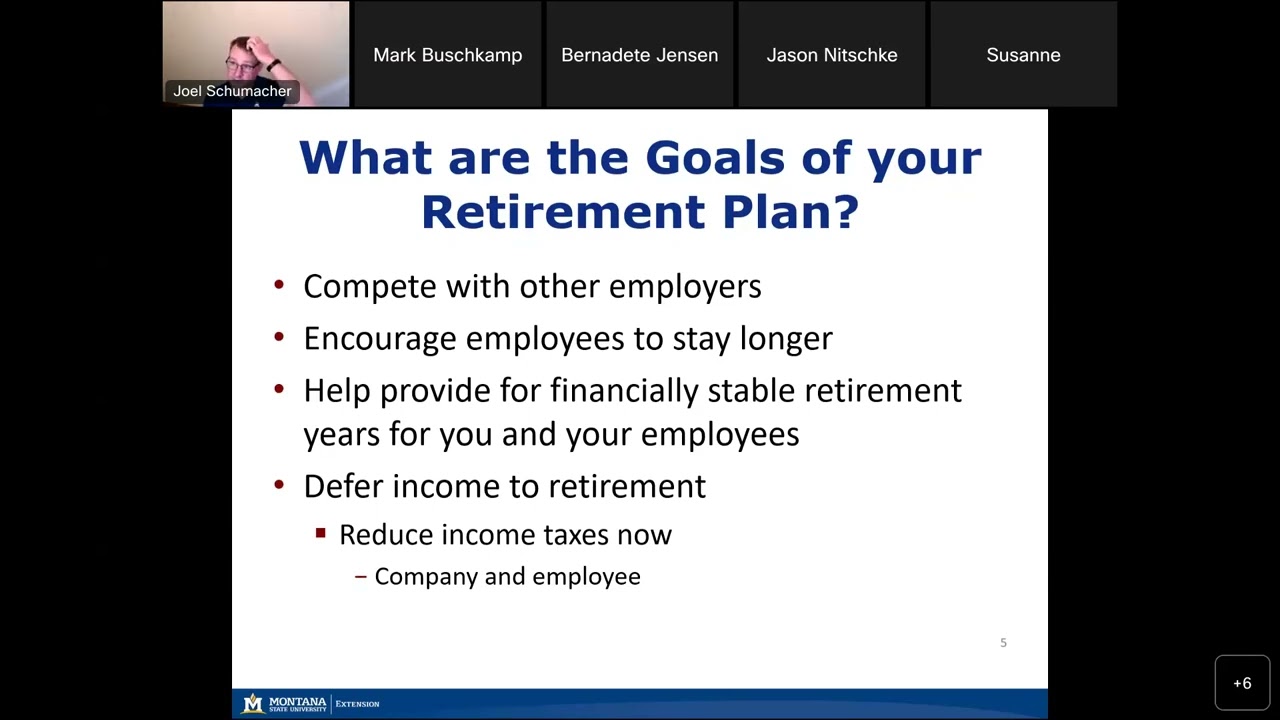

• What exactly a 403(b) is and who can contribute to one

• Tax-advantages of a 403(b) and concurrent 457 contributions

• 403(b) Roth options and other additional 403(b) features

To get further insight about 403(b)’s and to find out if one might be right for you, please contact your PlanMember Financial Professional.

www.planmember.com…(read more)

LEARN MORE ABOUT: Retirement Planning

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

0 Comments