Watch our next webinar to discover how to use whiteboard videos like this to grow your financial advisory practice:

A good retirement plan should be the same as a pyramid, built slowly over many years with diligent, responsible investing…

A strong base that serves as the cornerstone of the entire building.

A 403(b) plan, also known as a Tax-Sheltered Annuity Plan, is a retirement plan offered by public schools and certain non-profit organizations.

Much like a 401(k), participating in 403(b) benefit plan is only through payroll deduction and is invested Pre-Tax.

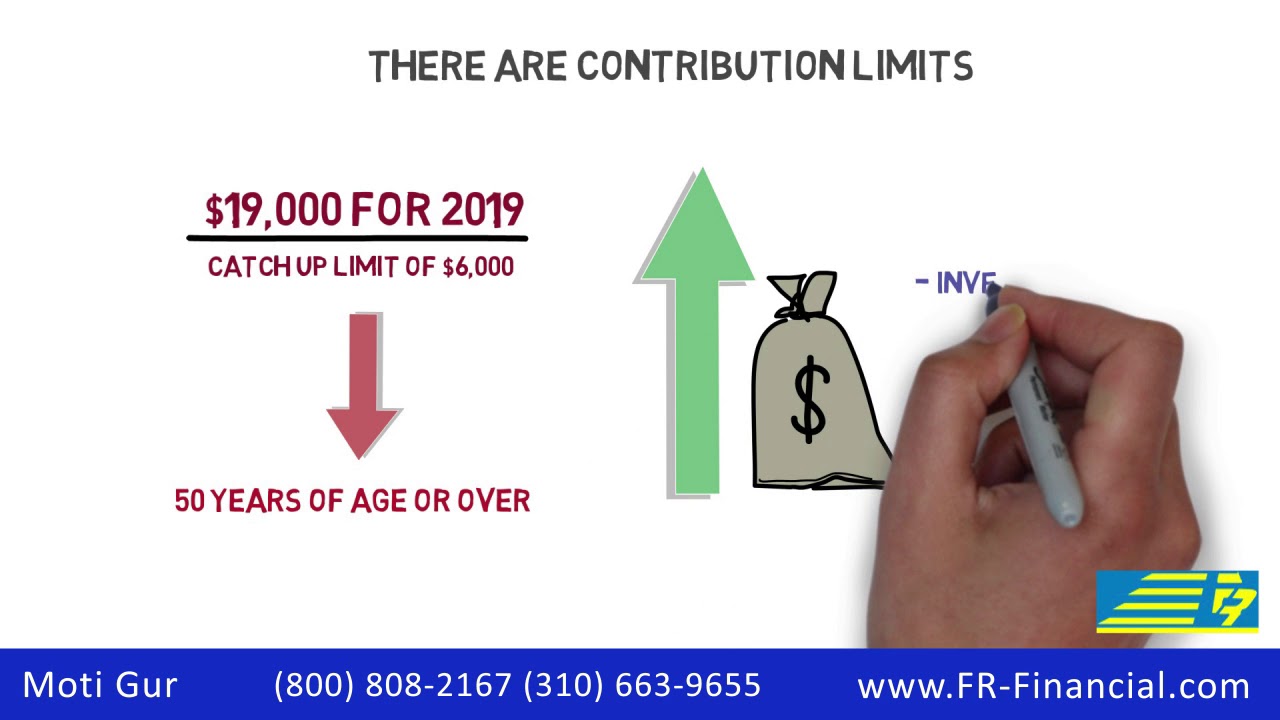

There are contribution limits – $19,000 for 2019 with an additional catch up limit of $6,000 if you are 50 years of age or over.

During the accumulation period, your money grows tax deferred – through investments offered by the plans, typically annuities and mutual funds.

The 403(b) retirement benefit also provides for a tax – free loan of a maximum of 50 percent of the cash value, not exceeding 50,000 dollars.

By age 59.5, you can begin withdrawals penalty-free, but subject to ordinary income tax. Call us today to learn more.

…(read more)

LEARN MORE ABOUT: Retirement Planning

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

0 Comments