![]()

#csrsretirement #csrspension #csrssickleave In this video we discuss CSRS retirement eligibility, how to calculate a federal employee’s average High-3 for retirement pension, and CSRS sick leave conversion.

Retirement Benefits Institute has trained thousands of federal employees as they make plans for federal retirement. For more information about your federal retirement benefits, go to our website at to get support.

The information contained in this video should not be used in any actual transaction without the advice and guidance of a tax or financial professional who is familiar with all the relevant facts. The information contained here is general in nature and is not intended as legal, tax or investment advice. Furthermore, the information contained herein may not be applicable to or suitable for the individuals’ specific circumstances or needs and may require consideration of other matters. RBI is not a broker-dealer, investment advisory firm, insurance company, or agency and does not provide investment or insurance-related advice or recommendations. Brandon Christy, President of RBI, is also president of Christy Capital Management, Inc. (CCM), a registered investment advisor….(read more)

LEARN MORE ABOUT: Retirement Pension Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

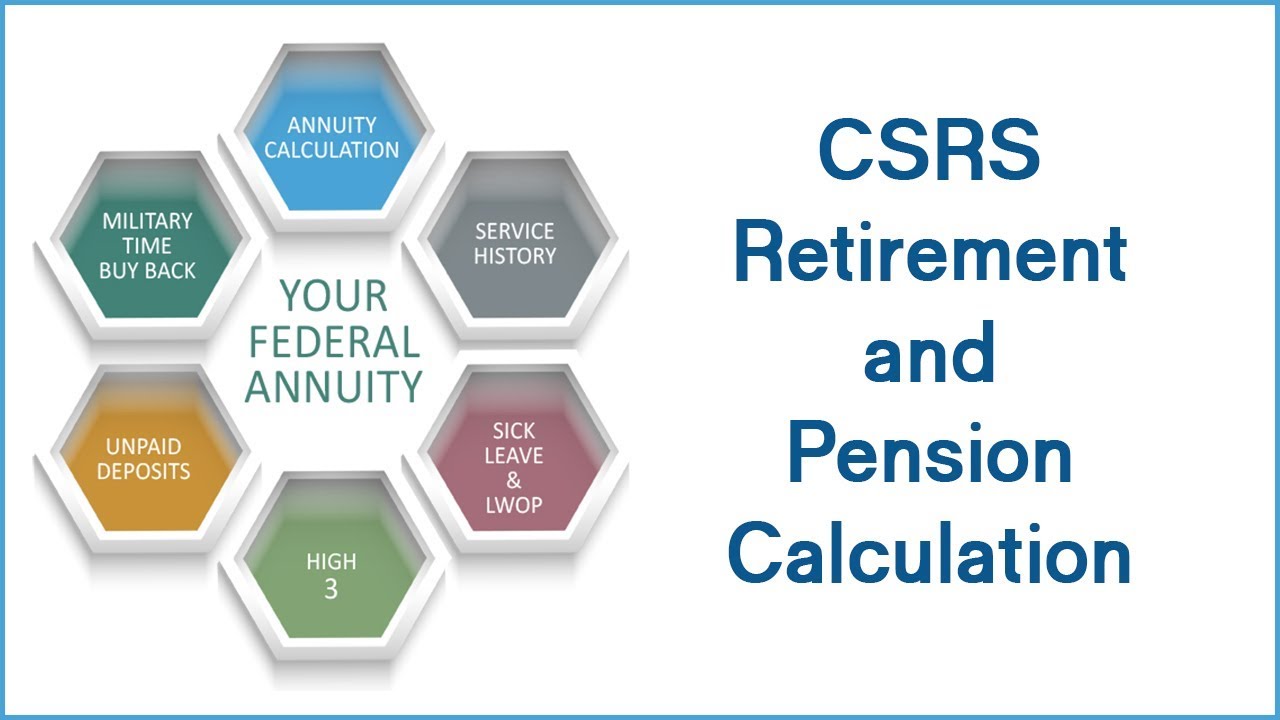

CSRS Retirement and Pension Calculation Explained

As federal employees, those under the Civil Service Retirement System (CSRS) contribute to a pension plan that will provide them with a comfortable retirement. The CSRS retirement and pension calculation is an essential aspect of this system, determining the amount of money an individual will receive throughout their retirement years. Let’s take a closer look at how the CSRS pension is calculated and what factors come into play.

To begin with, the CSRS pension is a defined benefit plan, meaning the retirement income is based on a fixed formula rather than contributions made throughout one’s career. Hence, the calculation focuses on three main factors: years of service, high-3 average salary, and the CSRS annuity formula.

Years of service play a crucial role in determining the size of a CSRS pension. The longer a federal employee has served, the higher their pension will be. The CSRS system awards one’s “creditable service” for each year of employment, including both full-time and part-time work. Typically, federal employees who have completed at least five years of service are eligible for a pension.

The high-3 average salary is another key factor in the CSRS pension formula. It refers to the average salary earned over the course of an employee’s three consecutive years with the highest earnings. This average is adjusted for inflation using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The higher the high-3 average salary, the greater the pension payout will be.

Finally, the CSRS annuity formula calculates the actual pension amount based on the above two factors. For employees who completed fewer than 20 years of service, the formula is as follows: 1.5% of the high-3 average salary multiplied by the years of service. For those who served more than 20 years, an additional 1% is added to the formula. As an example, someone with 30 years of service would receive a pension of 30% of their high-3 average salary.

To illustrate further, let’s consider an employee who retired after working for 35 years with a high-3 average salary of $100,000. If this person falls under the category of having more than 20 years of service, their pension would be calculated as follows: 1.5% of $100,000 (equal to $1,500) multiplied by 20 years (equal to $30,000) plus 1% of $100,000 (equal to $1,000) multiplied by the additional 15 years (equal to $15,000). Hence, their total annual pension would be $45,000.

It’s crucial to note that the CSRS pension is subject to deductions, such as the amount contributed to Social Security and the Federal Employee Retirement System (FERS) Special Retirement Supplement for those eligible. Moreover, the cost-of-living adjustments (COLAs) are applied to the pension, allowing it to keep pace with inflation and ensuring retirees’ purchasing power remains intact over time.

Understanding the CSRS retirement and pension calculation is vital for federal employees planning their financial future. By considering their years of service, high-3 average salary, and applying the CSRS annuity formula, individuals can estimate their pension and make informed decisions about their retirement plans based on their expected income.

What happen if you are long time workman's comp. 23 years +