![]()

(Nabers Group) 877-SOLO-401K. The owner of the world’s only full service self directed IRA & 401k provider presents the advantages of an Unlimited Solo 401k. This is a retirement account that is legally able to invest in gold, real estate, private companies, mortgages, LLCs, and virtually anything else.

This part explains investment options for the Self Directed IRA & Self Directed Solo 401k….(read more)

LEARN MORE ABOUT: IRA Accounts

CONVERTING IRA TO GOLD: Gold IRA Account

CONVERTING IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Part 2 of Solo 401k vs. Self Directed IRA – Investment Options

In the previous article, we discussed the key differences between a Solo 401k and a Self Directed IRA. While both retirement accounts offer unique benefits, one of the most important factors to consider when choosing the right plan for your individual needs is the investment options available within each account.

Solo 401k Investment Options:

The Solo 401k is a powerful retirement savings vehicle that provides a wide range of investment options. One of the key advantages of the Solo 401k is its ability to invest in a variety of assets, including stocks, bonds, mutual funds, real estate, precious metals, and private equity. This level of investment flexibility allows individuals to diversify their retirement portfolio and potentially achieve higher returns.

Additionally, the Solo 401k allows for checkbook control, which means that account holders have the ability to write checks and make investments on behalf of their retirement account without the need for custodian approval. This level of control can be beneficial for individuals who want to take a more hands-on approach to managing their retirement savings.

Self Directed IRA Investment Options:

Similarly, a Self Directed IRA also offers a wide range of investment options, including real estate, precious metals, private equity, and other alternative investments. However, unlike the Solo 401k, a Self Directed IRA typically requires a custodian to approve and oversee all investment transactions. This may limit the level of control and flexibility that individuals have over their retirement investments.

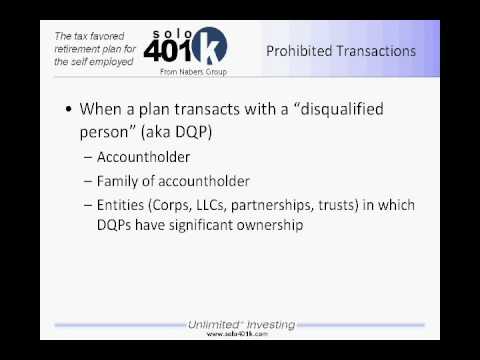

Furthermore, Self Directed IRA accounts are subject to certain restrictions and prohibited transactions, which can make it more challenging for individuals to navigate the complex rules and regulations surrounding alternative investments. This may result in additional costs and administrative burden for account holders.

Conclusion:

When it comes to investment options, both the Solo 401k and Self Directed IRA provide a wide range of choices for individuals looking to diversify their retirement portfolios. However, the Solo 401k offers greater control and flexibility, particularly with checkbook control, which may be appealing to individuals who want a more hands-on approach to managing their retirement savings.

Ultimately, the choice between a Solo 401k and a Self Directed IRA will depend on an individual’s unique financial goals, risk tolerance, and investment preferences. It is important to carefully consider the specific investment options and administrative requirements of each account before making a decision. Consulting with a qualified financial advisor or tax professional can also provide valuable guidance in selecting the right retirement plan for your individual needs.

0 Comments