![]()

Roth IRA!

Today’s video is a full in-depth video on the ROTH IRA.

I cover the history of it, when it was started, and why.

I’ll cover their requirements, income contribution limits, income allowed to make before not qualifying for them.

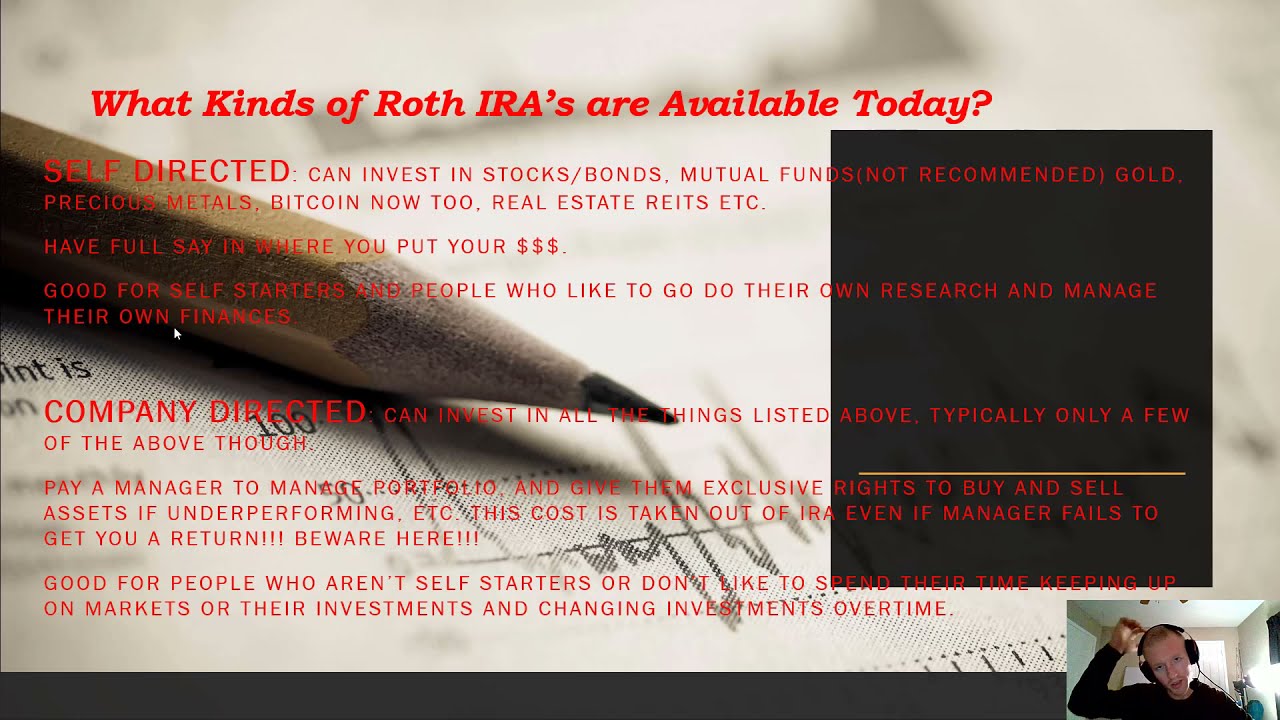

Also, I go over the types of Roths available to everyone, and how each works.

Anything you would need to know before starting a Roth IRA for yourself, your spouse, and or your children is in this video and will be covered in depth to get you rolling on your journey of FINANCIAL INDEPENDENCE!

IF YOU WANNA RETIRE EARLY AND COMFORTABLY, CHECK OUT TODAY’S VIDEO AND LEARN HOW YOU COULD START TODAY!

Join me as we all increase our financial IQ on this great account and subject!

Stay tuned to the end as I reveal THE RICH MAN’S ROTH Which has many fewer stipulations and more upside as well. (This LASER Fund allows high-income earners to Harnish the power of the tax-free Roth legally within the IRS tax code but allows as many accounts as you can afford!

Thank you all for watching! Please consider SUBSCRIBING. (IT’S FREE!)

If you are long on retiring early or are in this stage or nearing it, please share your ideas on how your journey has been.

I am long on financial independence and retiring early. I love stocks, dividends, real estate, passive income, and much more.

I am an author and currently working on my next books, one will be in financials!

Stay tuned for more new content, posted weekly.

Check out my new podcast!:

My M1 Finance Dividend portfolio:

Open an M1 Finance account:

(Fund you’re account and get a promotional amount of $50 just for opening an account and funding it! Some restrictions apply, and the amount changes or may not be present at the time of seeing this, although it’s very cool! Get on with your investing!

Simplysafedividends: My dividend income tracker:

Dividend Tracker: An AMAZING tool I use all the time to track, update, and get real-time portfolio income paydays, and so much more! Link:

Mint FREE budgeting tool:

AFFILIATE DISCLOSURE: Some of the links on this channel are affiliate links, meaning, at NO additional cost to you, I may earn a commission if you click through and make a purchase and/or subscribe. However, this does not impact my opinion. I recommend them because they are helpful and useful, not because of the small commissions I make if you decide to use their services. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

Books That have Really helped and inspired me!

Rich Dad Poor Dad: By Robert Kiyosaki

The Real Book of Real Estate: Real Experts. Real Stories. Real Life: By Robert Kiyosaki

Tax-Free Wealth: By Tom Wheelwright

The ABCs of Real Estate Investing: By Ken McElroy

Loopholes of Real Estate (Rich Dad’s Advisors) By: Garrett Sutton

Rich Dad’s Increase Your Financial IQ: Get Smarter with Your Money: By Robert Kiyosaki

The ABCs of Property Management: What You Need to Know to Maximize Your Money Now (Rich Dad’s Advisors): By Ken McElroy

FAKE: Fake Money, Fake Teachers, Fake Assets: How Lies Are Making the Poor and Middle-Class Poorer: By Robert Kiyosaki

Rich Dad’s CASHFLOW Quadrant: Rich Dad’s Guide to Financial Freedom: By Robert Kiyosaki

Right on the Money: Doug Casey on Economics, Investing, and the Ways of the Real World with Louis James

One Up On Wall Street: How To Use What You Already Know To Make Money In The Market, by the famous Peter Lynch

Return to Orchard Canyon: By Ken McElroy

Asset Protection for Real Estate Investors: By Clint Coons

The Real Crash: America’s Coming Bankruptcy – How to Save Yourself and Your Country, By the famous Peter Schiff

Get Rich with Dividends: By Marc Lichtenfeld

Hang in there you will succeed if you stay on the path to SUCCESS!

roth ira,tax-free growth,growing wealth, Michael Burry, Tax-free growth,Investing long-term, retirement plan, wealth accumulation roth ira explained

Disclaimer: I’m not a licensed financial advisor. Always do your own due diligence and research. Realize I put my mouth where my money is. I often invest in all the things on my channel. Thank you again for the support, have a great day!…(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

A Roth IRA is a type of individual retirement account that offers unique benefits to savers looking to build a nest egg for their future. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars, meaning that withdrawals in retirement are tax-free.

One of the key advantages of a Roth IRA is the ability to withdraw contributions at any time without incurring taxes or penalties. This makes it a flexible savings vehicle for those who may need access to their funds before retirement age. Additionally, Roth IRAs do not have required minimum distributions, allowing the account to continue to grow tax-free for as long as the account holder chooses.

Another benefit of a Roth IRA is the ability to pass on assets to heirs tax-free. This can be a powerful estate planning tool for individuals looking to leave a financial legacy for their loved ones.

In order to contribute to a Roth IRA, you must meet certain income requirements. For the 2021 tax year, individuals with modified adjusted gross incomes of $140,000 or less ($208,000 for married couples filing jointly) can make the maximum contribution of $6,000 ($7,000 for those age 50 or older).

Overall, a Roth IRA can be a valuable addition to your retirement savings strategy, offering tax-free growth and flexibility for accessing your funds. If you are eligible to contribute to a Roth IRA, it may be worth considering as a way to build a secure financial future.

0 Comments