![]()

What You Will Learn in this Masterclass:

– What are your options with your 401K when you retire?

– Why is it important you consider self-direction as one of those options?

– How to move your old 401k into a self-directed and keep your funds tax-protected when investing in real estate and other alternative assets

- And so much more!

Learn more about passive investing from Whitney Elkins-Hutten:

Get a copy of Dan Handford and Danny Randazzo’s book: “Apartment Syndication: The Ultimate Guide for the Active or Passive Investor”

View on Amazon:

Be sure to leave a review to show your support!

Follow Whitney Elkins-Hutten

Follow Dan Handford:

Follow Danny Randazzo:

#apartmentsyndication #realestateinvesting #apartmentinvesting #multifamilysyndication #realestatesyndication #multifamilyinvesting #danhandford #dannyrandazzo…(read more)

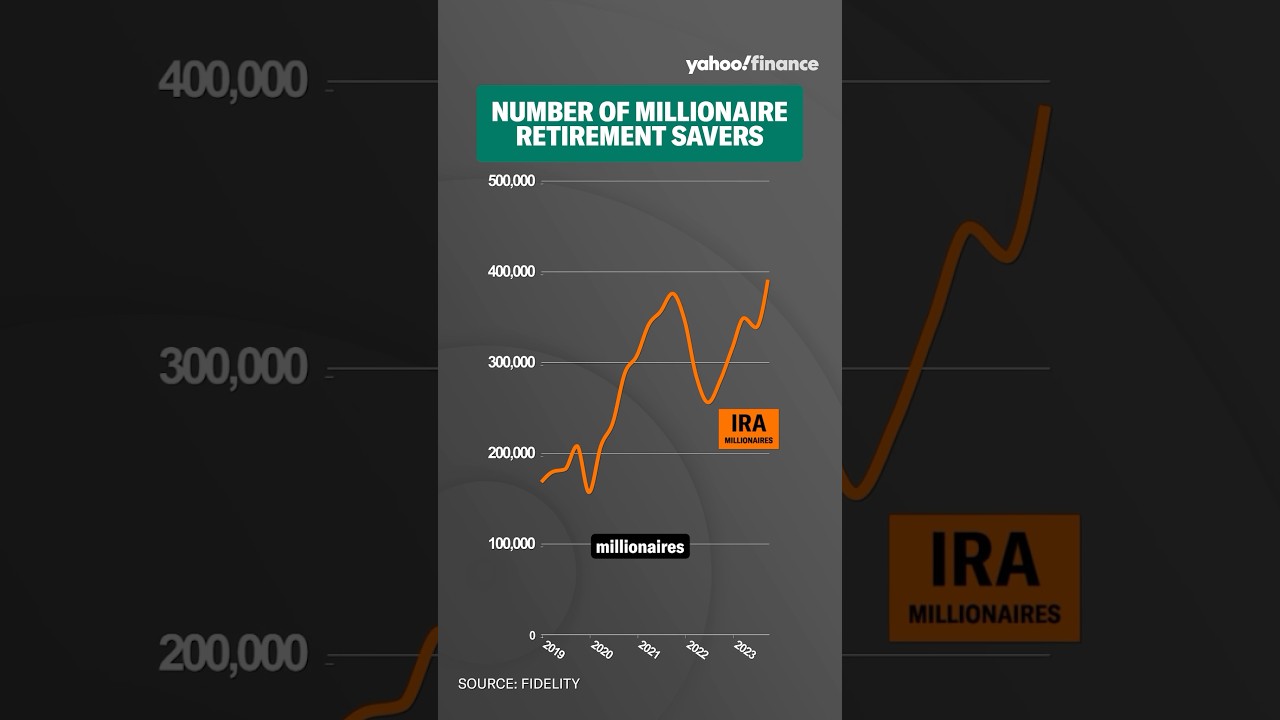

LEARN MORE ABOUT: IRA Accounts

CONVERT IRA TO GOLD: Gold IRA Account

CONVERT IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Retirement is a milestone that most people look forward to, but it can also be a stressful time if you’re not financially prepared. One way to ensure a comfortable retirement is by taking control of your retirement savings. Many people have a 401k through their employer, but did you know that you can actually move that money into a self-directed IRA (SDIRA) to have more control over your investments? Scott Maurer, Director of Business Development at Advanta IRA, is an expert in helping individuals make this transition.

First, let’s talk about why moving your company 401k to an SDIRA might be beneficial. With a 401k, your investment options are limited to what your employer offers. This can leave you at the mercy of the stock market and the performance of the funds in your company’s plan. By moving your funds to an SDIRA, you have the freedom to choose from a wider range of investments, including real estate, precious metals, private equity, and more. This diversity can help protect your retirement savings from market volatility and potentially increase your returns over time.

So, how do you go about moving your 401k to an SDIRA? Scott Maurer recommends working with a reputable custodian like Advanta IRA who can help guide you through the process. The first step is to open a self-directed IRA account, which can be done easily online. Once your account is set up, you’ll need to initiate a direct rollover of your 401k funds into your new SDIRA. This process is typically straightforward, but having a knowledgeable custodian to assist you can make it much smoother.

Once your funds are in your SDIRA, the sky’s the limit in terms of investment options. Scott Maurer suggests working with a financial advisor to determine the best strategy for your retirement goals. Whether you’re interested in diversifying your portfolio with real estate or investing in alternative assets, a self-directed IRA can give you the flexibility to tailor your investments to your unique needs.

In conclusion, prepping for retirement involves more than just saving money in a retirement account. Taking control of your investments by moving your company 401k to a self-directed IRA can help secure your financial future and give you peace of mind as you approach retirement. Scott Maurer and the team at Advanta IRA are ready to help you navigate this transition and make the most of your retirement savings. Contact them today to start the process of moving your 401k to an SDIRA.

Give this video a THUMBS UP right below the video if you enjoyed and post any questions you may have below.