If you’re 401(k) or 403(b) plan has ever failed either the ADP or ACP (as applicable), you’ve probably wondered, “well, what now?” Do you always have to return money to the highly paid employees? Do you have any options? This video has FIVE tips you can employ before processing refunds.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated….(read more)

LEARN MORE ABOUT: Qualified Retirement Plans

REVEALED: How To Invest During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

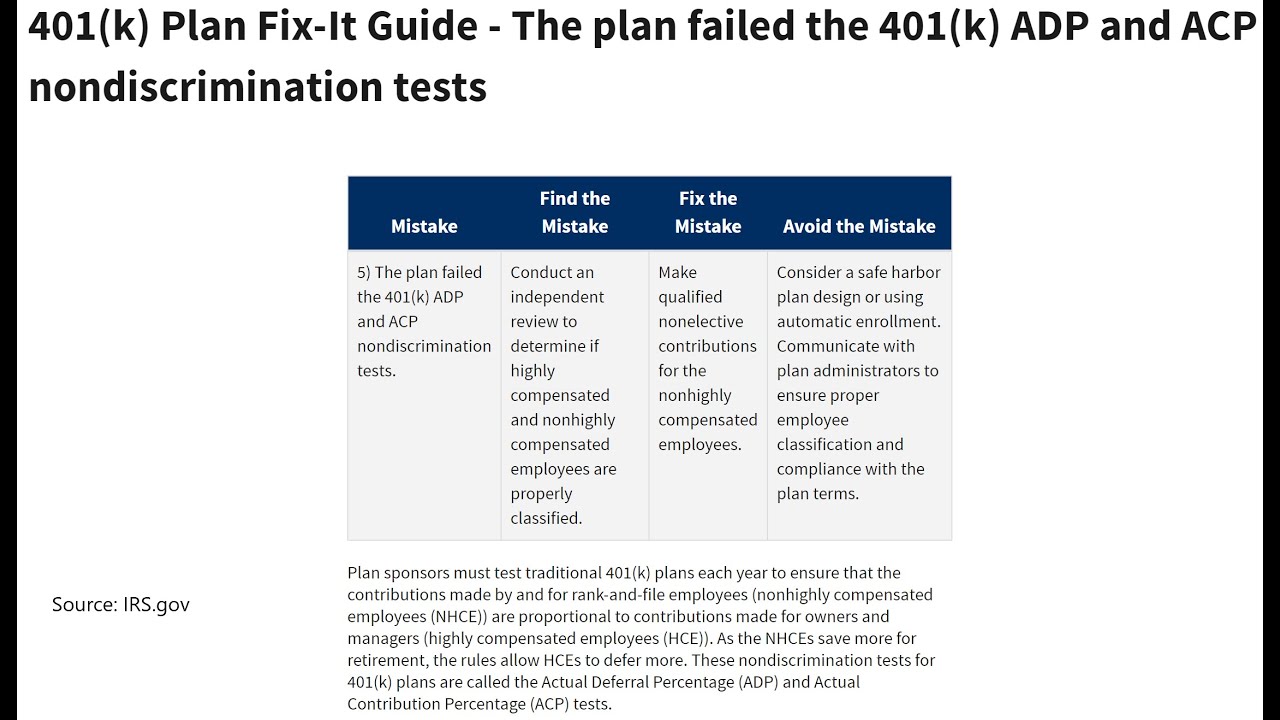

As an employer offering a retirement plan, you have a responsibility to ensure that the plan is in compliance with IRS regulations. One important aspect of maintaining compliance is the annual ADP/ACP testing.

The ADP (Actual Deferral Percentage) and ACP (Actual Contribution Percentage) tests are designed to ensure that retirement plans do not disproportionately benefit highly compensated employees (HCEs) compared to non-highly compensated employees (NHCEs). If the test results show that the plan is favoring HCEs, it must be remedied to avoid penalties and potential plan disqualification.

Here are some tips to help you navigate the ADP/ACP testing process:

1. Understand the requirements: Familiarize yourself with the rules and regulations surrounding ADP/ACP testing. Make sure you know the deadlines for testing and the consequences of failing to meet compliance standards.

2. Work with a trusted retirement plan provider: Consider partnering with a third-party administrator or retirement plan consultant to help you navigate the complexities of ADP/ACP testing. They can help you understand your plan’s specific requirements and develop a compliance strategy.

3. Communicate with your employees: Keep your employees informed about the ADP/ACP testing process and why it is important. Encourage participation in the retirement plan to help improve overall plan compliance.

4. Monitor contributions throughout the year: Regularly review employee contributions to ensure they are staying within the allowed limits. Make adjustments as needed to avoid compliance issues.

5. Consider safe harbor provisions: One way to bypass ADP/ACP testing is to adopt a safe harbor provision. This involves the employer making matching or non-elective contributions to employees’ accounts, which can help ensure compliance with the regulations.

6. Correct any failures promptly: If your plan fails the ADP/ACP tests, take corrective action as soon as possible to avoid penalties. Options for correction may include distributing excess contributions to HCEs, making additional contributions to NHCEs, or adopting a safe harbor provision for the following plan year.

ADP/ACP testing is a crucial part of maintaining compliance with IRS regulations for retirement plans. By understanding the requirements, working with a trusted provider, communicating with employees, monitoring contributions, considering safe harbor provisions, and correcting any failures promptly, you can help ensure that your retirement plan remains in compliance. Remember that staying compliant not only protects your employees’ retirement savings but also helps avoid costly penalties for your business.

0 Comments