![]()

There are benefits and drawbacks of taking money from your 401k….(read more)

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

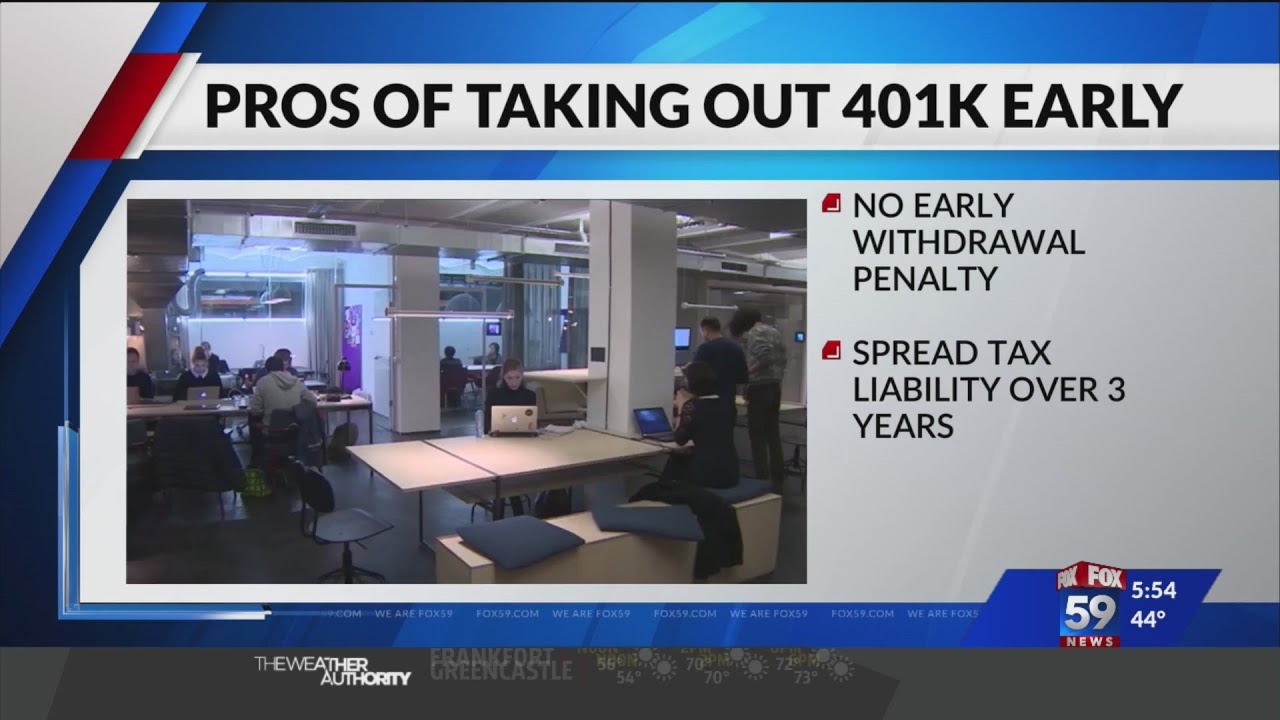

A 401k is a retirement savings plan offered by many employers that allows individuals to save for their future. While traditional advice suggests leaving your 401k untouched until retirement, there are instances when early withdrawals may be necessary. Let’s explore the pros and cons of early 401k withdrawals.

Pros:

1. Emergency access to funds: One of the main benefits of early 401k withdrawals is the ability to access funds in case of a financial emergency. Whether it’s a medical expense, unexpected bill, or job loss, having access to your 401k funds can provide much-needed relief during a crisis.

2. Debt consolidation: If you have high-interest debt, such as credit card debt, taking an early withdrawal from your 401k to pay off that debt can be a savvy financial move. By eliminating debt, you can improve your financial standing and potentially save money on interest payments in the long run.

3. Investment opportunities: Some individuals may choose to withdraw funds from their 401k to invest in other opportunities, such as starting a business or purchasing a home. While this can be risky, it can also lead to significant financial gains if the investment pays off.

Cons:

1. Penalties and taxes: One of the biggest drawbacks of early 401k withdrawals is the penalties and taxes associated with taking money out before retirement age. If you withdraw funds before age 59 1/2, you may be subject to a 10% early withdrawal penalty in addition to income taxes on the amount withdrawn.

2. Impact on retirement savings: Withdrawing funds from your 401k early can significantly reduce the amount of money you have saved for retirement. This can have a long-term impact on your financial security in your later years, as the money you withdraw now may have grown significantly if left untouched until retirement.

3. Loss of compound interest: By withdrawing funds from your 401k early, you are not only reducing the amount of money you have saved, but you are also missing out on potential compound interest. Over time, compound interest can significantly grow your savings, so early withdrawals can hinder your overall retirement savings growth.

In conclusion, while there may be valid reasons for taking an early 401k withdrawal, it is important to weigh the pros and cons carefully before making a decision. Consulting with a financial advisor can help you navigate the potential pitfalls and explore alternative options for accessing funds in times of need. Remember that your 401k is designed to provide financial security in retirement, so it is best to leave it untouched until then if possible.

The system really sucks