![]()

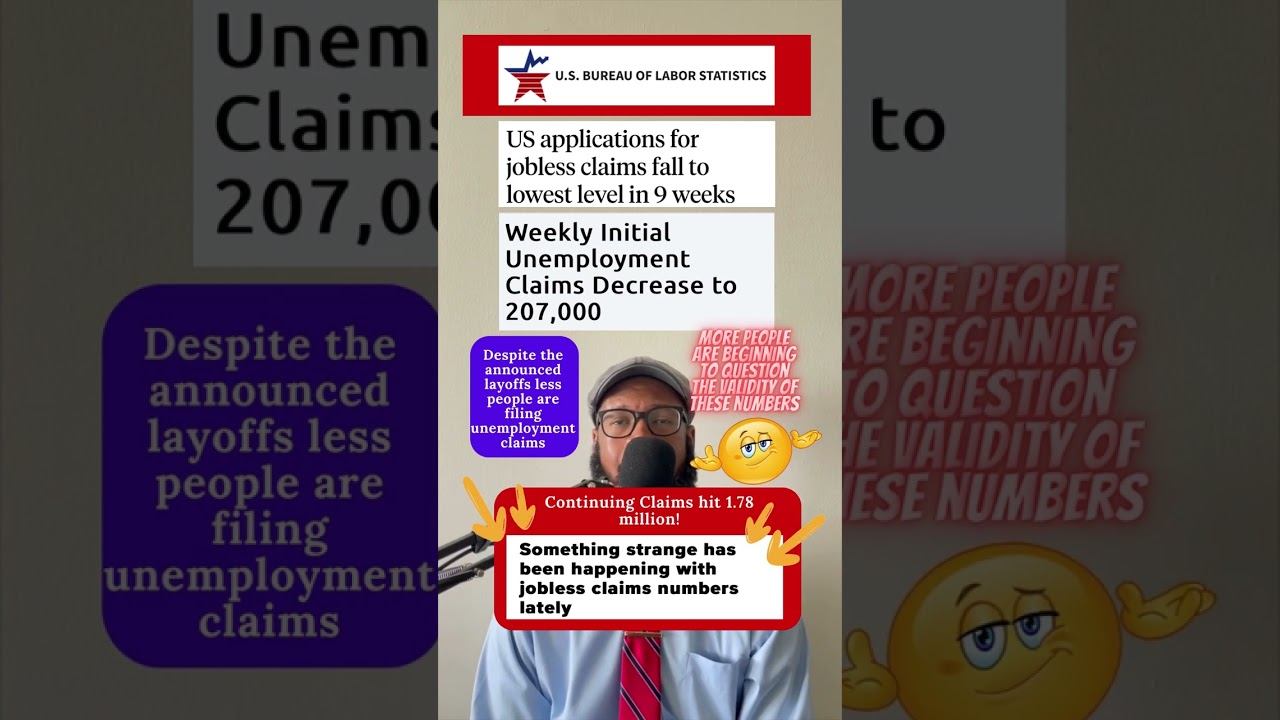

Weekly jobless claims are a key indicator of the health of the economy, as they provide insights into the number of people filing for unemployment benefits. However, there has been some speculation about the legitimacy of these claims in recent times.

Jobless claims are reported by the U.S. Department of Labor every week, indicating the number of individuals who have filed for unemployment benefits for the first time. These figures are closely watched by economists, policymakers, and investors as they can give a sense of the overall economic situation and the impact of layoffs and job cuts.

In recent months, there has been a surge in weekly jobless claims due to the economic downturn caused by the COVID-19 pandemic. Millions of people have lost their jobs as businesses have had to shut down or reduce their workforce to survive. This has led to a spike in unemployment claims, with some weeks seeing record-high numbers.

However, there have been concerns raised about the accuracy of these claims. Some experts believe that the actual number of people losing their jobs may be higher than what is being reported. This could be due to several factors, including the difficulty in filing for unemployment benefits, delays in processing claims, and people not being eligible for benefits.

Another concern is the potential for fraudulent claims. With the sudden increase in job losses, there may be individuals who are filing for benefits even though they have not actually lost their jobs. This could artificially inflate the jobless claims figures and provide an inaccurate picture of the economic impact of the pandemic.

Despite these concerns, weekly jobless claims remain an important metric for assessing the state of the economy. While there may be some inaccuracies in the data, they still provide valuable information about the trends in unemployment and the overall health of the labor market.

As the economy continues to recover from the pandemic, it will be important to closely monitor jobless claims and other economic indicators to assess the progress being made. While there may be questions about the accuracy of the data, jobless claims remain a key tool for understanding the impact of layoffs, job cuts, and the broader economic situation.

BREAKING: Recession News

LEARN MORE ABOUT: Bank Failures

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

0 Comments