Learn how to maximize your returns in the stock market and plan for a successful retirement with our comprehensive guide! In this video, we’ll cover everything from calculating stock market returns and federal income tax, to leveraging assets and making tax-free income. We’ll also discuss the best ways to reinvest dividends, track stock market performance, and take advantage of federal income tax brackets in 2022. Discover the best assets that make money and how to invest in them, as well as tips for retiring early and maximizing your retirement savings. We’ll also explain the concept of leverage and how to use it to your advantage in real estate and other investments. Don’t miss out on this opportunity to improve your financial future – watch now!

In addition, we’ll show you how to use tools like Fidelity and Vanguard to reinvest dividends and take advantage of compounding. We’ll also provide an in-depth look at the US income tax rate and how to file your income tax return for stock market investments. Whether you’re a beginner or an experienced investor, our video has something for everyone. Learn how to invest in assets that generate income and achieve financial freedom with our retirement savings strategies. Take control of your finances and retire by 30 with our expert tips and guidance. Don’t miss out on the chance to make your money work for you.

Finally, we’ll explore the idea of leveraging investments and show you how to use this strategy to maximize your returns. Whether you’re looking to increase your portfolio size, reduce your risk, or both, leveraging can be an effective tool in achieving your financial goals. We’ll provide step-by-step instructions on how to calculate dividends, reinvest dividends in stocks, and get the most out of your investments. With our guidance, you’ll have the tools and knowledge to invest with confidence and achieve financial success. So, what are you waiting for? Start building your wealth today by watching our video on how to get 20% return in the stock market!

————————————————————–

Click the link to access additional information on building your wealth, tax-free!

Visit –

Setup a personal strategy session with me:

Like and Subscribe!

Visit me on the web-

I have been involved in financial planning for over 36 years. I started out as a high volume stockbroker. After working with millions of dollars I decided there had to be another way for people to earn money in the market without all the risky ups and downs that leave you where you started, or worse. After reading a ton of books I came across a book on the Infinite Banking Concept and it completely changed my life and the way I view investments.

Now I focus on building wealth using a tool we developed by leveraging life insurance.

This way we can get:

Double Digit returns

Keep you money safe

Keep your money liquid

Create substantial passive income

Leave a legacy for you family

And do it all Tax-Free!

I post videos regularly so if you have any questions of comments feel free to email them to…

dan at wisemoneytools dot com

00:00 Introduction

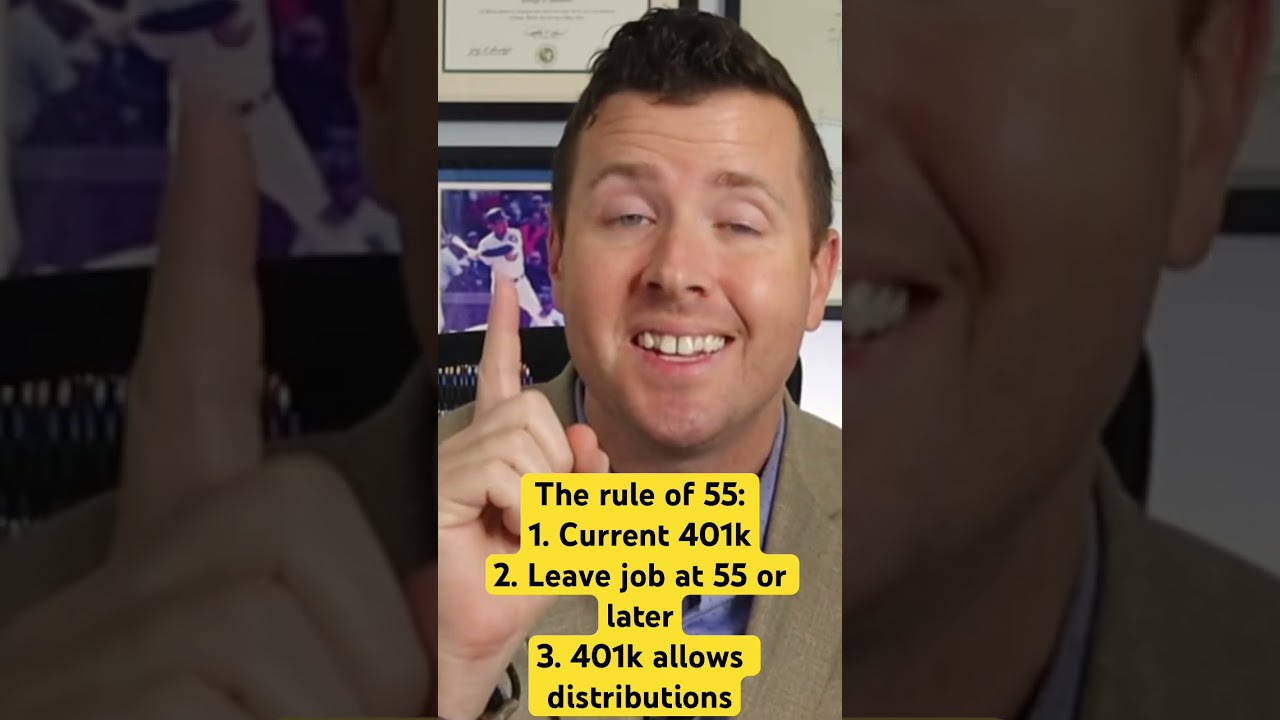

00:10 Average 401K

00:59 Million Dollars in 401K

02:25 Vnaguard

03:40 Average is Broke

04:17 Reach Out

04:38 Outro…(read more)

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

In today’s society, the concept of average is often associated with being broke. Many people struggle financially, finding themselves living paycheck to paycheck without any real hope of retiring comfortably. With the added burden of fees and expenses associated with retirement plans, it can often seem like a losing proposition. However, there are ways to leverage assets and take control of your financial future.

One of the biggest challenges for those looking to retire comfortably is the fees and expenses associated with retirement plans. Over time, these costs can add up, draining your savings and putting a damper on your ability to retire comfortably. To combat this, it’s important to take a thoughtful approach to your retirement plan.

The first step is to carefully consider your options. Research available plans and compare fees and associated expenses. Look for plans with lower fees and investment expenses. This could mean using a self-directed retirement account, like a self-directed IRA, which allows you to invest in a wide range of assets, including real estate, precious metals, and private equity.

Another way to leverage assets is to focus on income-generating investments. Income-generating investments produce regular income streams that can help supplement your retirement income. Examples of income-generating investments include dividend-paying stocks, rental properties, and annuities. These types of investments can provide stable, long-term income streams that can help offset the costs of retirement plans with fees.

Finally, it’s important to consider alternative assets. Alternative assets are investments that fall outside of traditional stocks, bonds, and mutual funds. They include assets like precious metals, real estate, and private equity. These types of investments can offer portfolio diversification and provide opportunities for higher returns.

In conclusion, the idea that average is broke is a common misconception. With careful planning and leveraging of assets, it’s possible to retire comfortably and avoid the burden of fees and expenses associated with retirement plans. By choosing low-fee plans, focusing on income-generating investments, and exploring alternative assets, you can take control of your financial future and enjoy the retirement you deserve.

lmfao where do these figures come from, i know atleast 20 ppl who are 65+ yrs old and they dont have a pot to piss in let alone $255,000

Does your company sell some type of life insurance?

I’m 19 nd I’m tryna have mine set right