Rob sits down to talk about the 401k and some of the challenges that it poses. #shorts #epic #investing #finance #business #savings #moneymindset #recession #inflation #stockmarket #401k

Watch and Enjoy!

JOIN MY FREE LIVE WEBINAR JANUARY 26TH, 2023:

✅ SUBSCRIBE SUBSCRIBE SUBSCRIBE ✅

📚GET A FREE COPY OF OUR BRAND NEW BOOK! :

🤝 GET FREE CONSULTATION HERE: 🤝

💰GET OUR FREE FINANCIAL FREEDOM ROAD MAP💰

📈 DOWNLOAD YOUR FREE CASH FLOW ANALYSIS GUIDE 📈

GET ACCESS TO OUR GUARANTEED INCOME GUIDE

📲 CONNECT WITH ROB AND EPIC FINANCIAL STRATEGIES

=================

Rob Gill – Instagram

Facebook

Twitter

YouTube Channel

LinkedIn:

TikTok:

EPIC – Instagram

EPIC – Facebook

“EPIC Financial Strategies” is a trade name referring to EPIC Insurance Services, LLC. All references to “EPIC” contained in this video pertain to EPIC Insurance Services, LLC.

Robert Gill is not in the business of providing investment advice and specifically disclaims any liability, loss or risk incurred as a consequence, either directly or indirectly, through the use of any of the information contained in this video. Also, Robert Gill, in his appearance on various social media platforms, does NOT provide ANY legal, accounting, securities, investment or tax advice, and the opinions he shares are not intended to be a substitute for meeting with professional advisors. If legal advice or other expert assistance is required, the services of competent, licensed and certified professionals should be sought. In addition, Robert Gill does not endorse ANY specific investments, financial advisors or securities brokerage firms. Robert Gill is not a securities-licensed professional, financial planner or investment advisor.

The views and opinions of any guests who may appear in the videos on this channel, regardless of whether they hold any securities, advisory or insurance license, are shared for informational and educational purposes only. Any chart, illustration or other demonstrative contained in this presentation or video is for educational purposes only and does not represent the actual performance of any specific product. And whether they originate with Robert Gill or any guest, the views and opinions of persons appearing in these videos should not be considered investment, financial, legal or tax advice. Before making any investment or other significant financial decision, viewers should consult with qualified and licensed professionals, who will assess the appropriateness of the decision in light of each individual’s specific goals, experiences and financial status.

It is possible that certain material facts, including but not limited to legal conditions directly affecting the functions of products discussed herein, may have changed in the time since this video was filmed. Viewers should not assume that such conditions have remained the same in the ensuing period.

#EPIC

#WealthManagement

#MoneyMindset…(read more)

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

EPIC #Shorts: Is the 401k the Best Option?

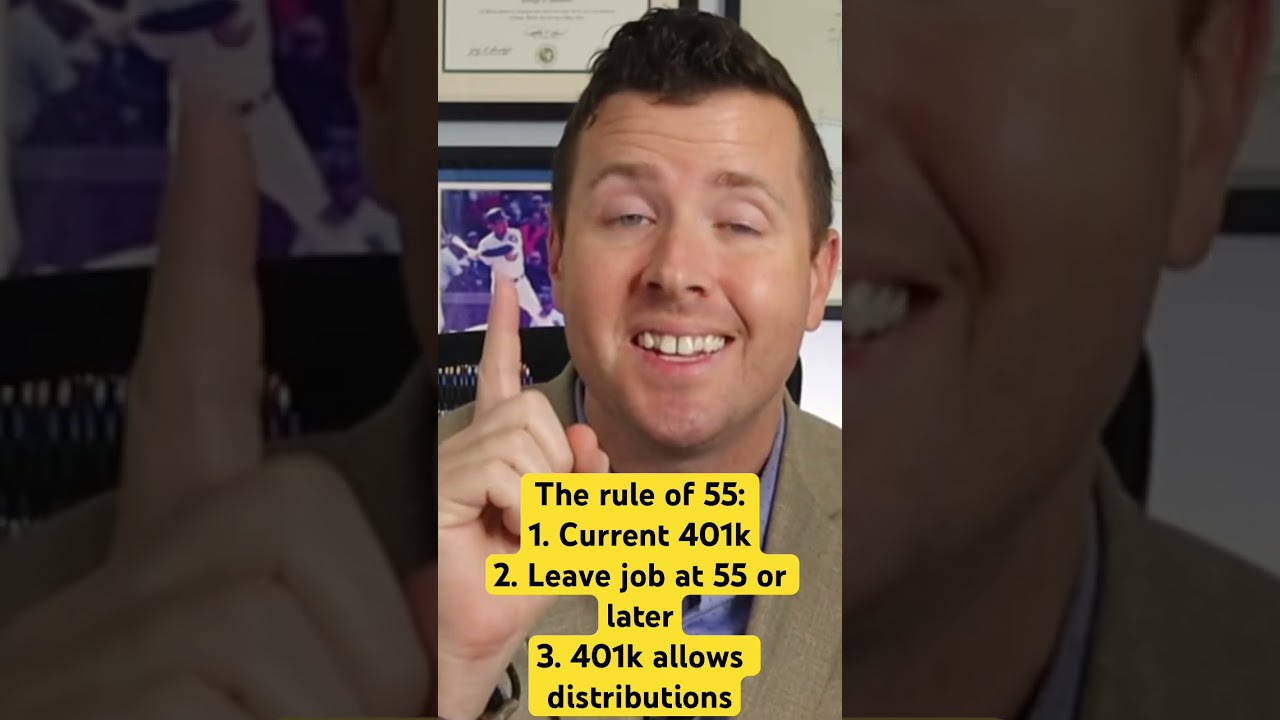

Investing for one’s retirement is a crucial financial decision that requires careful consideration of various factors. One of the widely known retirement savings options in the United States is the 401k, which allows employees to contribute a portion of their salary towards their retirement fund. However, the question is, is the 401k the best option for everyone?

The 401k plan has been the popular choice of many individuals because it offers several benefits, such as tax advantages, employer contributions, and automatic contributions. It also allows employees to control their funds and manage their investments. Moreover, 401k plans have higher contribution limits compared to other retirement savings options like IRAs and Roth IRAs.

While the 401k has various benefits, it may not be the best option for everyone, especially those who are self-employed or have a fluctuating income. Self-employed individuals may find it challenging to contribute to a 401k since they do not have an employer to match their contributions. They may opt for other retirement savings options like a Solo 401k, SEP IRA, or Simple IRA, which cater to their specific needs and offer similar benefits.

People with unstable income may not benefit much from a 401k as they may not be able to contribute consistently or may have to withdraw their funds early, incurring penalties and taxes. For these individuals, they may choose to focus on building an emergency fund or contribute to an IRA, which offers more flexibility and doesn’t charge penalties for early withdrawals.

Another drawback of the 401k plan is the limited investment options, as the funds are often limited to those offered by the employer. In contrast, IRAs offer a wider range of investment options as the individuals manage their funds and make investment decisions.

Moreover, individuals who prioritize saving for short-term goals may opt for other savings plans, like a high-yield savings account, a money market account, or a CD account, which offer higher interest rates and greater flexibility to access funds.

In conclusion, while the 401k plan provides numerous benefits, it may not be the best choice for everyone. Choosing a retirement savings plan requires an understanding of individual circumstances, financial goals, and risk appetite. It is essential to evaluate all available options and seek financial advice to select the most suitable plan that aligns with one’s objectives.

0 Comments