In this video, you’ll see calculations and examples of aged retirement Vs 54/11 for CSS members.

Meet Geoff, he’s approaching age 55, has 33 years contributory membership with CSS, has Salary of $90,000 p.a. (Final Salary), CSS Member Component $250,000, CSS Productivity Component $110,000, Married to Mary also aged 54.

Geoff is considering whether a 54/11 would work best for him.

**Age Retirement Calculation**

The Age Retirement indexed pension would be as follows:

– Final Salary x Age Factor

– $90,000 x 38.063% = $34,257 p.a.

The Age Retirement maximum non-indexed pension is calculated as follows:

– (Member + Productivity Components) x Age Factor

– ($250,000 + $110,000) x 0.0925 = $33,300 p.a.

As $33,300 is greater than 18.5% Geoff’s final salary the non-indexed pension will be capped at 18.5% of $90,000 or $16,650 p.a.

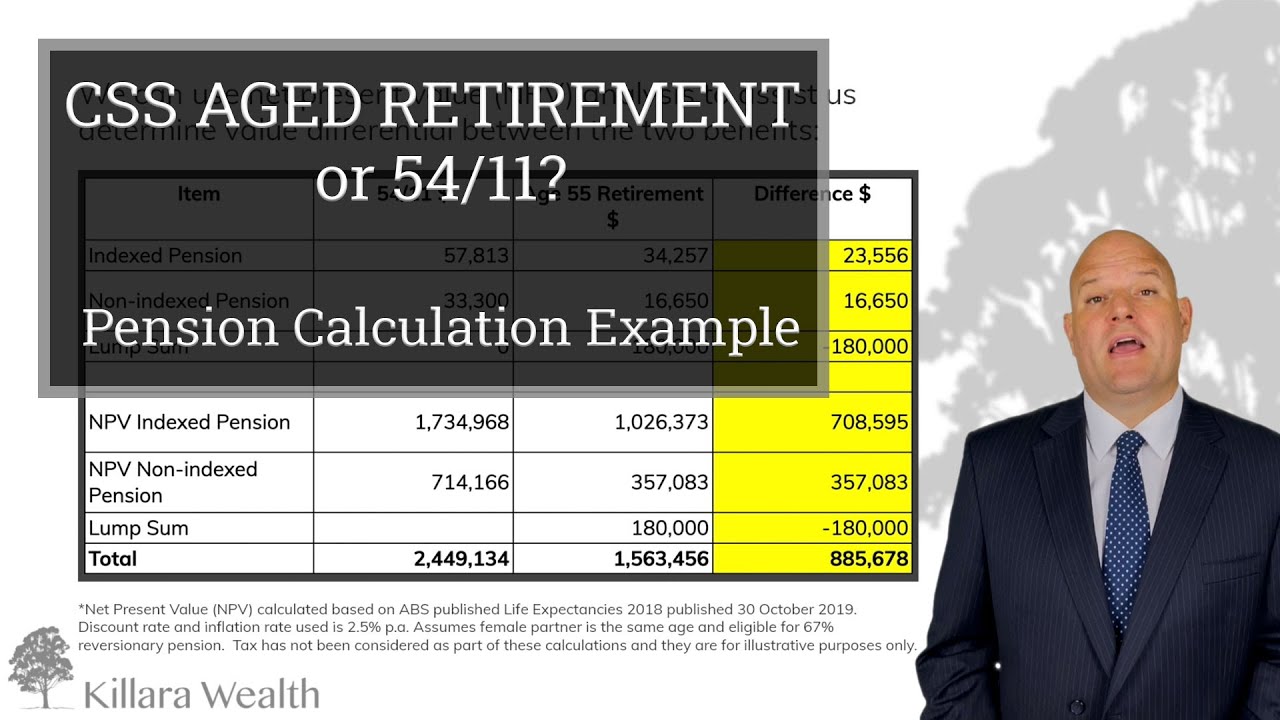

Balance of his member and productivity of 50% or $180,000 will be paid in the form of a lump sum that will need to be rolled over to another superannuation fund and preserved. Geoff’s benefit will consist of a lifetime indexed pension of $34,257 p.a., non-indexed pension of $16,650 p.a. and a lump sum of $180,000.

**54/11 Benefit Calculation**

The 54/11 indexed pension calculation would be as follows:

– (Basic Contributions + Interest) x 2.5 x Age Factor

– $250,000 x 2.5 x 9.25% = $57,813 p.a. indexed pension

The 54/11 non-indexed pension would be as follows:

– (Member + Productivity Components) x Age Factor

– ($250,000 + $110,000) x 9.25% = $33,300 p.a.

Geoff’s benefit will consist of a lifetime indexed pension of $57,813 p.a. and a non-indexed pension of $33,300 p.a.

**Tax and Other Considerations**

Geoff maybe better off by $297K by working an extra 5 years. This may seem like an insufficient pay-off. We need to apply Geoff’s tax position

Look at sustainability of living expenses of $70,000 p.a. Consider additional strategies. In this case we assume Geoff continues to work to Age 60 and:

Salary Sacrifices into non-CSS super. Any other surplus income invested into superannuation for spouse. Takes CSS Age retirement at 60.

For more information contact us for your free initial phone conversation.

**General Advice Warning **

Any advice in this video is general advice only and does not take into account your individual circumstances, needs or objectives. Before acting on any advice provided in this video you should consider the appropriateness of the advice regarding your individual circumstances, needs and objectives.

The CSS is a defined benefit scheme, is complex and has different rules to standard accumulation superannuation funds. It is recommended that members seek their own financial advice from a licensed adviser regarding their own specific circumstances….(read more)

LEARN MORE ABOUT: Retirement Pension Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Good explanation of CSS calcs, but spoiled a bit at the end by comparing a guy who earns 90k pa and retires at 55 v a guy who earns 150k and works 5 more years til age 60. Apples and watermelons. That example is not going to help anybody in the real world. Nobody is going to get a 70% pay rise in their 50's heading into retirement, at least not enough people to make it useful.