To download the Form 8880 in printable format and to know about

the use of this form, who can use this Form 8880 and when one should use this Form 8880 form.

To Learn how to fill Various legal form,

Go to …(read more)

LEARN MORE ABOUT: Qualified Retirement Plans

REVEALED: How To Invest During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Learn How to Fill Form 8880: Credit for Qualified Retirement Savings Contributions

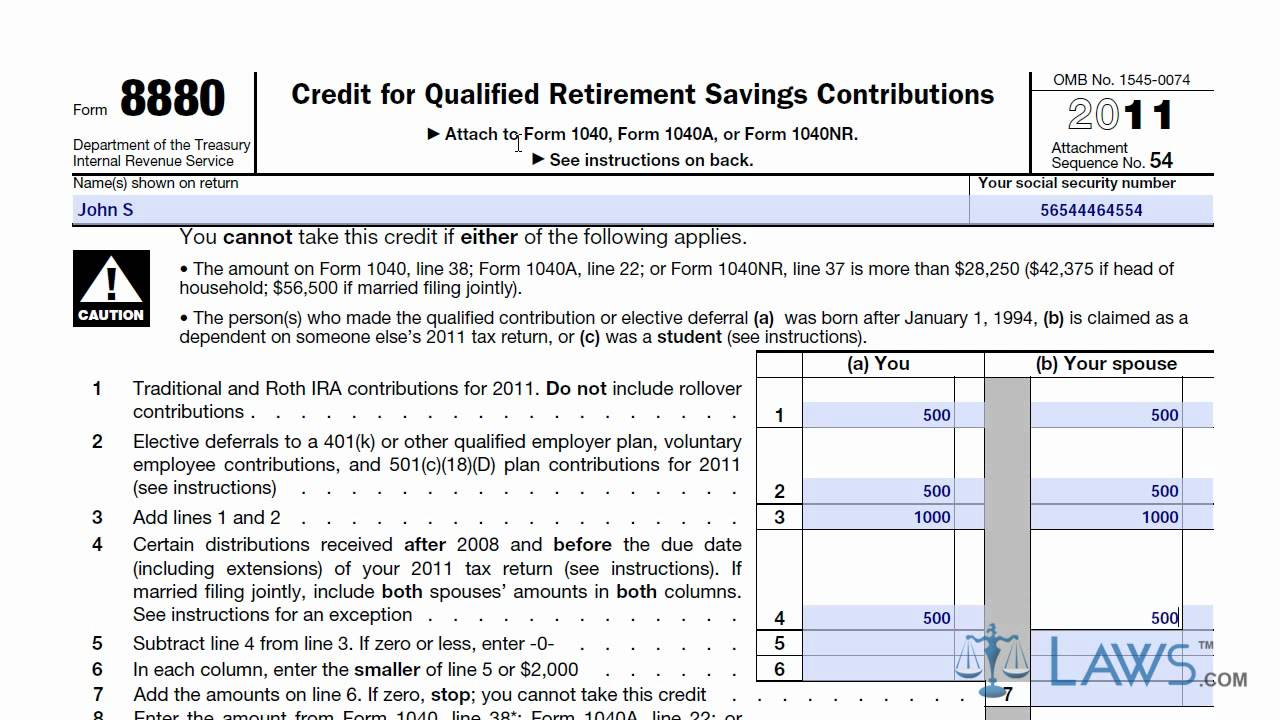

Filling out tax forms can be a daunting task, especially when it comes to understanding the various credits and deductions available to tax filers. One such form is the Form 8880, also known as the Credit for Qualified Retirement Savings Contributions. This form allows taxpayers to claim a credit for their contributions to qualified retirement savings plans, such as 401(k) plans or individual retirement accounts (IRAs). Here’s a step-by-step guide on how to fill out the Form 8880.

Step 1: Gather the necessary information

Before you start filling out the form, make sure you have all the required information handy. This includes your annual income, the amount of your retirement plan contributions, and any distributions you may have received from retirement plans during the tax year.

Step 2: Determine your filing status

On the top left corner of the form, you need to indicate your filing status by checking the appropriate box. The available options are single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

Step 3: Enter your total contributions

In Part I of the form, you will need to enter the total amount of your retirement plan contributions made during the tax year. This includes contributions made to traditional IRAs, Roth IRAs, and employer-sponsored retirement plans such as 401(k)s or 403(b)s.

Step 4: Determine your credit rate

Part II of the form requires you to calculate your credit rate based on your filing status and income. You can refer to the corresponding table provided in the instructions for Form 8880 to find your applicable credit rate. The credit rate ranges from 10% to 50% depending on your income level and filing status.

Step 5: Calculate your retirement savings contributions credit

Multiply your total contributions from Step 3 by the credit rate determined in Step 4. This will give you the amount of your retirement savings contributions credit.

Step 6: Complete the rest of the form

Fill out the remaining sections of the form, including any additional taxes owed, payments, or refundable credits you may have. Make sure to double-check all the information entered to ensure accuracy.

Step 7: Attach the form to your tax return

Once you have completed all the necessary sections of Form 8880, attach it to your tax return when filing. Consider keeping a copy of the filled-out form for your records.

It’s important to note that the Form 8880 is subject to specific income limitations, and not all taxpayers may be eligible for the retirement savings credit. Additionally, certain other conditions and restrictions may apply. Therefore, it’s always recommended to review the instructions for Form 8880 or consult a tax professional to ensure eligibility and accurate completion of the form.

Claiming the Credit for Qualified Retirement Savings Contributions through Form 8880 can provide significant tax benefits for those who qualify. By understanding the process and following the step-by-step guide provided, you can confidently fill out this form and potentially receive a valuable credit for your retirement savings contributions.

trash video

Great.

Wow, it's almost like you just read the directions. Maybe I'll make a new video doing the same thing

WHY AREN'T YOU EXPLAINING WHERE TO FIND ANY OF THIS SHIT?

FOR JOINT RETURNS YOU SAY 26K AND NOT 56K PER YEAR. WHICH IS CORRECT?