![]()

Finding your optimal roth IRA conversion strategy

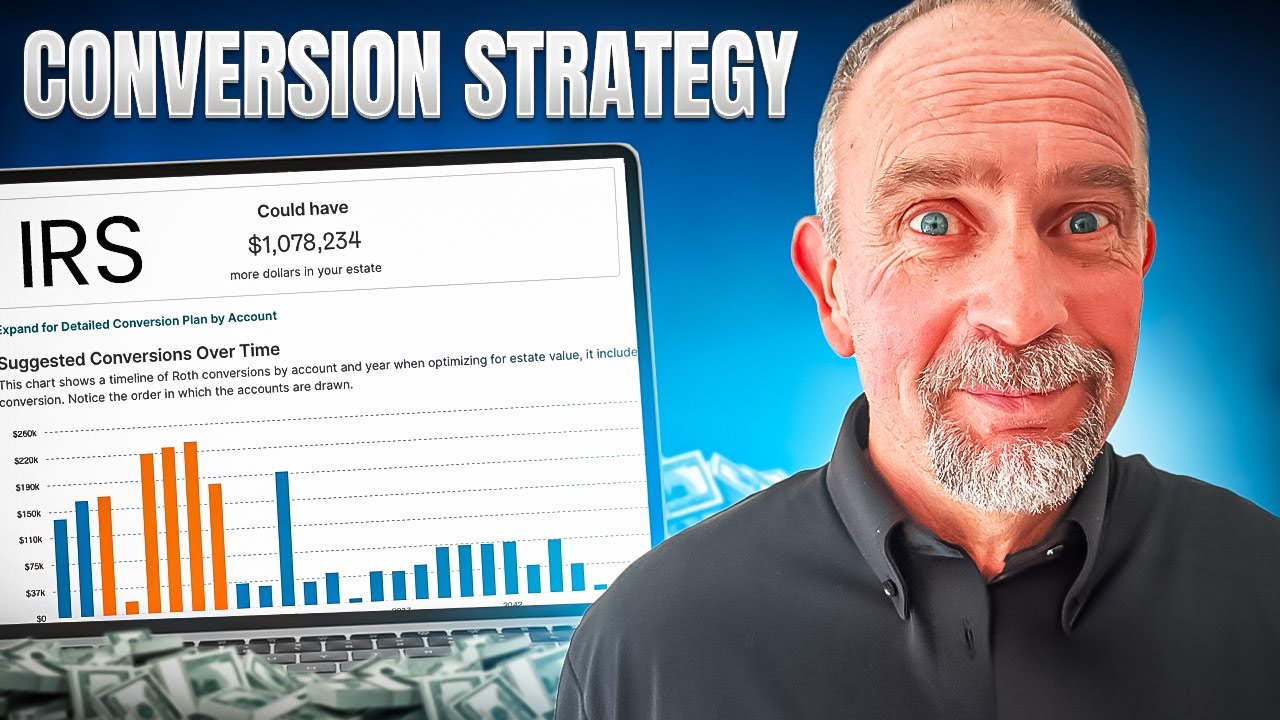

🔍 In this video we dive into the importance of optimizing Roth conversions and how it can significantly impact your savings. Join us as we explore real-life examples, scenarios, and potential savings to help you understand why an optimal Roth IRA conversion strategy is crucial for your financial future.

💼 Understand the Roth conversion process and why more people are considering this strategy to save money. Discover how failing to maximize your conversions could result in leaving hundreds of thousands, if not millions, of dollars on the table for the IRS.

🌟 Explore a real-life scenario of a couple in their mid-60s with $1.5 million in their IRA, presenting three different scenarios and showcasing the benefits of an optimal Roth IRA conversion strategy.

💡 Learn why settling for “”good”” isn’t enough when it comes to Roth conversions and why informed decision-making and a customized approach are necessary for maximizing your financial future.

📈 Discover the benefits of seeking professional help for optimal Roth IRA conversion strategies and how our team of certified financial planners can assist you in developing a customized plan tailored to your specific needs.

🔍 Ready to take the first step towards a brighter financial future? Schedule a call with our team today to explore how our services can benefit you and ensure you maximize savings through an optimal Roth IRA conversion strategy.

📌 Conclusion: Don’t settle for “”good”” when it comes to your financial future. By choosing the optimal Roth IRA conversion strategy, you can significantly reduce projected RMDs, minimize taxes, and decrease Medicare premiums, securing a more financially secure future.

❓Interested in Learning More?

📚 Download my FREE Book:

🖥️ Attend an On-Demand Webinar:

☎️ Want to Talk with Someone About Your Roth Conversion Strategy? Schedule a Call!

Don’t miss out on this essential discussion on Roth IRA conversion strategies! Hit the subscribe button and turn on notifications to stay updated on our latest content. 💼💰

#RothIRAConversion #FinancialPlanning #RetirementSavings #TaxOptimization #RothConversionStrategy #CertifiedFinancialPlanners #ExpertInsights #MaximizingSavings #FinancialFuture…(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Finding Your Optimal Roth IRA Conversion Strategy

A Roth IRA conversion can be a smart financial move for individuals looking to save on taxes and maximize their retirement savings. By converting a traditional IRA or 401(k) to a Roth IRA, individuals can potentially enjoy tax-free withdrawals in retirement and pass on tax-free assets to their beneficiaries. However, the decision to convert to a Roth IRA should be carefully considered, as it can have a significant impact on one’s tax liability.

To determine the optimal Roth IRA conversion strategy for your specific financial situation, consider the following factors:

– Current and Future Tax Rates: One of the key considerations when deciding whether to convert to a Roth IRA is your current income tax rate compared to your expected tax rate in retirement. If you expect to be in a higher tax bracket in retirement, it may make sense to pay taxes on the conversion now and enjoy tax-free withdrawals later. Conversely, if you expect to be in a lower tax bracket in retirement, it may be better to keep your funds in a traditional IRA.

– Time Horizon: The longer you have until retirement, the more time your investments will have to grow tax-free in a Roth IRA. If you have a significant amount of time before retirement, a Roth IRA conversion may be more beneficial than if you are close to retirement.

– Available Assets: Consider the assets you have available to pay the taxes on the conversion. It may be more advantageous to convert to a Roth IRA if you have funds available outside of your retirement accounts to cover the taxes.

– Required Minimum Distributions (RMDs): Keep in mind that Roth IRAs are not subject to RMDs, unlike traditional IRAs and 401(k)s. If you want to minimize RMDs in retirement, a Roth IRA conversion may be a good strategy.

– Estate Planning Goals: If passing on tax-free assets to your beneficiaries is a priority for you, a Roth IRA conversion can help achieve that goal. Roth IRAs allow for tax-free withdrawals by beneficiaries, potentially leaving them with a larger inheritance.

Before making any decisions about converting to a Roth IRA, consult with a financial advisor or tax professional to evaluate your individual circumstances and develop a comprehensive retirement savings strategy. They can help you analyze your current financial situation, project future tax implications, and determine the most advantageous conversion strategy for your retirement goals.

In conclusion, finding your optimal Roth IRA conversion strategy requires careful consideration of factors such as current and future tax rates, time horizon, available assets, RMDs, and estate planning goals. By weighing these factors and seeking professional advice, you can make an informed decision that maximizes your retirement savings and tax benefits.

Showing total taxes paid is interesting but does not tell me if the plan is optimal. I don't care how much taxes I pay – I care about total net present value that I take home at the end of the day. If I convert early I will pay taxes up front that will be less than if I wait but just because I pay more taxes later does not mean that I am getting less net present value. The investments will grow and with inflation included I would expect I will pay more taxes later if I do not convert. So I would like to see actual after tax income for my investments discounted for inflation to really see what different conversion strategies are providing. Does you analysis provide these estimates?

With all due respect, your advertisements that I see every day, all day long are NOT respectful. It is demeaning to tell people that they are doing things "all wrong". Could you please change your ad?

Craig, what type of assumptions are you making relative to future tax rates?