#shorts #retirement #retirementplanning

The 5 Year Rule is an important concept to understand if you are considering a Roth IRA conversion. But, many people don’t know anything about it.

Watch this video to learn the other four most Common Roth IRA Conversion Mistakes.

👉🏻 👈🏻

⬇️ DISCLAIMER :

Celestial Wealth Management, LLC is registered as an investment adviser in the State of Maryland and Texas.

Neither the information nor any opinion constitutes an offer or an invitation to make an offer, to buy or sell any securities or other financial instruments.

This video is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation and the particular needs of any specific person.

Investors should seek financial advice regarding the appropriateness of investing in financial instruments and implementing investment and planning strategies discussed in this video and should understand that statements regarding future prospects may not be realized.

Nothing provided here constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments.

Investments in securities entail risk and are not suitable for all investors. This is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction. All investment strategies have the potential for profit or loss….(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

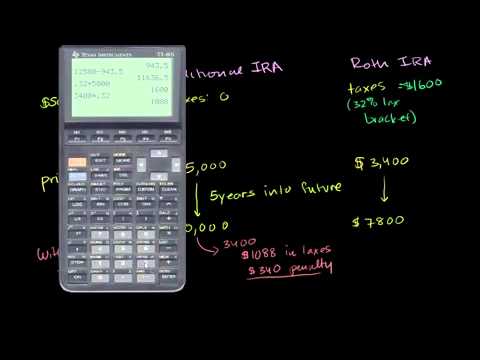

retirement planning is a complex process, and one of the most important steps to consider is a Roth IRA conversion. This process involves transferring money from a traditional IRA into a Roth IRA, and it can be a great way to save for retirement. However, there’s one crucial rule to keep in mind when making a Roth IRA conversion: the five-year rule.

The five-year rule states that any money you convert into a Roth IRA must remain in the account for at least five years in order to be eligible for tax-free withdrawals. This means that if you make a Roth IRA conversion and then withdraw the money before the five-year mark, you will be subject to taxes and penalties.

It’s important to understand this rule before making a Roth IRA conversion. If you don’t plan on leaving your money in the Roth IRA for the full five years, then it may not be the best option for you. You should also consider the fact that Roth IRAs typically have higher contribution limits than traditional IRAs, so it’s important to make sure you can take advantage of those higher limits.

Finally, it’s important to understand how the five-year rule works with other retirement accounts. If you have money in a traditional IRA and a Roth IRA, the five-year rule applies to the Roth IRA, not the traditional IRA. This means that if you withdraw money from the traditional IRA before the five-year mark, you won’t be subject to taxes or penalties.

Making a Roth IRA conversion can be a great way to save for retirement, but it’s important to understand the five-year rule before making the decision. If you don’t plan on leaving your money in the Roth IRA for the full five years, then it may not be the best option for you. It’s also important to consider how the five-year rule works with other retirement accounts, and make sure you’re taking advantage of the higher contribution limits of a Roth IRA. By understanding the five-year rule, you can make sure you’re making the right decision for your retirement planning.

0 Comments