![]()

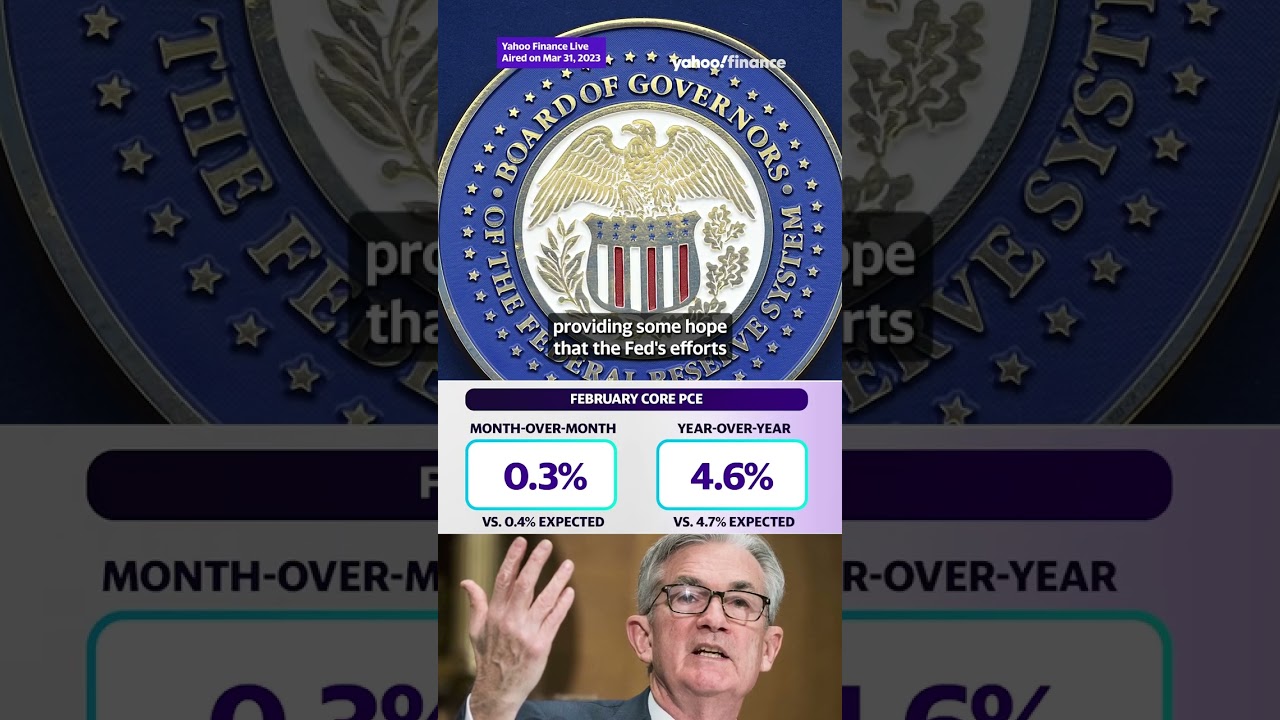

The Fed’s preferable gauge of inflation, PCE, rose less than expected in February, slowing to 5% annually versus 5.3% in January. Yahoo Finance Live breaks down the details with UBS Chief Economist Paul Donovan as the first quarter comes to an end. Segment aired on Mar 31, 2023. #yahoofinance

Subscribe to Yahoo Finance:

About Yahoo Finance:

At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.

Yahoo Finance Plus: With a subscription to Yahoo Finance Plus get the tools you need to invest with confidence. Discover new opportunities with expert research and investment ideas backed by technical and fundamental analysis. Optimize your trades with advanced portfolio insights, fundamental analysis, enhanced charting, and more.

To learn more about Yahoo Finance Plus please visit:

Connect with Yahoo Finance:

Get the latest news:

Find Yahoo Finance on Facebook:

Follow Yahoo Finance on Twitter:

Follow Yahoo Finance on Instagram:

Follow Yahoo Finance Premium on Twitter:

#yahoofinance #finance #news #youtubeshorts #youtube #shorts #jeromepowell #federalreserve #fed #inflation #unitedstates #economy #stockmarket #2023 #pce #report #explained…(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

The Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) index, showed a cooling trend in February 2023, according to a recent report released by the US Bureau of Economic Analysis.

The PCE index measures the changes in prices paid by consumers for goods and services, and is closely watched by the Fed as it considers its monetary policy decisions. In February, the index increased by 0.3%, marking a slower pace of inflation compared to the previous month.

The report also showed that on a year-over-year basis, the PCE index rose by 6.7%, which is still well above the Fed’s target of 2%. However, this was a slight deceleration from the 7.1% annual increase recorded in January.

The cooling of the PCE index in February may provide some relief to policymakers who have been grappling with soaring inflation amid supply chain disruptions and rising energy prices. The Fed has been under pressure to tighten its monetary policy in order to curb inflation, but has also been cautious not to disrupt the economic recovery.

The report comes at a time when the central bank is preparing to raise interest rates to combat inflation. The Fed has signaled that it may increase rates multiple times this year, with the first hike expected to come as soon as March.

While the cooling of the PCE index in February may offer some reprieve, economists warn that inflation pressures are likely to persist in the near term due to ongoing supply chain disruptions and geopolitical uncertainties.

Overall, the latest PCE report underscores the challenges facing the Fed as it navigates the delicate balance between supporting the economy and controlling inflation. Policymakers will be closely monitoring incoming data to gauge the impact of their policy actions and adjust their decisions accordingly.

Why did yahoo turn off comments in YouTube videos???