![]()

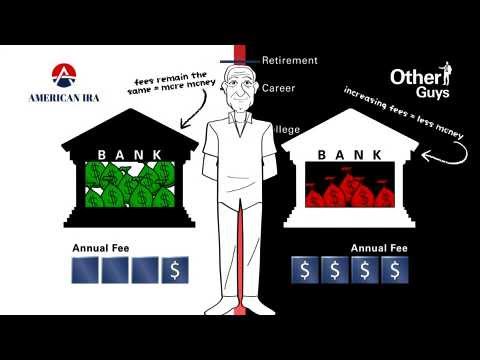

When you choose American IRA as your administrator versus the other guys, you’re choosing a path that will save you money with lower Self-Directed IRA fees without sacrificing expertise or performance.

Because unlike the “other guys”, we do not work on a sliding scale of fees. We offer one low set annual administration fee.

Let’s take a closer look. As your assets grow with American IRA your annual Self-Directed IRA fees remain the same. The other guys base their fees on the number of assets you own or the value of your account, so over the life of your Self-Directed IRA, your annual fees will continue to increase year after year.

What does this mean for you? When you work with us, you’ll have more money to put towards the important things in your life, like retirement.

We know that there are already enough places your money has to go, from your state and local government, to the IRS. Don’t let your Self-Directed IRA administrator take more from you than they should.

So with American IRA, no matter how your assets grow over the life of your investment, you’ll pay one low set annual fee, putting you in total control of your financial future.

Choosing American IRA means you’re choosing expertise, value and performance. Fee Schedule

Visit our Client Interviews page to see what our clients are saying about us and then give us a call to receive a complimentary, no obligation, free consultation about what we can do for your specific situation….(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

A Self-Directed IRA is a type of individual retirement account that allows you to have more control over your investment choices. With a Self-Directed IRA, you can invest in a wide range of assets, including real estate, precious metals, private equity, and more. However, it’s important to consider the fees associated with a Self-Directed IRA before opening one.

One of the main fees you’ll encounter with a Self-Directed IRA is the annual account fee. This fee is typically charged by the custodian of the IRA and covers the cost of administering the account, processing transactions, and providing customer service. The annual account fee can vary depending on the custodian and the services they offer, but it generally ranges from $100 to $300 per year.

In addition to the annual account fee, you may also have to pay transaction fees for buying and selling assets within your Self-Directed IRA. These fees can vary depending on the type of investment you’re making and the custodian you’re working with. For example, if you’re buying real estate through your Self-Directed IRA, you may have to pay fees for title searches, appraisals, and property management.

Another fee to consider with a Self-Directed IRA is the asset custody fee. This fee is charged by the custodian for holding and safeguarding your investments. The asset custody fee can vary depending on the type of assets you’re holding in your Self-Directed IRA, but it generally ranges from $20 to $100 per year per asset.

It’s also important to be aware of any additional fees that may be charged by the custodian of your Self-Directed IRA. These fees can include fees for wire transfers, check processing, account termination, and more. It’s important to carefully review the fee schedule of your custodian to understand all the costs associated with your Self-Directed IRA.

In conclusion, while a Self-Directed IRA can offer you more control over your investments, it’s important to be aware of the fees associated with this type of retirement account. By understanding the various fees that may be charged, you can make informed decisions about your investments and ensure that you’re maximizing the benefits of your Self-Directed IRA.

0 Comments