![]()

In this video, we’ll go over the top strategies for tax-efficient retirement withdrawals. Learn how to make the most of your retirement savings by minimizing taxes and maximizing your income. Whether you’re already retired or planning for the future, these tips will help you achieve financial security in your golden years. Watch now to learn more!

We’re an investing service that also helps you keep your dough straight. We’ll manage your retirement investments while teaching you all about your money.

0:00 – 0:25 Intro

0:26 – 2:14 retirement account Overview (Roth IRA, 401k, traditional ira, etc.,)

2:15 – 4:18 Strategies to reduce taxes

4:19 – 6:28 Strategy 2: Taxable, tax-deferred, tax free: find the opportunity

6:29 – 7:22 Real life example on how to use this practically!

#retirement #retirementplanning #dohstr8

—Ready to subscribe—

For more information visit:

— Instagram @jazzWealth

— Twitter @jazzWealth

Business Affairs 📧Support@JazzWealth.com…(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

retirement planning is an essential part of financial stability in our later years. One key aspect of retirement planning is understanding how to make tax-efficient withdrawals from your retirement accounts. By doing so, you can maximize your retirement income and minimize the amount of taxes you owe.

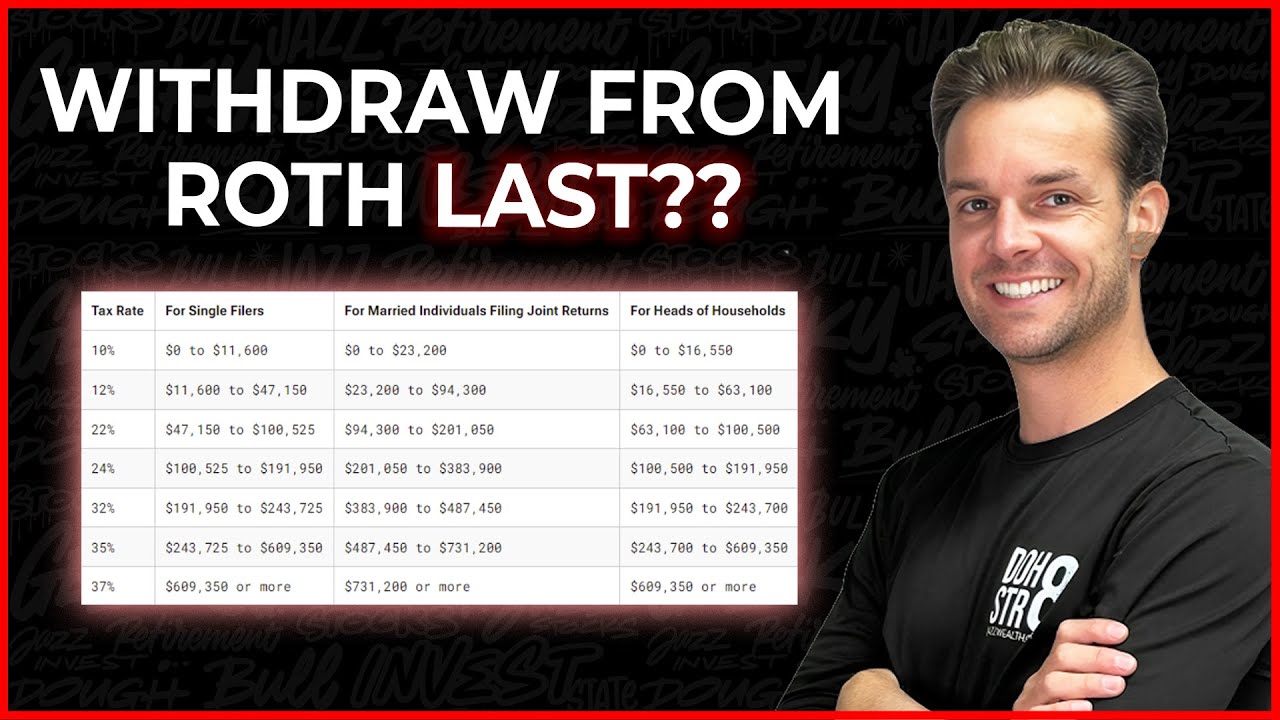

When it comes to retirement accounts, such as 401(k)s, IRAs, and Roth IRAs, there are different tax implications for each type of account. Traditional 401(k)s and IRAs are tax-deferred, meaning you do not pay taxes on the contributions when you make them, but you do pay taxes on the withdrawals in retirement. On the other hand, Roth IRAs are funded with after-tax dollars, so withdrawals in retirement are tax-free.

One strategy for tax-efficient withdrawals is to have a mix of traditional and Roth retirement accounts. By having a diverse portfolio of accounts, you can strategically withdraw funds from each account to minimize your tax liability. For example, in years when your income is lower, you may choose to withdraw funds from your traditional accounts to take advantage of lower tax rates. In years when your income is higher, you may opt to withdraw from your Roth accounts to avoid pushing yourself into a higher tax bracket.

Another important factor to consider when making tax-efficient withdrawals is your age. Once you reach the age of 70 ½, you are required to start taking minimum distributions from your traditional retirement accounts. These required minimum distributions (RMDs) are subject to income tax, so it’s important to plan ahead and budget for these additional tax liabilities.

It’s also crucial to consider the timing of your withdrawals. By spreading out your withdrawals over multiple years, you can potentially lower your overall tax burden. For example, if you have a large expense one year, such as a major home repair or medical bill, you may want to carefully plan your withdrawals to minimize the tax impact of this extra income.

Overall, tax-efficient withdrawals are an important aspect of retirement planning. By understanding the tax implications of different types of retirement accounts, having a mix of traditional and Roth accounts, considering your age and timing of withdrawals, and seeking advice from a financial advisor, you can maximize your retirement income and reduce your tax liability. By taking the time to develop a thoughtful withdrawal strategy, you can enjoy a secure and financially sound retirement.

0 Comments