▸▸▸Enroll in our Stock Market Investing Course for Financial Independence and Retiring Early: Enroll in our new 21 module, 4-plus hour stock market investing course with more than 30 handouts of summary notes, homework assignments, and resources. Learn how to research and select investments, how to determine your asset allocation, how to rebalance your portfolio, how to optimize your investments for tax purposes, how to automate your investments, and much more (including a 19-page Investment Plan to work on)!

▸▸▸Enroll in our FIRE Master Class: This FIRE Master Class is designed for people interested in pursuing financial independence and retiring early. In the Master Class, we explain how to live off of your investments during early retirement; how to withdraw money from your investment accounts to support your living expenses during retirement; how to calculate your FIRE number; new and creative ways that you can save money; new side hustles for making money; how to invest in the stock market and in real estate; we discuss healthcare options in retirement . . . and MORE!

▸▸▸Enroll in our How to Move to Portugal Course: A Step-By-Step Course to Relocating and Living in Portugal: This course is designed for people interested in moving to Portugal. In the course, we explain the visa process, the documents you need to submit for your application, and the step-by-step process that we took to obtain our visas; we explain the residency permit process and how we obtained our residence permit here in Portugal; we explain the process for buying and renting a house in Portugal; we discuss healthcare, school options, and setting up NIFs, we explain taxes here in Portugal, and MORE!

Books that have helped us on our Financial Independence Journey

—–

The Bogleheads’ Guide to Investing:

The Intelligent Investor:

A Random Walk Down Wall Street:

The Book on Rental Property Investing:

Building Wealth One House at a Time:

Rich Dad Poor Dad:

The Total Money Makeover:

The $100 Startup:

Freakonomics:

▸▸▸Follow us on Instagram:

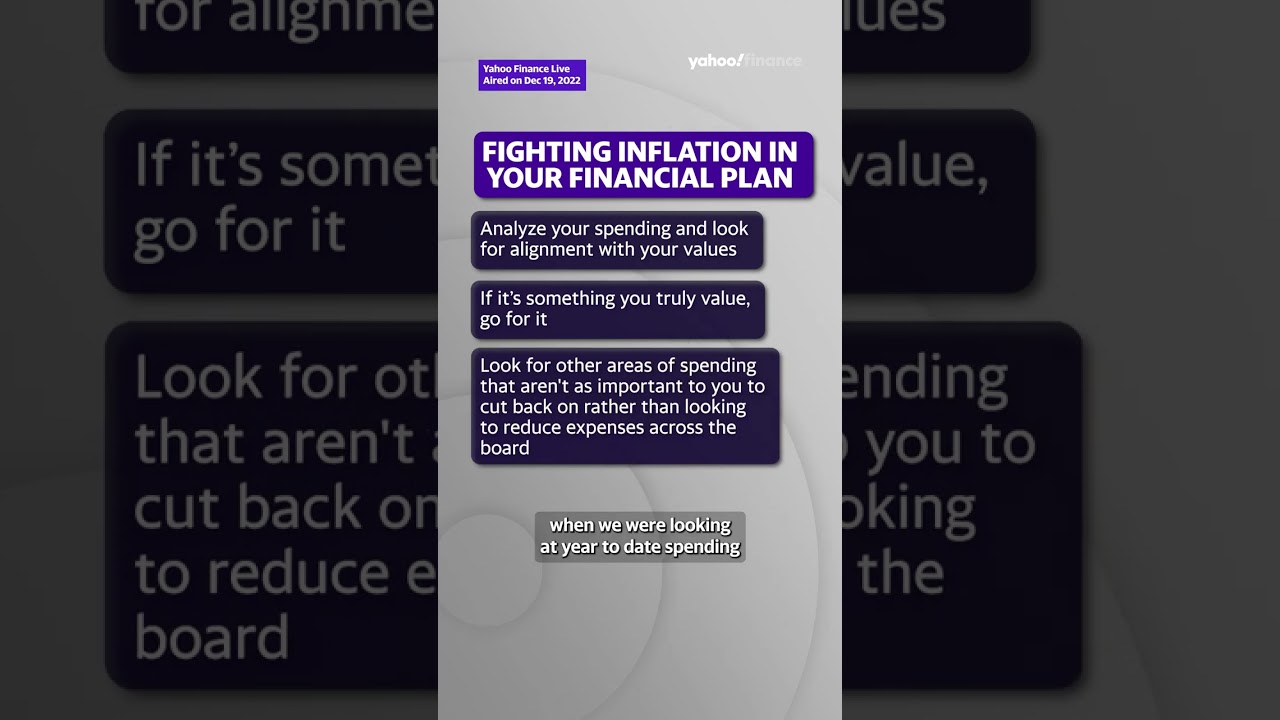

Our Rich Journey – High Inflation Is Here | How to Beat It & How It Impacts Your Financial Independence: With a spike in inflation just last month, we think it’s a great time to discuss the topic of high inflation! If you’re pursuing financial independence and retiring early, you constantly have to be mindful of inflation. Extreme spikes in inflation can drastically reduce your purchasing power and potentially even hinder your pursuit of FIRE. So, in this video, we want to talk about what you can do about high inflation rates. We talk about how inflation impacts your FIRE journey, how it impacts your FIRE calculation, and we provide our five tips for how you can protect yourself against inflation. Thanks for watching!

▸▸▸Check out some of our other videos!

5 Reasons to BUY NOW | REITs (Real Estate Investment Trusts):

How to Calculate Your Financial Independence Number When Investing In Stocks & Bonds:

ETF vs. Index Funds | Our Investments for Financial Independence (FIRE Investing):

Investing in Index Funds for Beginners | Tips & Advice From Millionaire Investors:

▸▸▸PLEASE SUBSCRIBE:

If you like our video, please make sure to “like” the video and subscribe to our channel. We post one video a week related to our journey towards financial independence, including making money, saving money, and investing money. Make sure to check out all our videos and . . . join the journey!

DISCLAIMER:

We are not financial advisors. Our videos are for educational purposes only and merely cite our own personal opinions. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary. Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!

AFFILIATE DISCLOSURE: Some of the links on this channel are affiliate links, meaning, at no additional cost to you, we may earn a commission if you click through and make a purchase and/or subscribe. However, this does not impact our personal opinions.

#FinancialFreedom #HowToRetireEarly #FinancialIndependenceRetireEarly…(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

can I also apply 4% rule for real estate investment? Because in short term rentals you make more then 10%?

You both are so helpfu

FJB

I am having a great time binging your content. Thanks for all the hard work and inspiration!

Hi! Love all of your videos! How do you feel about HMBradley’s 3% savings accnt?

Enjoyed the thought-provoking content.

Glad to see there is an actual word for those products which appear to have shrunk over the years, yet have not reduced in price "Shrinkflation". Who knew!!

I series bonds are a good choice, but your money will be locked up for a time before you can take it out without penalty.

Hey you give us some ideas of others account to save your emergency funds in

great videos guys, subscribed! We have a few rentals but the odds of us getting another due to the demand and inflated prices we will probably not be able to again. So now I'm looking at index funds! This is a great stuff, you guys speak very clearly, so I can keep up with you!

Is this a good time to covert a traditional IRA to Roth ?

Recently been hearing a lot about a banking crisis and banks getting ready with their playbook for closing accounts and credit lines…the crisis is supposedly worse than 2008 due to inflation here and countries around the world and supply chains being affected etc it is said that your money over 250k which is not FDIC insured could be gone as government funds "bail ins" …the recommendation is to invest in gold /silver and crypto currency instead so one does not loose the uninsured money in Banks for which banks have no liability to protect for you…any thoughts?

this is wrong definition of inflation – what u gave is a RESULT of inflation….

its like definition of cake

cake is sweet that gives diabetes

Are you putting money in a retirement account or brokerage account? How are you pulling money before the age of 59? perhaps you have a video about this already, pls send the link.

The other lesson we have from Our Rich Journey to beat inflation is by having a source of income outside of investments. I haven't bought any of their courses yet, but if these are anything like their videos, then these are likely to be of very good quality.

USA: We are having lots of inflation

Eurozone: what a heck are you talking about?

friends laughed back in the day at the DOLLAR TREE….honey please, i have a kart full of stuff

Hey I just found you two and I’m binging your content! Quick question. Looking back do you feel like your 401K contributions were worthwhile? Or do you feel like you could have gained equal or greater value (and greater flexibility) from investing those dollars in the market or real estate instead?

You guys are awesome! And how can you not like two people who wear Chewbacca and Smokey the Bear t-shirts, eh? I´ve been investing for 30 years and still learn things from your videos. Well done and a good service to people just getting going. If even a teacher like me can do it, anyone can.

Question: you stated that the 3% adjustment for inflation plus the 4% withdrawal is 7% of the 10% average growth rate of stock market. Here’s my question, does the yearly adjustment for inflation come from the total portfolio or is it adjusted from the withdrawal amount? I was calculating it on my $20k yearly withdrawal.

Packed with great content and education!

Been watching awhile now. Thank you. But question: for personal expenses, bill etc… are you withdrawing or living solely off your dividends.. and thanks. I may have missed that episode.

Great video.im in the UK so just follow your principles and look for bank accounts with similar concepts in the UK.

Thank you as always I have beneficial take-aways

You guys are AMAZING. I love these videos. I am so inspired by you

HI! Love your channel! I have a question: how to overcome the fear of fraud and identity theft over investing on-line? What are your strategies to combat that problem?

They don’t understand that inflation is actually around 13%, so they are not beating inflation.

Just finished the stock investing course with my oldest son, who is 21. It was great, thank you! I now plan to go back and view your past videos to keep my continuing education. We are both well on our way to FIRE. Thanks for all the helpful information!

VIDEO REQUEST: I’ve been investing across many accounts (i.e., ROTH’s, brokerage, HSA’s) for years. My investments are spread across many classes (VTSAX, bond, funds, etc.). How would you go about rebalancing to get a solid strategy like yours without selling everything and reinvesting? Still thinking about that. Thanks again!

Luke: Those Index funds are too strong for blasters. Rouge Group, use your harpoons and tow cables. Go for the computer servers. It might be our only chance of stopping them.

I think there's a significant error in this video: the 4% stands for the annual spending and if prices rise by 3,5% then the 4% needs to grow by 3,5% (=4,14%). if the video would be correct (4%+3,5%=7,5%) and calculate that over 10 years with 2,5% average inflation it equals 4%+(10*2,5%)=29%. seems strange.

How’s the housing market going in Portugal vs the USA’s rapid growth. Our equity doubled in 4 years. We are 34 and will retire in 5ish years and we talk about moving out of the states quite often.

Inflation rate calculation by the fed does not include housing. Only basic need commodities are included in its estimation. The true inflation rate is much much higher than the average 3.5% or the 5% last year. Can you put a video on FIRE considering true inflation?

Love your channel!

I don't think you can consider yourself retired, when you still have to hustle and worry about inflation.

P.S. more likely we are in a stagflation cycle.

Having gone through the 80's and 90's you are reminded that finance is cyclical. My MIL bought tax free munis that returned 10+% didn't look 'good' then but sure did in the 00's.

Bitcoin is the ultimate inflation hedge

Im waiting for Biden to define inflation to me because he is causing it.

I watched your video last year and invested n vtsax. It has been a good decision so far , thanks!

Love the t-shirts!

Thank you guys for everything you do! SERIOUSLY!!

As always, love the topics and approachability! I was reminded especially to move emergency money out of regular savings account. I need to do this! Glad we have you two in our journey as we work toward FIRE. Your names come up regularly in our daily conversations—our toddler is even starting to become familiar with your family!