![]()

⭕️Sign up for our newsletter to stay informed with accurate news without spin. 👉 If the link is blocked, type in NTD.com manually to sign up there.

–

⭕️Subscribe to our new YouTube channel 👉

–

⭕️ Get NTD on TV 👉

⭕️ Download EpochTV Ebook for free👉

–

⭕️Support us:

–

💎Save 10% off your next order with the code: NTDNews10

Visit

Inspired by Shen Yun Performing Arts, Shen Yun Shop infuses tradition, good values, and artistic beauty into all of our products.

–

⭕️ Follow us on GAN JING WORLD:

–

⭕️ SUBSCRIBE to the NTD YouTube channel TODAY:

🔴 Check out ‘The Real Story of January 6’ documentary DVD here: use promo code “EpochTV” for 20% off!

🔴 “The Shadow State,” a feature documentary by The Epoch Times, takes a deep dive inside the environmental, social, and governance (ESG) industry. ORDER DVD:

🔵 Watch more:

–

If you’d like to share our stories with friends, you can find those stories on our website:

–

⭕️Watch more:

NTD News Today

NTD Evening News

NTD Business

How the Specter of Communism Is Ruling Our World

NTD Featured Videos

–

Facebook:

Twitter:

Parler:

Telegram:

Rumble:

Instagram:

Minds:

Gab:

MeWe:

Contact us:

#HouseOversightSubcommitteeHearing #BankFailuresm #SupervisionFailure

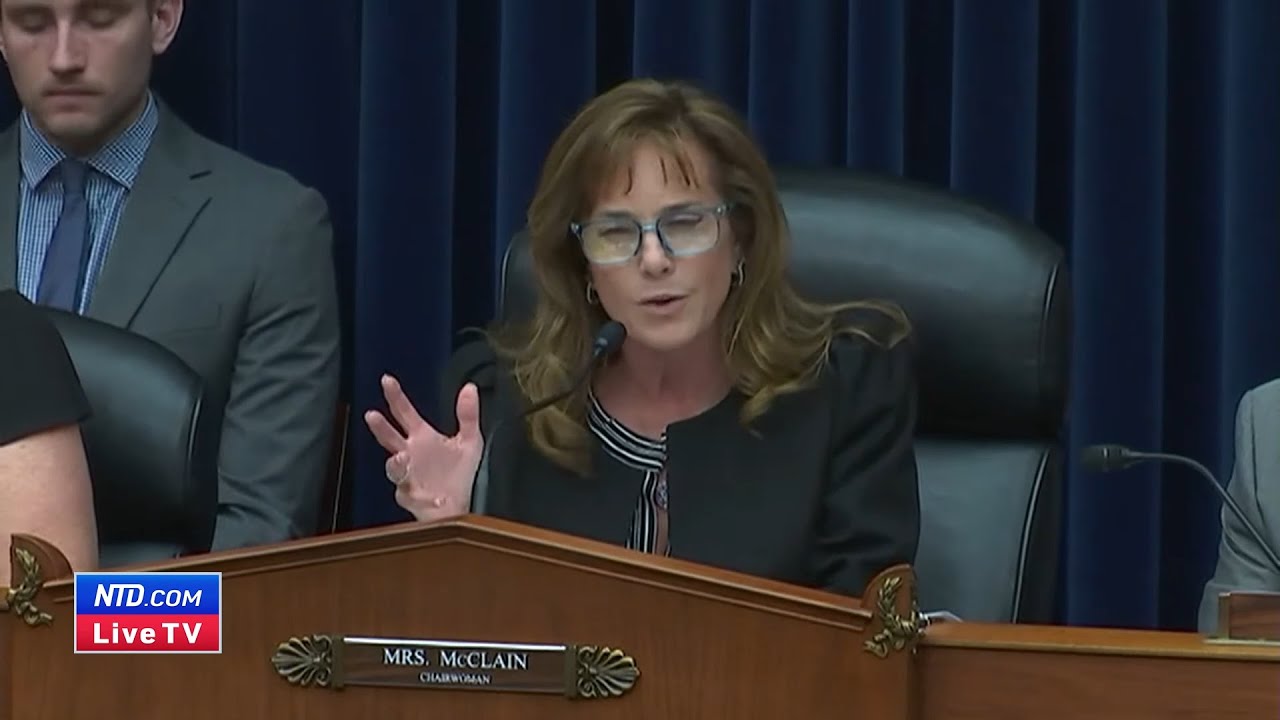

LIVE: House Oversight Subcommittee’s Hearing on Bank Failures and Supervision Failure

–

© All Rights Reserved….(read more)

LEARN MORE ABOUT: Bank Failures

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

On Thursday, the House Oversight Subcommittee held a hearing to investigate bank failures and supervision failures that have plagued the financial industry in recent years. The hearing brought together experts from various fields including banking, regulatory agencies, and consumer protection to shed light on the issues and propose solutions for preventing future failures.

The subcommittee’s chairman, Rep. Katie Porter, led the proceedings by highlighting the importance of strong oversight and regulation in preventing bank failures. She stated, “It’s clear we need to do better when it comes to supervising banks and ensuring that consumers are protected from potential financial instability.”

The hearing focused on recent high-profile bank failures, including the collapse of Greensill Capital and Archegos Capital Management, which have raised concerns about the stability of the financial system. Witnesses provided insights into the regulatory failures that allowed these institutions to take excessive risks and engage in risky behavior without proper oversight.

During the hearing, the witnesses stressed the need for stronger regulatory frameworks and increased transparency in the banking sector. They also emphasized the importance of accountability for banks and their executives, urging Congress to pass legislation that holds them responsible for their actions.

One witness, a former bank regulator, recommended that Congress establish an independent oversight body to monitor and regulate the financial industry to prevent future crises. He also suggested imposing stricter penalties on banks that engage in risky behavior and fail to comply with regulations.

Another witness, a consumer protection advocate, emphasized the need for stronger consumer safeguards to prevent predatory lending practices and ensure that consumers are not being exploited by financial institutions.

The hearing also addressed the role of regulatory agencies such as the Securities and Exchange Commission and the Federal Reserve in supervising and regulating banks. Some experts criticized these agencies for being too lenient on banks and failing to adequately monitor their activities.

Overall, the hearing underscored the urgent need for improvements in the oversight and regulation of the banking sector. Lawmakers and witnesses alike agreed that stronger measures need to be taken to prevent future bank failures and to protect consumers from the repercussions of financial instability.

In conclusion, the House Oversight Subcommittee’s hearing on bank failures and supervision failure was a crucial step towards identifying the root causes of these issues and proposing solutions to prevent future crises. The testimony from experts highlighted the need for stronger regulatory frameworks, increased transparency, and greater accountability from financial institutions. It is clear that action must be taken to address these shortcomings and protect the financial well-being of American consumers.

Ms Lee is so uninformed with blaming Trump she must have got her financial degree MBA or other degrees from AOC woke university. I can't watch her stupidy any longer.

It's all about protecting the wealthy the rich man

Remember when the big Banks were called too big to fail, and so when they failed, they got bailed out with tax payors money, then they used that money to buy up smaller banks and become even bigger than too big to fail, insuring they would be bailed out again if ever in trouble? Here we go again, day one Janet Yellin said "We are not going to bail them out!" 24 hrs later they were again being bailed out ! History repeats itself, especially when the same numbskulls are in charge!