![]()

Join my brand New newsletter for weekly in-depth report & notes.

Join this channel to get access to perks:

For Sponsorships Email MichaelCowan@lighthouseagents.com

For other inquires email me Michaelinvests11@gmail.com

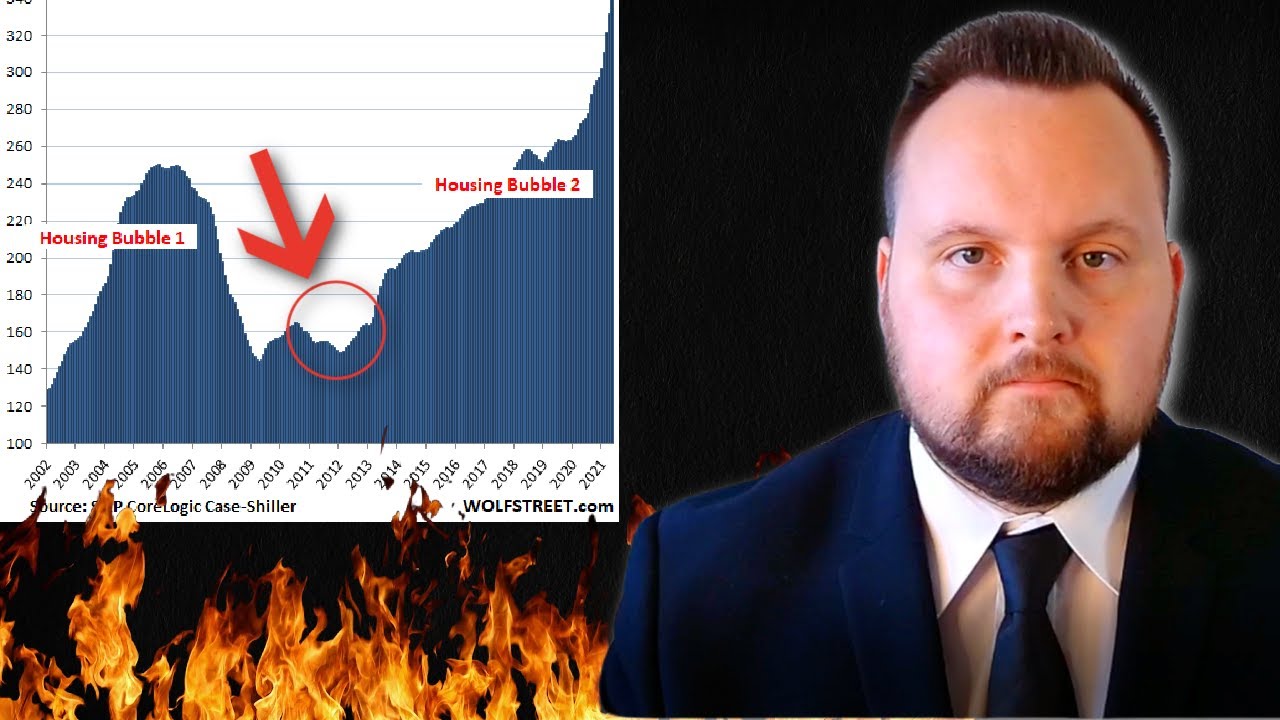

ECONOMIC CATACLYSM! Home Prices Declines Hit Decade High for The Real Estate Market

HOUSE PRICE CRASH BEGINS! This Will Rival 2008

Please note: some of these links are affiliate links where I’ll earn a small commission if you make a purchase at no additional cost to you.

Michael Cowan is not A financial adviser. The information provided in this video is for general information only and should not be taken as financial advice. There are risks involved with stock market or other asset investing and consumers should not act upon the content or information found here without first seeking advice from an accountant, financial planner, lawyer or other professional. Consumers should always research companies individually and define a strategy before making decisions. Michael Cowan is not liable for any loss incurred, arising from the use of, or reliance on, the information provided by this video….(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

House prices have always been a topic of interest for most of us, but it seems that the recent trends have taken the market by storm. Yes, you guessed it right, house prices have just done it! The market has witnessed a sudden surge in house prices and the demand for properties has skyrocketed. Let’s have a look at the recent statistics to know more about this phenomenon.

According to the data released by the National Association of Realtors(NAR), the median existing-home price for all housing types in May was $350,300, up 23.6% from May 2020 ($283,500), as every region recorded price increases. This marks the 111th straight month of year-over-year gains.

Why did this happen? The answer is simple – the pandemic. The pandemic brought a lot of changes, one of them being the concept of ‘Work from Home’ and the need for larger spaces. People started realizing the importance of owning a comfortable home where they can work and relax at the same time. Moreover, low-interest rates played a significant role as well. People have been taking advantage of the low-interest rates and buying properties.

Another reason for this sudden surge in house prices is the shortage of supply. The pandemic has disrupted the construction and supply chain, causing a delay in building new homes. Due to this, the number of available properties for sale has decreased, leading to an increase in demand and ultimately the prices.

These factors have paved the way for the current market trend, which is expected to continue for some time. However, experts predict that the market will eventually stabilize, and the house prices will reach equilibrium.

What does this mean for buyers and sellers? Well, for sellers, this is an excellent opportunity to sell their properties for a higher price. On the other hand, for buyers, this might not be an ideal time to buy a house unless it’s an urgent requirement. They might need to wait for the market to stabilize to get a fair price.

In conclusion, the sudden surge in house prices is an outcome of various factors and a shift in priorities. It’s essential to keep an eye on the market trends and analyze them before making any investment decisions.

The price decline has not happened in my area yet. Northeast WI. Very low inventory. Buyers are paying 10 to 15% above asking.

I sold a couple properties in 2021 and I'm waiting for a house crash to happen so I buy cheap. In the meantime, I've been looking at stocks as an alt., any idea if it's a good time to buy? I hear people say it's a madhouse and a dead cat bounce right now but on the other hand, I still see and read articles of people pulling over $225k by the weeks in trades, how come?

All the Westminster commonwealth clownshows who built house price agenda around "sell_your_children_to_realestate_man_stratergy" are failing.

Good riddance. Enjoy your cannibalistic poverty and crime. You idiots all cheered it on.

The Market have been suffering over the past month, with all the three indexes recording losses in recent weeks. My $400,000 portfolio is down by approximately 20%, any recommendations to scale up my returns before retirement will be highly appreciated.

My neighbors house has been on the market for 6 months and has dropped asking price by 68k

Housing prices are still going up in Florida so I have no clue what you are trying to talk about

Very interesting.

I may have saved a friend, a lot of money. Thank you.

Your a wadongus brotha

I'd rather starve than pay debt

Look at that SHS pattern!

Thank you.

The last crash happened in 2008, and I bought my house at more than 50% off in 2010. I want 50% or more off the next property.

Whole real estate market not hole

The feds has unleashed chaos! I wonder if people that experienced the 2008 crash had it easier because this market conditions are driving me to insanity, my portfolio has lost over $27000 this month. alone my profits are tanking and I'm don't see my retirement turning out well when I can't even grow my stagnant reserve.

RP data reporting that appraisals are skyrockets which has a few months delay to list so expect an flow of houses hitting the market in spring. Agents create reports from this program when they visit potential sellers.

Thanks Mate

Back in the 70s depending on where in the world you lived in…

Food (groceries) accounted for up to 70% of your weekly spending.

Think about that for a sec… 70%… especially if you happened to be in the lower decile of the economic strata.

Comments = ALL bots

— in Austin TX here; house prices have dropped 10-15% accross the board in the city; house at the corner sold in Dec22-Jan23 for about 500k (its a flip, they are still working on it); well, same house would have sold at around 600k back in late 2021-early 2022; NOT anymore… and it will keep going down; there are pockets in the city still selling for outrageous prices, but it is out of state investors or buyers from Cali or NY state (for most part); its just not sustainable over time… summer ‘24 and 2025 should have better prices

Another reason it's less likely to happen that way is that there is already too much demand waiting to absorb that regardless of how everyone is panicking and calling the crash. Nobody was making this prediction in 2008, at least not the general public, as I indicated below. In the other comment, it was mentioned that the ownership rate peaked in 2004. As of today, we are at the median level, having previously peaked in the second quarter of 2020. It decreased by 3% over 4 years, from 2008 to 2012, going from 68 to 65 in the second quarter of 2020.

The effects of the downturn are beginning to sink in. People are being impacted by the long-term decline in property prices and the housing market. I recently sold my house in the Sacramento area, and I want to invest my lump-sum profit in the stock market before prices start to rise again. Is now the right moment to buy or not?

Why do you keep talking about stimulus checks. They DID NOT MAKE MUCH DIFFERECE. They were used for emergencies or they allowed for some limited fringe benefits.

The market, as a whole, will go down at Minimum 30% and stay that way for quite a time. Your graph shows as you say in 2022 a 26% rise. It must give all that up and then some. Only question is How much more. Their is absolutely nothing to support the housing market. Nothing.

…….

Lumber. As in your back?