![]()

Best known as the author of Rich Dad Poor Dad—the #1 personal finance book of all time—Robert Kiyosaki has challenged and changed the way tens of millions of people around the world think about money. He is an entrepreneur, educator, and investor who believes that each of us has the power to makes changes in our lives, take control of our financial future, and live the rich life we deserve.

With perspectives on money and investing that often contradict conventional wisdom, Robert has earned an international reputation for straight talk, irreverence, and courage and has become a passionate and outspoken advocate for financial education.

Robert’s most recent books—Why the Rich Are Getting Richer and More Important Than Money—were published in the spring of this year to mark the 20th Anniversary of the 1997 release of Rich Dad Poor Dad. That book and its messages, viewed around the world as a classic in the personal finance arena, have stood the test of time. Why the Rich Are Getting Richer, released two decades after the international blockbuster bestseller Rich Dad Poor Dad, is positioned as Rich Dad Graduate School. Robert has also co-authored two books with Donald Trump, prior to his successful bid for the White House and election as President of the United States.

#robertkiyosaki #richdadpoordad #millennialmoney

Facebook: @RobertKiyosaki

Twitter: @TheRealKiyosaki

Instagram: @TheRealKiyosaki

…(read more)

LEARN MORE ABOUT: Keogh Plans

REVEALED: How To Invest During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Net trade surges highlight aggregation, and the new numbers "areas of strength for propose" for Bitcoin when it is evaluated under the $30,000 level, as per the specialist.

Does anyone know what he means by the property putting 25 dollars in his pocket?

I personally cleared $230k of debt going aggressive in the other markets. Right now the markets are crazy but there are still hidden opportunities therein. Having monitored my portfolio performance return huge six figures from the last 2 quarters of last year, I have learned why the market will remain a money den for those who know where to look.

MAKE MONEY WHILE YOU ARE SLEEPING!

AS YOU SLEPT LAST NIGHT, YOUR RENTS ARE RUNNING. YOUR ELECTRIC BILL WAS RUNNING. YOUR DATA WAS RUNNING. NONE OF YOUR BILLS SLEPT. THEY KEPT ON BILLINGS AS YOU WERE SLEEPING. IN OTHER WORDS, YOU WOKE UP OWING MORE THAN YOU DID BEFORE SLEEPING. THAT'S WHY YOU NEED 'PASSIVE INCOME'. SO WHEN YOU SLEEP, YOU CAN ALSO MAKE MONEY, NOT JUST DEBTS.

It's all right if I buy a house for a loan and then rent it out, then I have the cash flow, but who will give me a loan if I have no money and no mortgage?!

Wow!!

Robert is mentally patient. don't listen to him

Starting early is the best way of getting ahead to build wealth. Most times, it amazes me greatly how I moved from an average lifestyle to earning over $83k per month, Utter shock is the word. I have understood a lot in the past few years that there are lots of opportunities in the financial market. The only thing is to know where to focus.

QUESTION PLS ANSWER

I'm really trying to get my head round this because I want to learn and educate myself because nobody else will, Robert said he bought his first property on his credit card for 18k right but it only put 25 in his pocket a month…. so how does he pay off that credit card debt, or does he not, if you understand and have an answer id really appreciate the help. Thx.

He keeps mentioning the age 22.

Obviously he's had some kind of trauma or epiphany at 22.

I got distracted with the beautiful Latina woman but I agree good debt is good only headache is tenant complaints on rentals.

he is still an evil landlord keeping ppl from having accessible affordable housing, so take what he says with a grain of acidic salt.

This is Great Content! Great Stuff, Robert!

Is make sense – NOT AT ALL , another scamer. He sleep many thinks which with out of them you can't do anything. Scamer

Oh boy, that girl was clearly coached on what to say. Just makes the whole thing feel inauthentic.

So Robert owns 6500 condo units?? That means he can take out as much debt as he wants to fund his lifestyle (using properties as collateral), never pay any income tax as long as all his earnings are reinvested into more properties. Quite the tax avoidance scam he’s got going on…

can someone explain, so what Robert Kiyosaki is saying is to use the money and make more money instead of paying the dept?

if you do not pay taxes,are you on a Ponzy scheme, always buying houses to generate more debt to overcome the rental income?

and if that is the case, what happens in the end?

also,why you need to support yourself with the aid of book sales and youtube videos? thanks

If you have to 'study' being an entrepreneur it means you aren't one. It's not something you study, it's something you DO.

I am a social media marketing expert, if you need any kind of services ,I can help you there.

Nice and all, just where am I supposed to live if I'm renting out my house?

I fell dumber ever time she speaks

Isn’t he still getting taxed on what he cash flows?

Important Question… The money in your pocket is actually the money income of your business… So from your business… do you simply give yourself a wage? and how is this taxed? or do you set it up as directors fees? Finally, how exactly is it that tax free deals are made… how does the flow on that actually work?

Now I understood why Robert kiosaki has open fight with financial system, he financed all his real estates on debt which he says 100 % financed from bank money or any kind of debt and as FED is increasing rate of interest from 1% to today 2.8% his calculation start going wrong and still more intrest rate going to increase to cope up with inflation, hence he is brain washing public by saying that stock market is bad and everything going to melt down , long term recession is coming such negative statement he is giving to create fear mongering and after this he may be thinking FED will stop increasing further rate of interest, if stock market get crash, what a masterplan. Selfish person who invested mostly in real estates.

I don't have a credit card and I'll tell you how I check into a hotel. A debit card. I shop with cash. It's not hard.

It's always good to hear your perspective

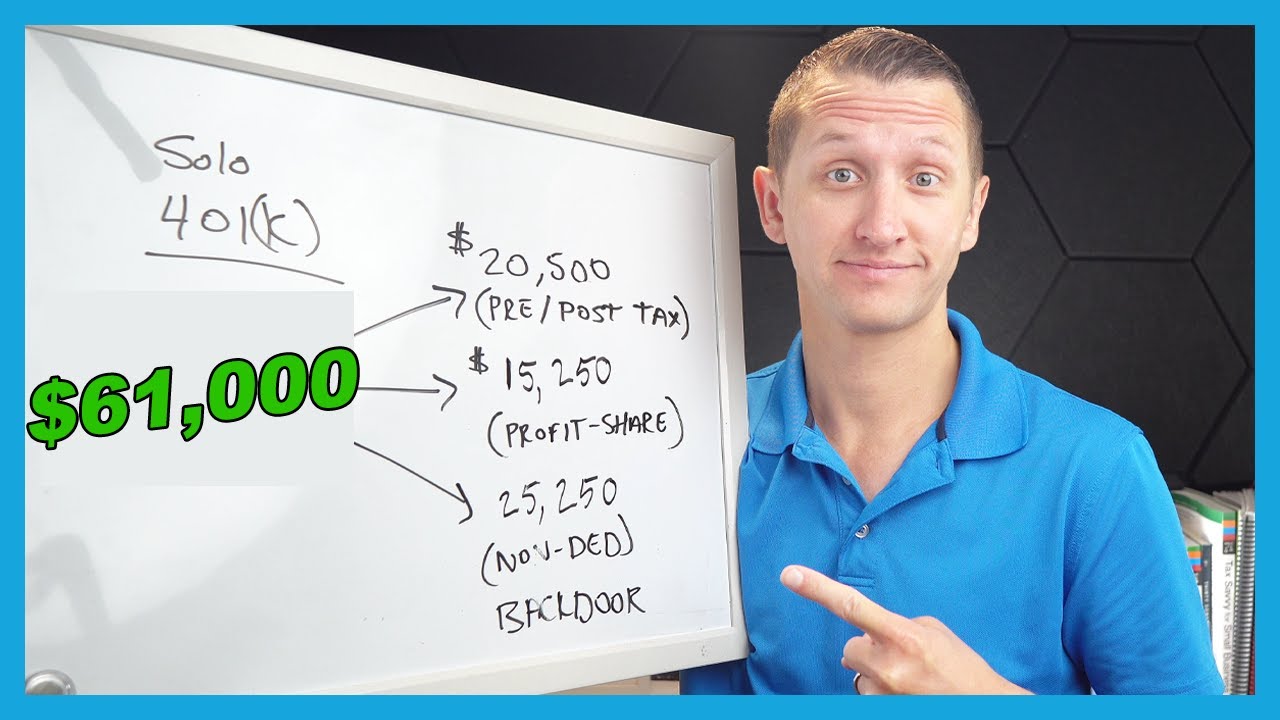

I currently make$105,000/year. No home or lnvestments and the job is in California as I work from home. I need to do something quick or else I’m going to be paying thousands to the IRS come tax season. What can I do?

I've learned a lot from his interviews, podcast these things thought me more than anything else about money.. thank you so much for this ❤

I was wondering how you find good classes/teachers? Most of them live only from the course fees, but in the end, they have not achieved anything in the given area of what they are lecturing, who has achieved something, has no need to spread his know-how, why would he do it in the end? So how you can find good teacher, who is willing to teach you?

This video made me understand the power of investment.. I just started investing with miraveststock and I can tell you that everything is working perfectly in miraveststock..

I hope you got on I just noticed this is 4 years ago lol

You're Don't have to borrow anymore You can get rid of your taxes.

And credit card is never good done they're bothering money from your treasury account and charging you interest on it dude Wake up You're missing up on big opportunities right now just classes all over the place start searching them and start studying You won't have any debt ever again

Why don't you get your money out of the treasury the government treasury You just need to know how to do some paperwork dude and get it trust account and a bunch of $10.99 A's and 1099C

Amazing video

Do do you need to return all your debt or you just keep increasing your debt unless you have like 6500 houses and a hell lot of debt to pay to the bank