![]()

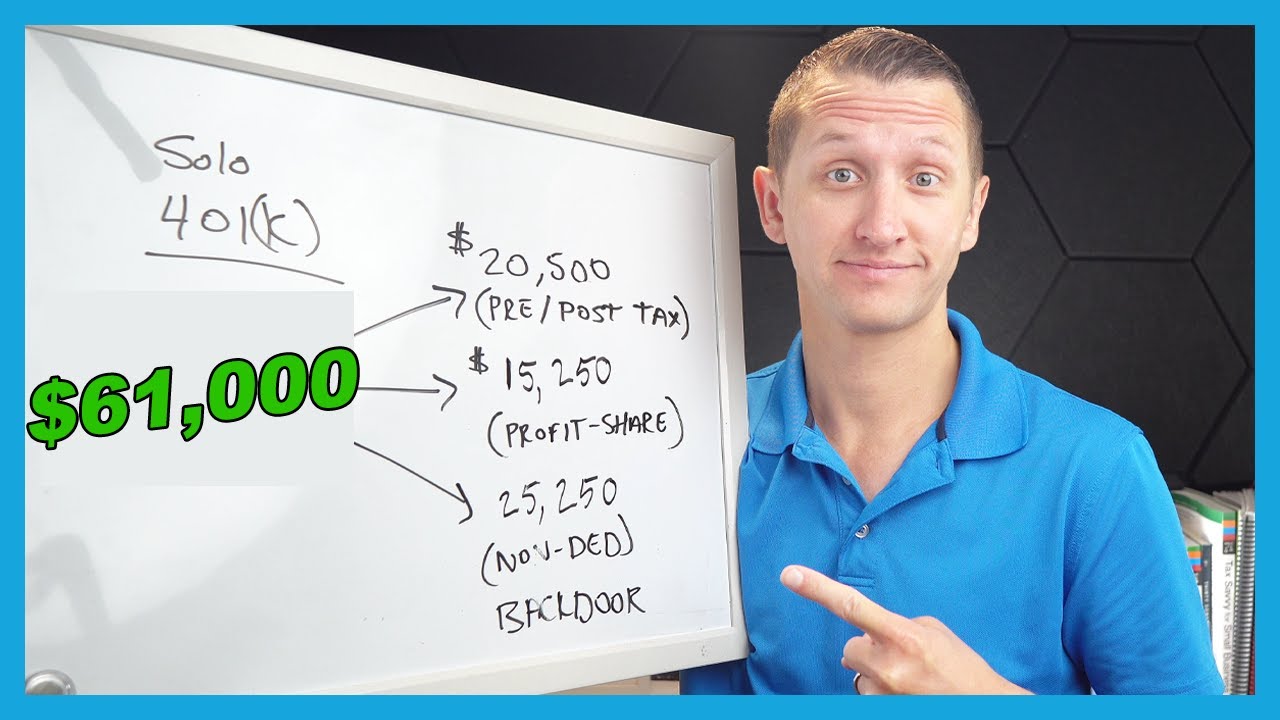

It’s simply line 16 on your 2021 Schedule 1 tax return, “Self-employed SEP, SIMPLE, and qualified plans”, but how do you specify that value when using HR Block to file your tax return for a small business or side hustle? It’s not under Deductions as you might think! Will HR Block help you calculate your Solo401k contribution?

To find the Fidelity form I use, search for “fidelity solo 401k contribution calculator” in google. The form link changes, so I’m not linking directly to it here.

This is not financial advice and I am not a financial advisor. This is simply an instructional video for how to enter a value for 2021 Schedule 1. Consult a financial or tax advisor for your tax planning needs. In order to contribute to one of these plans, you need to have net profit with a solo small business and meet other requirements….(read more)

LEARN MORE ABOUT: Keogh Plans

REVEALED: How To Invest During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Timestamps

0:00 Intro

1:38 Tax forms related to your contribution

2:13 Setup business profile in HR Block

2:50 Business expenses – HR Block vs Schedule C

3:55 'Retirement account contributions' in HR Block

4:59 Confirming no change to net profit

5:35 Calculate your Solo401k contribution – Schedule SE

6:23 Calculate your Solo401k contribution – Fidelity's worksheet

7:30 Again, where to enter your contribution in HR Block

7:44 Outro

Thank you! I was having the exact same problem. That was so kind of you to put this info up for people like me.

Thank you! I tried speaking with several people at H&R Block and no one could answer this question.