![]()

Are you …

– a sole proprietor?

– a business owner with less than 100 employees?

– an independent contractor?

– self-employed?

– a partner in a business?

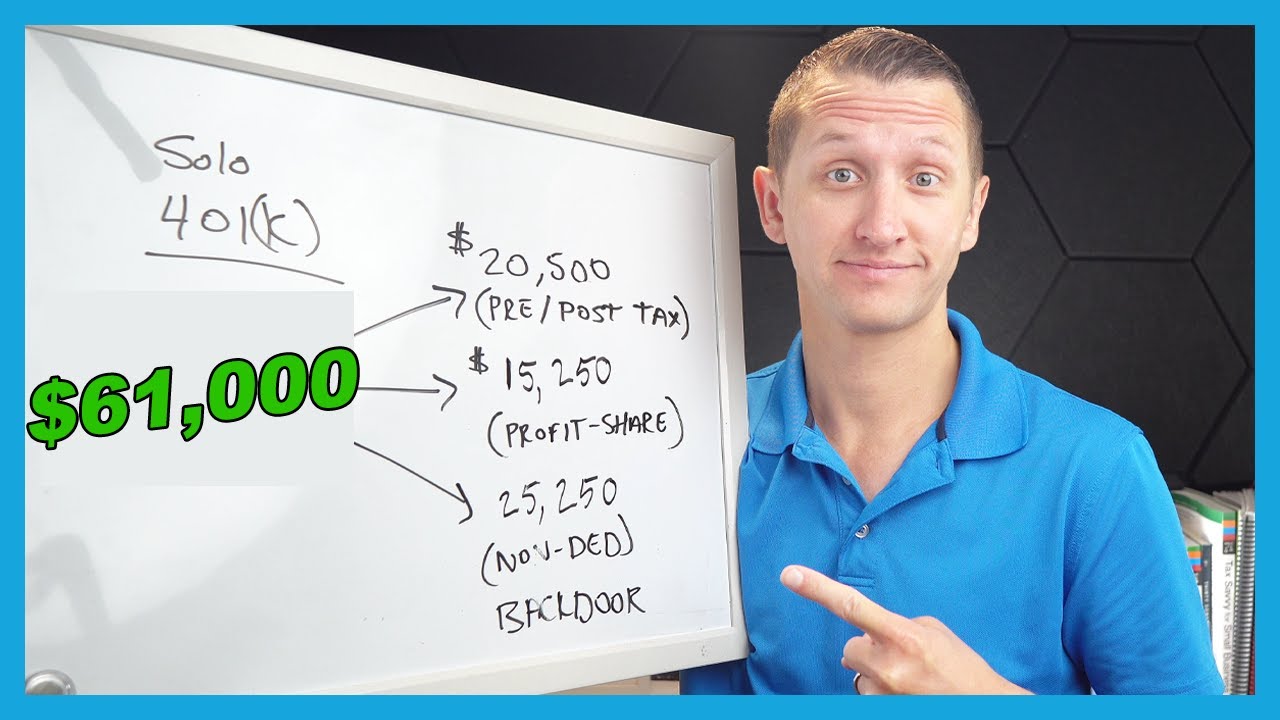

In this webinar, we will be discussing what types of contributions can be made to your self-directed IRA such as the Simplified Employee Pension Plans (SEP), the Savings Incentive Match Plan for Employees (SIMPLE), and the Individual(k).

Here’s what you can expect to learn …

– An overview of each plan;

– How to choose the right plan for your business;

– How to calculate your contributions;

– What the maximum contributions are;

– How to establish your plan.

To learn more about how to maximize your self-directed IRA visit …(read more)

LEARN MORE ABOUT: Keogh Plans

REVEALED: How To Invest During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

0 Comments