![]()

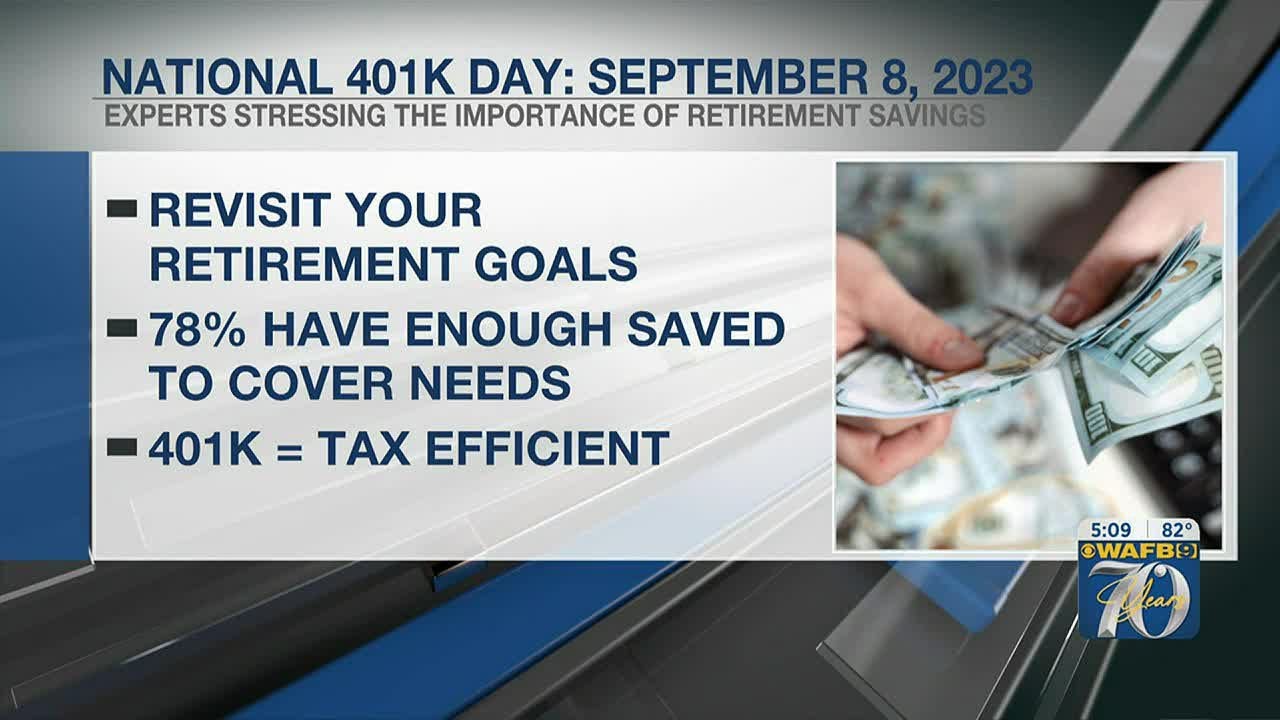

Experts want you to know that 401ks are tax efficient, offer matching contributions and provide your money with compounding growth over time.

For more Local News from WAFB:

For more YouTube Content:

Follow WAFB on Instagram:

Like WAFB on Facebook HERE:

Follow WAFB on Twitter HERE:

Follow WAFB on TikTok:

Follow 9Sports on Twitter:

Get your news on the go!

Download WAFB 9News mobile apps HERE: …(read more)

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

What You Need to Know About 401(k) Day

Every year, on the first Friday of September, Americans celebrate 401(k) Day. This day serves as a reminder and an opportunity to educate individuals about the importance of retirement planning and the benefits of 401(k) accounts. If you are unfamiliar with 401(k) Day, here is what you need to know.

What is a 401(k) Account?

A 401(k) account is a retirement savings plan sponsored by an employer. It allows employees to save and invest a portion of their wages before taxes are deducted. The funds within the account grow tax-deferred until withdrawal. Often, employers match employee contributions, further increasing the potential for growth.

401(k) Day Origins

401(k) Day was first launched in 1996 by the Profit Sharing/401(k) Council of America, an association dedicated to promoting retirement security. They aimed to raise awareness about the importance of saving for retirement and to encourage Americans to take advantage of employer-sponsored retirement plans.

Why is 401(k) Day Important?

401(k) Day acts as a reminder, encouraging individuals to take control of their financial future. It highlights the importance of saving for retirement and emphasizes the benefits of employer-sponsored retirement plans. By participating in a 401(k) account, individuals can save for retirement in a tax-efficient way, with the potential for compound growth over time.

Celebrating 401(k) Day

While 401(k) Day is not a widely recognized holiday, there are various ways you can celebrate and raise awareness about retirement planning:

1. Educate Yourself: Use this day to learn more about retirement planning, the different types of retirement accounts, and the investment options available to you. Educate yourself on the benefits of contributing to a 401(k) account and take advantage of any employer matching contributions.

2. Review Your 401(k): Take some time to review your current 401(k) account. Assess your contributions, investment performance, and fees. Consider increasing your contributions if possible and ensure your investment allocations align with your long-term goals.

3. Start a Conversation: Engage in conversations with your colleagues, family, and friends about retirement planning. Share your knowledge and encourage them to take advantage of employer-sponsored retirement plans.

4. Seek Professional Advice: If you are unsure about your retirement plan or investment choices, consider seeking advice from a financial advisor. They can help you make informed decisions and create a tailored retirement strategy.

5. Share on Social Media: Spread the word about 401(k) Day on social media platforms. Use hashtags like #401kday, #RetirementPlanning, and #FinancialSecurity to raise awareness about the importance of saving for retirement.

Remember, retirement planning is essential, regardless of your age or career stage. Starting early and remaining consistent with contributions can significantly impact your financial security in retirement. Take advantage of 401(k) Day as an opportunity to evaluate your current retirement plan and make any necessary adjustments.

0 Comments