![]()

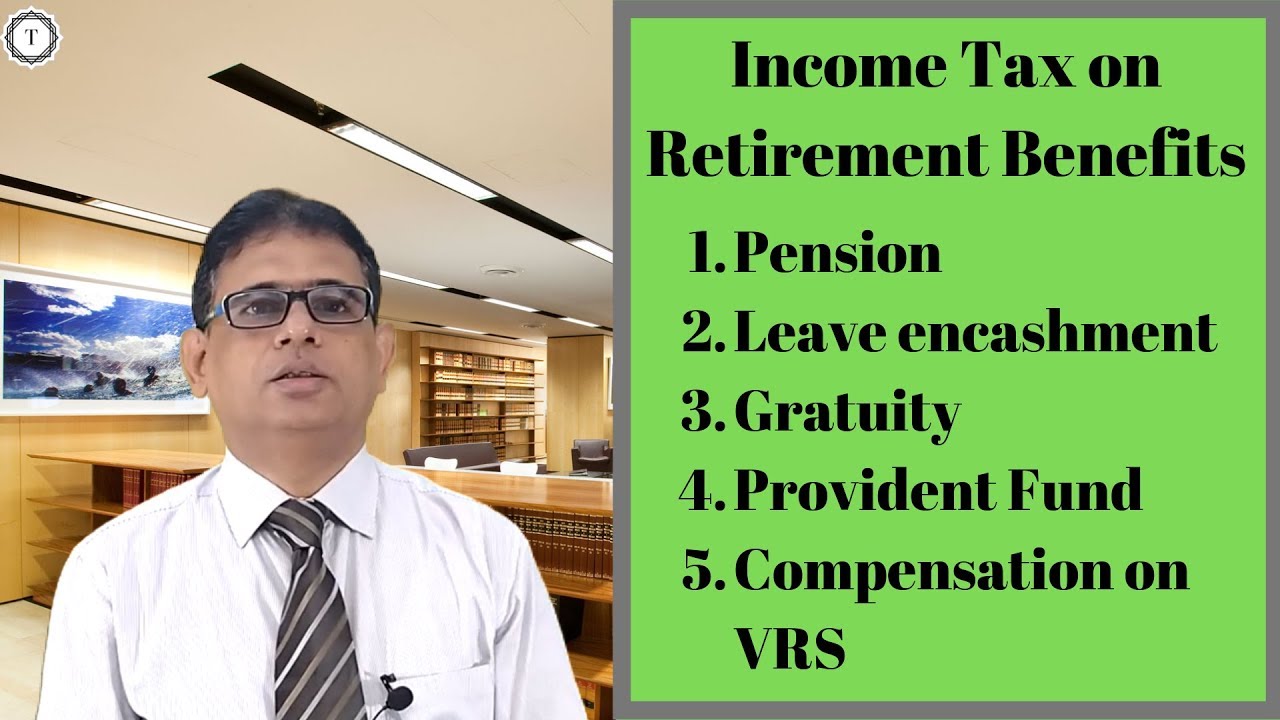

In this video we will learn about the tax treatment of various retirement benefits.

[1]. Leave Encashment :

(A) Encashment of leave during the continuation of service :

Leave encashment received during continuation of service by Government or nonGovernment employees is charged to tax in the year of such encashment. However, relief under section 89 is available.

(B) Encashment of leave at the time of retirement :

Encashment of leave at the time of retirement can further be classified as :

(i) Tax treatment in the hands of Central Government or State Government employees:

In case of a Central Government or State Government employee, any amount received for encashment of accumulated leave at the time of retirement/superannuation is exempt from tax under section 10(10AA)(i).

(ii) Tax treatment in the hands of other employees:

In case of non-Government employees (i.e., other than the Central or the State Government employees), leave salary exempt from tax under section 10(10AA)(ii) will be least of the following:

1. Period of earned leave in months × Average monthly salary

2. Average monthly salary × 10 (i.e., 10 months’ average salary)

3. Maximum amount as specified by the Central Government i.e., Rs. 3,00,000

4. Leave encashment actually received at the time of retirement

[2] Gratuity :

Tax treatment of gratuity can be classified as follows:

(A) In case of a Government employee, any death-cum-retirement gratuity received is wholly exempt under section 10(10)(i). It should be noted that employees of statutory corporation will not fall under this category.

(B) Gratuity received by non-Government employees :

This category will further be classified as follows :

(1) Exemption in respect of gratuity in case of employees covered by the Payment of Gratuity Act, 1972.

(2) Exemption in respect of gratuity in case of employees not covered by the Payment of Gratuity Act, 1972.

3. [Pension] :

Pension can be in any of the following forms:

(a) Uncommuted pension is a periodic payment received after retirement.

(b) Commuted pension is a lump sum payment in lieu of periodic pension.

(c) An employee may (depending upon his service rules) partly commute his pension and receive the balance as periodic payments (i.e. uncommuted).

As per section 10(10A)(i), any commuted pension is exempt in the hands of a Government employee. In case of non-Government employee exemption in respect of commuted pension will be as follows :

If the employee receives gratuity, one third of full value of commuted pension will be exempt from tax under section 10(10A)(ii)(a).

If the employee does not receive gratuity, one half of full value of commuted pension will be exempt from tax under section 10(10A)(ii)(b).

4. [Compensation received at the time of voluntary retirement or separation]

is exempt from tax, if the following conditions are satisfied:

Compensation is received by an employee of an undertaking specified in section 10(10C).

Compensation is received in accordance with the scheme of voluntary retirement/separation, which is framed in accordance with prescribed guidelines. (for guidelines see Rule 2BA).

Maximum amount of exemption is Rs. 5,00,000.

Where exemption is allowed to an employee under section 10(10C) for any assessment year, no exemption under this section shall be allowed to him for any other assessment year.

Relief under section 89 is admissible in respect of such amount.

With effect from assessment year 2010-11, section 10(10C) has been amended to provide that where any relief has been allowed to an assessee under section 89 for any assessment year in respect of any amount received or receivable on his voluntary retirement or termination of service or voluntary separation, no exemption under

section 10(10C) shall be allowed to him in relation to such, or any other assessment year.

5. [Payment from provident fund]

From taxation point of view provident funds can be classified as follows and Amount received at the time of termination of service is taxed as under :

Statutory provident fund = Exempt

Recognised provident fund = If certain conditions are satisfied, then lump sum amount is exempt from tax

Un-recognised provident fund = Payment on termination will include four components, viz, employee’s contribution and interest thereon and employer’s contribution and interest thereon. The tax

treatment of such payments is as follows :

i. Employee’s contribution is not charged to tax; interest thereon is taxed under the head “Income from other sources”.

ii. Employer’s contribution as well as interest thereon will be taxable as salary income. However, relief under Section 89 will be available.

Public provident fund = Exempt…(read more)

LEARN MORE ABOUT: Retirement Pension Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Hey sir,

My dad has taken retirement on August 2021, but his original 60 years retirement is in April 2027, my dad had received commutation money.. or kuch din m pension v start ho jayega. But ye gratuity ka pesa 2027 m aaega ya fir pension start hone ke sath aa jayega, ye hme ni pta…

.

Sir please HELP !!

कितना exemption है ये क्यु नही batate.

बहुत बहुत धन्यवाद।

THANK YOU SIR

SIr, please guide where to show GPF amount received after retirement..? Also, where to show CGEGIS amount received after retirement amount in ITR 2?

@CA Puneet Jain sir if an individual getting pension rs.272000/- per fy and another salary rs.9 lakh then he will get some exemption on pension amount in ITR 1? Please reply

Sir , the section -10 exemptions of gratuity ,committed pension and leave encashment for govt employee are exempted under new regime or not? Kindly throw light on it.

Very nice ji

After retirement Govt.Employee received Arear…how much tax he pay ?

Complicated video

No comments are responded to by advisor. How people would like to subscribe it?

Government employees ke death hone per jo pf/gratuity milti h usko pentioner kaise tax file katta h. Kya vo amount tax se exemted hota h

As per Gratuity Act 1972 Gratuity received at the time of retirement is fully exempted from Income Tax.For Govt PSU employees. However if Gratuity is not paid in time employer has to pay interest on it.If Gratuity Amount along with interest is paid by employer ,whether such interest is tax free?

,Whether Leave Encashment taken by Govt PSU Retired employee is fully exempted from I.T.

Sir GPF kis PF M aayega

Create info

Sir, we few senior citizens were retired from Central govt. on 31.12.2020. Leave encashment, Gratuity, PF etc. were shown as exempted income in ITR for FY 2020-21.

After one year of retirement, due to increase of DA of corona period is released by govt., in FY 2021-22. As such, we have received arrears of Leave incashment and arrears of Gratuity of FY 2020-21 in FY 2021-22. These arrears are exempted.

Kindly enlighten us where to get these arrears as exempted in ITR.

Whether 10E is mandatory for these arrears, if yes, there is no provision to show leave encashment arrears in 10e. What should be we.kindly teach us.

Sar good mahiti api thanks

Honourable Sir,

We few Senior Citizens retired on 31.12.2020. The exemption of payment of gratuity n commuted Pension were taken in FY 2020-21.

In FY 2020-21 due to DA increase in Corona period but not paid that time, now we have recd EXEMPTED ARREARS of GRATUITY, EXEMPTED ARREARS of COMMUTED PENSION, EXEMPTED ARREARS of LEAVE ENCASHMENT, PENSION and COMPENDATION in FY2021-22.

We request you to kindly upload a Video preparing Form10E (for EXEMPTED ARREARS and COMPENSAYTION ARREATS) such Video is not available anywhere.

Kindly also teach how to put figures of 10E with other ANNUAL INCOME in ITR1 for FY 2021-22.

Giving your kindself example of our colleague brother who retired with us from Central Govt. on 31.12.2020 and recd. some ARREARS of FY 2020-21 in FY 2021-22 as under:

1.Annual Pension recd.Rs. 2,74,432/- in FY 2021-22.

2. ARREARS INCENTIVE Rs. 6,104/- for 2020-21in 2021-22

3. ARREARS PENSION Rs. 3216/- as above period.

4. ARREARS GRATUITY Rs.61,908/- recd. after one year of retirement.

5.ARREARS LEAVE ENCASHMENT Rs. 37520/- after one year of retirement

6.Bonus Rs. 13,463/-

7.CEA 27,000/-

8.Bank Interest 43,579/-2021

9.Corporate FD Interest Rs. 403,076/- in FY 2021-22

Total income 8,71,298/-.

Recd LIC maturity 73500/-

1.Last year 2020-21 his taxable salar was Rs.8,14,310

2.Last year 2020-21Tax paid was Rs.73,376/-

Sir, we Senior Citizen wish to file ITR by ourselve.

Sir, Punjab State Power , Corporation Ltd.(PSPCL)which is governed owned corporation, employees of PSPCL can be treated as Government Employees for the purpose of IT act rule 10(10AA) or not

Superb

Sir, my collegue retired in february 2022. his full and final settlement was done by the HR dept in the month of march and tax was to deducted but the finance Dept could not pay the final amount in the month of march and payment was to be credited in the new financial year ie 2022-23. which tax bracket will he be assessed by income tax how does he stand to benefit or loose because of taxesation

Sir, my brother retired on 31.12.2020. whatever commuted pension and leave encashment amount he received was shown as exempted income during FY 2020-21

Sir, after one year of his retirement from central govt. He has received arrers during FY 2021-22 on :

1) commuted pension arrers Rs.61,908/-

2) leave encashment arrear Rs. 37,520/-.

Now my problem is whether above both the amount can be shown as exempted income in ITR for 2021-22 or what is the proper way to show it as exempted income as arrears received after one year of retirement.

It will be beneficial at large to the society, if avideo is uploaded on web covering treatment of arrears recd after one year of retirement. Regards VK.midra

PLEASE HELP. My father is going to retire on 4 july 2022. If he get 30lakhs lets say as total money including all will it be counted as GROSS SALARY in IT Returns. How the retirement money will be shown in IT Returns or it will not be seen.

Sir whether bank employees of leave encashment at the time of retirement is taxable kindly advise?

किसी शासकीय कर्मचारियों को GIS (समूह बीमा योजना ) से पैसा मिलता है वो टैक्सबल है या पूरा exampt है । plz सर जी बताये।

Sir, whether west Bengal govt. Group Insurance scheme (GISS) fund at the time of retirement is taxable or not ? Please advice me. And if, it is not taxable please tell the relevant IT section , please Sir.

Good evening sir, very good explanation sir, thank you very much sir. It is very essential to all pensioners

Thanks a lot manyvar

Thanks for guide

How much Maturity amount of lic is taxable?

Which form is to be used itr 1 or itr 2?

Thnku sir

Sir,

Any amount received from the sale of own property, that amount received so may come under taxable amount?

Thank you sir

Sir I resigned fro NWDA, gov. Of India after 9 yrs on 2 yrs lien basis how can I apply for gratuity, because he says it's a DCRG , can I apply yes ya no