December 1, 2023, the Michigan Public Service Commission (MPSC) approved a rate hike for DTE Energy starting December 15, 2023. This decision will significantly impact Metro-Detroiters during the holidays and throughout the harsh winter.

What You Need to Know:

Too Much Money: The approved rate hike grants DTE Energy a staggering $368,115,000 increase. This comes after the energy corporation reported a third-quarter gross profit of $1,580,000,000.

Last year, despite a request for $388,000,000, only $30,557,000 was approved. People-powered efforts reduced the increase by 90%, yet DTE will now receive almost the entirety of their original request and millions more.

We Should All Question Michigan Public Service Commission Deliberations when they favor DTE: of the commission’s $34.9 million budget, all but about $3 million in federal grants is paid by assessments levied against Michigan utilities. DTE and Consumers pay 88% of that assessment, or 80% of the total commission budget.

Too Many Questions: The MPSC’s Investment Recovery Mechanism (IRM), aimed to track investments in DTE Electric’s distribution system and ensure continued investment in the distribution grid to improve reliability and resilience, this won’t be completed until Summer 2024. The rate hike decision comes before a full review of DTE’s investments, compromising reliability and efficiency.

Too Cruel: Some of the rationale the MPSC used to justify the rate hike is to assist DTE during historic inflation. However, this prioritizes corporate interests during times of high inflation over the well-being of the people, their customer base, and the group the MPSC is appointed to serve.

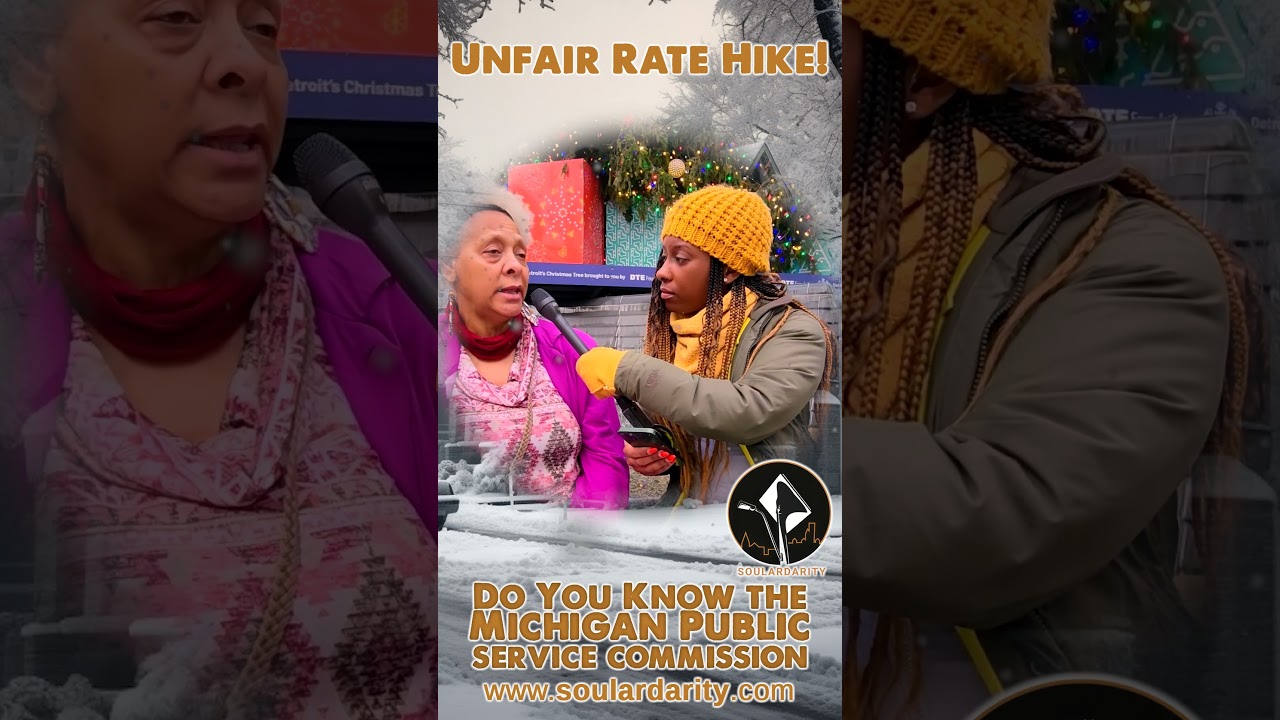

Support Fair Energy Practices!

Soulardarity, a 501c3 organization, fights for Energy Democracy in Highland Park & Detroit MI. The organization began when DTE viciously removed all street lights throughout Highland Park MI. Since then Soulardarity has gathered support by installing solar street lights, organizing policy initiatives, and advocating for fair, equitable, sustainable, clean, efficient, energy for everyone. Visit Soulardarity.com and become a member today!…(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

After a high grossing third quarter, many corporations have decided to raise their rates to capitalize on their success. This decision comes after a record-breaking quarter where companies saw significant profits and growth. With the economy booming and consumers willing to spend, businesses are seizing the opportunity to increase their prices.

One industry that has seen a rate hike after a successful third quarter is the airline industry. With increased demand for air travel and higher ticket sales, airlines have raised their fares to maximize their profits. This move has been met with mixed reactions from consumers, with some expressing frustration over the higher costs of travel.

Another sector that has implemented rate hikes is the hospitality industry. With higher occupancy rates and increased bookings, hotels and resorts have increased their room rates to take advantage of the market demand. While this may be great news for investors and shareholders, it can be a burden for budget-conscious travelers.

Retailers are also getting in on the action, with many raising prices on popular items after a strong quarter of sales. This move has sparked debates on the ethical implications of raising prices on essential goods, especially in a time of economic uncertainty.

Overall, the decision to raise rates after a high grossing third quarter is a calculated one for businesses looking to capitalize on their success. While this move may be beneficial for the bottom line, it can also lead to backlash from consumers who feel the impact of higher prices. It will be interesting to see how these rate hikes affect consumer spending and the economy in the months to come.

0 Comments