![]()

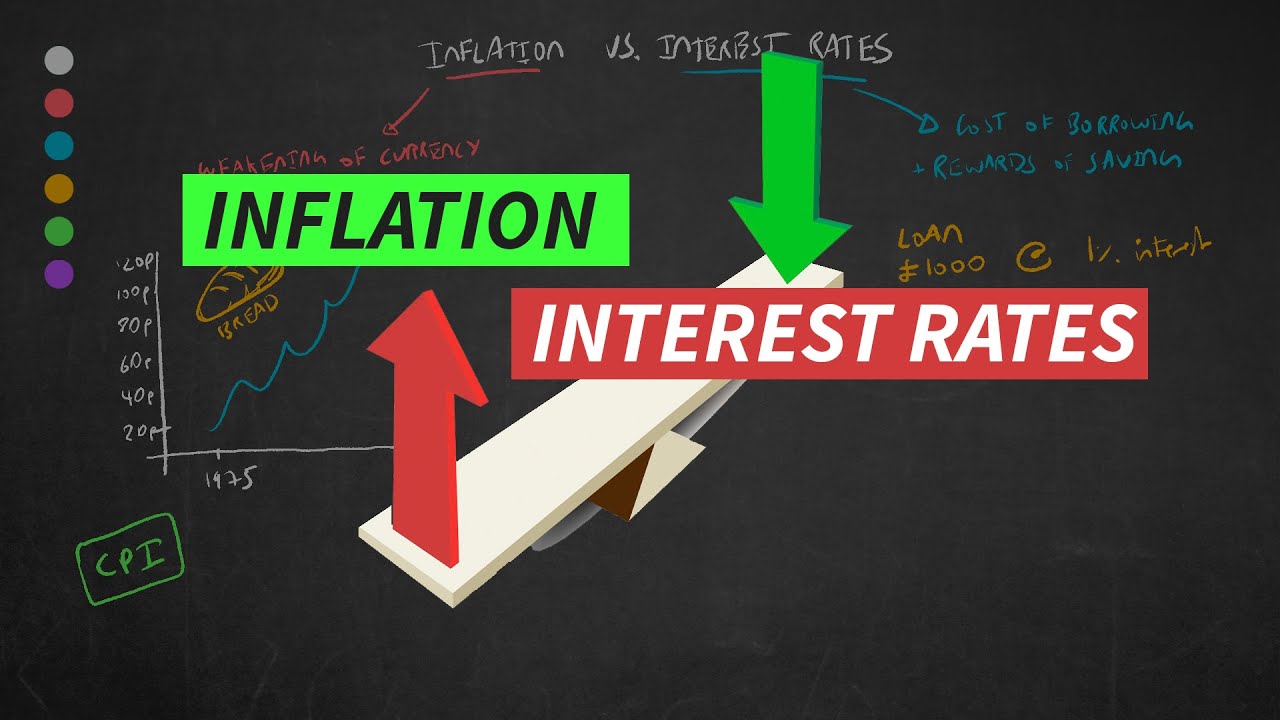

There is a general correlation that says interest rates and inflation has an inverse relationship. Higher interest rates usually decrease the rate of inflation, whereas lower interest rates typically increase the rate of inflation.

In this video we will discuss the logic behind this relationship.

#inflation #interestrate #finance #business…(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Life isn't fair. Wealth disparity is real. Inflation is up, wages are stagnant, recession is likely. But, complaining won't help you. Cut costs and spending choices. Build your skills and earn more. Learn how to invest and grow. Take control of your life.

Appreciate the quick overview

Why do we talk about inflation “RATE”? It’s just “the prices of goods”? it’s not a rate/percentage/figure moving, it’s a static (at any one moment) figure as a result of the theory arising from interest rates well explained.

This concept is explained well herer. I don't agree with this theory though- (I understand this is not the author's theory but an explanation of a widespread theory believed by many top economists) My thoughts on why this is a false economy theory is that interest rates don't impact whether I save or not. I save because I want to. Now, it may impact upon where I save my money (stacks, bonds, precious metals, etc) The only thing that an increase in interest rates does is to make the rich richer, therefore the banks spread this false theory to make us believe it to be true. One big con by banks and politicians, the elite that control the world.

This what happens when your president sells his country oil preserve and that money gone even know that wasn't what it supposedly been for.

Hi, can you help me with some economic questions regarding to business cycle fluctuations?

I suggest that the Interest Rate Hike is Punitive and raises prices in a general sense. This is percieved to reduce the demend and spend, however this is not true as the demand merely grows causing the increase to compound, maintaing the comodity to increase in price.

The fact is that should you take any commodity of 50 years back and measure the increased price currently the theory does not calculate to control nor reduce the effective price. This means that the COST OF LIVING will increase causung the affordability to diminish.

I WOULD APPRECIATE YOUR COMMENT?

modity

I understand the concept BUT, how are people expected spend less (because interest rates are high) when the things they are spending all their money on are energy and food which have gone through the roof. We can't operate in modern society without purchasing energy and food. We don't have the real estate to generate our own energy or grow our own produce

SafeMoon Inu is the best math in all of crypto. SafeMoon Inu has Locked liquidity until 2027, which means no rug pulls and is verified!! SafeMoon Inu only has 1 trillion coins and has a defl ationary burn rate of 2% per transaction that rewards its holders. Safemoon recently moved up over 300 spots on the Coinmarketcap list. SafeMoon Inu also offers rewards to gamers and also has a really nice website and great game-plan moving forward. The market cap has almost tripled in the last couple of weeks( 6.19 million now), but is still low enough to 250x to 2500x times your investment, especially when its market Cap blows past the 1 billion mark, which it will many times over. SAFEMOON INU will be the Crypto story of 2022 and 2023.. The Mathematics with this Crypto is incredible and unstoppable. If you read to this point, YOU ARE WELCOME!

Wel analyzed and explained. You've won a new subscriber

Thank you for the video 🙂

Of course I don’t think so , people don’t have a habit to save money likely to be clueless and be spending regardless, some also been living paycheck to pay check for ages regardless what they do, so this totally don’t make sense hoping that by interesting increase rate people demand things less. It may bring down the property prices people have a harder time to pay off loan, business goes bankrupt, they get sacked, that’s. Bigger problem, to fight the inflation, they just need to lockdown people lol u not allow them to travel, then they have no choice but to stay in the oil price plummet, is not like they have never done it

Thanks

Thank you so much!

Very narrow understanding about inflation.

very insightful thanks. can you please do non farm payroll

That’s just market manipulation. Your damn if you do. And damn if you don’t. That’s not sound financial principle. You should always save more. And spend less. Not easy to do. I had to learn that the hard way. But I was able to rectify it. Stop impulse buying. Budget. Save every Penny. Invest. Live below your means. Become financially literate. Learn,learn,learn. Grow grow grow your future.

W video

You explained this concept in the simplest way…I loved it

We are told cpi represents inflation, but cpi leaves many essential things out. Rent, for example. Rents in many us cities doubled from 2010 to 2020, yet cpi was one or two percent.

Important stuff simply and clearly stated. Thank you.

If economists built bridges, they would all fall down. Stick your hand up if you heard economists and banks all predicting real estate prices would fall 20% because of Covid? What actually happened was real estate prices all increased by 20% because people couldn't travel so they put their excess saving towards larger mortgages because they could afford them. Now interest rates have been increased by 0.25% and economists are once again predicting real estate values will drop 20%. 20% seems to be the go to number for everything. The relationship between inflation and interest rates is a lot more complex than in the presentation.

Real estate prices are ALWAYS being predicted to fall by 20% (there's that number again) by those hopefuls that never jump into the market because "prices will fall" and they don't want to "pay too much". The truth is they will never be home owners as prices will forever never be low enough for them as they try to time the market. Any real estate graph will tell you prices continue to rise over the years. Sure there maybe a dip every now and then, but they are always trending upwards over the years. It's time in the market, not timing the market which is important.

My first house cost me $96,000 back in 1990, it is now worth 10X that amount in 2022. My mortgage was about $87,000 in 1990, which seemed a lot of money back then, now I could pay the entire mortgage off in less than one year with the rise in income over the same period.

Remember, the mortgage amount you borrow is fixed, but this value gets eroded over time with inflation. So for most people, modest inflation is a good thing. Modest interest rates are also a good thing, especially for those who are retired and living off the interest of their savings.

We have been living in a period of unusually low interest rates for a very long time, and interest rates are still extremely low. I can still get a mortgage for under 2.5%. Most people won't lose their houses because lenders have been factoring in interest rates going to 5%, so there is still a good buffer. Most people won't sell their houses cheaper than what they bought them for, they will just hold onto them until the prices rise again, even if there is a small dip for a short period.

When people don't sell, then there is a drop in supply and the demand pushes the prices back up again, the real estate prices wiggle around but continue to trend up, and the higher inflation is the steeper that trend up will be. Just like the loaf of bread, houses will just get more expensive, incomes will have to rise so peoples real wages don't fall, and the fixed mortgage amount will appear smaller and smaller until it becomes chicken feed like my former $87,000 mortgage.

So am I going to sell my houses because interest rates are going up 0.25%, you gotta be kidding me.

Now is the time to BUY houses. Interest rates are still low, incomes will rise (especially with the low level of unemployment), inflation will make the original mortgage amount seem tiny in years to come. REJOICE!!

Young people, buy what you can afford NOW, don't wait for prices to drop. Buy something affordable, don't put yourself under mortgage stress. Buy an investment property in a cheaper town that has a good industrial/income basis to ensure you can rent the house out constantly and then just let time work its magic.

Thank you for this explanation

This is excellent stuff! Both simple and Comprehensive! Thanks!

Inflation and interest rate move in the same direction not inverse relationship according to my perspective. Each governments have specific object about managing inflation.

If the inflation occurs, they want to decrease by raising interest rate.

sir, what if the inflation is driven by lack of supply? low supply of oil drive basic goods and services prices higher….. these demands are basics,,,, people must consume and take these services even at the higher price… then comes central banks raising interest rates? seems government just only want to sucks more money from unfortunate citizen. why they just dont dig dig dig more oil to lower the prices of basic goods and services,,,,,?

Thanks so much loved it

my country has high interst rates and high inflation

No. Your causation ultimately is supply and demand. Low interest rates causes higher demand = higher prices. . This is NOT inflation folks. To ad to that, higher demand equals higher short term prices, but long term causes more supply (more incentive) and prices come down. You ultimately gain more jobs and a more abounded product or service. Everyone is better off.

What we have here is monetary inflation caused by excess digital and physical currency from the fed. This gives the government more money short term (essential a transfer of capital to them) but causes long term devaluing of everyone’s dollar.

THANK UOU!

I don't understand. According to your explanation, they are inversely correlated but in the chart you show at 3:47 it appears directly correlated.

Easiest video to follow to help me with my report.

Very straightforward and easy to follow. Everything was made simple to understand and not one bit overwhelming. Thank you for making this video.

Amazing

Explained it so simply!!! Brilliant video

higher interest rate, less money on the market, so people spend less and save more. so lower inflation. But what explains the comovement before the oil crisis?

Really nice helpful video, hopefully I will pass my test on economics

We are screwed!!!