Hey Rich Friend!

If you’re like most people, you have a 401k account. And if you’re like most people, you don’t really know what to do with it. In this video, I’m going to show you the secrets to making your 401k grow and becoming a millionaire. So tune in and learn something new today!

Want monthly financial education workshops? Join the membership |

Grab your FREE budgeting template |

Video Reference Links:

Social Media Hangout Spots:

TikTok Boujie Budgeter |

IG Boujie Budgeter |

Investing Flavor Podcast |

Hosting a financial education workshop? Submit an inquiry:

for OTHER business inquiries: hello@boujiebudgets.com

Subscribe for new videos every Thursday!

Disclaimer: This video is meant only for educational purposes and is not to be taken as financial advice. However, I am sharing my personal experience and individual opinions, views expressed are those of my own. Mykail James, Boujie Budgets, LLC, nor The Flavor Podcast are not responsible for your financial decisions. This channel’s content is not to be construed as personalized advice. If you are seeking financial advice, please consult a finance professional….(read more)

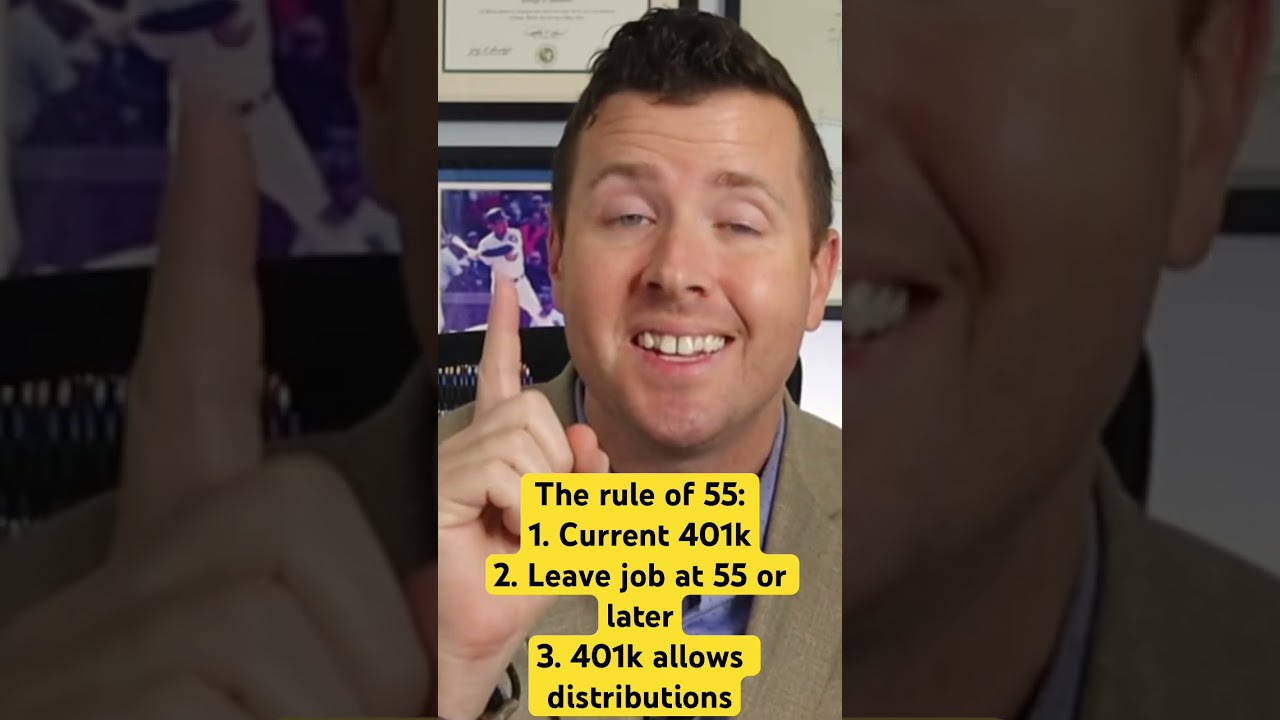

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Investing 101: The Secrets to Successful 401k Growth

Are you looking to maximize the growth potential of your 401k plan? A 401k is an excellent opportunity to invest in your retirement, but it’s vital to understand the basics of successful investing. Here are some investing secrets to help you achieve your financial objectives:

1. Start Early

The earlier you start, the better. Compound interest is the most powerful force in finance, meaning simply that your money can grow exponentially over time. To take advantage of compound interest, start contributing to your 401k plan as early as possible. Even small contributions add up over time and make a big difference.

2. Contribute Consistently

Consistency is key to a successful 401k investment strategy. Make contributions to your 401k plan every paycheck, and strive to increase your contributions every year. Some employers also offer a matching contribution program; take advantage of this opportunity to increase your savings.

3. Diversify your Investments

Diversification is a fundamental investing principle. A well-diversified 401k portfolio can help you mitigate losses in one segment of the market and take advantage of gains in another. Review your investment choices regularly to ensure that you’re diversified across different asset classes.

4. Keep an Eye on Fees

401k plans come with management and administrative fees, which can eat away at your investment returns over time. Look for low-cost options, such as index funds, that can provide consistent returns at lower fees.

5. Rebalance Your Portfolio

Market fluctuations can cause your portfolio’s allocation to shift over time, and your investment strategy may need to be rebalanced. Rebalancing your portfolio helps you adjust your investments to reflect your financial goals, risk tolerance, and market performance.

6. Avoid Making Emotional Decisions

It’s easy to become emotional when the market performs poorly, leading to panic decisions that can negatively impact your long-term investment strategy. Avoid making decisions based on emotions, and instead, focus on your long-term goals, investment strategy, and financial plan.

7. Seek Professional Advice

Investing can be complicated and confusing, but a professional financial advisor can help you understand your options and develop an optimal investment strategy that aligns with your financial goals.

In conclusion, expanding your understanding of the basics of 401k investments can help you make better decisions, enabling you to grow your retirement savings as much as possible. Start early, contribute consistently, diversify your investments, watch out for fees, rebalance your portfolio, avoid emotional decisions, and don’t hesitate to seek advice from professionals. By doing so, you’ll be well on your way to achieving your retirement investment goals.

I remember hitting 75K, and at that point it compound quickly.

Get a Solo 401k then you can contribute 61k a year plus you can pick your own equities, ETFs, etc. As a business owner you can double match with this specific acct.. then you can open a Roth 401k and move solo 401k money to roth and now its tax free after retirement