Are you looking for a source of predictable monthly cashflow from hassle-free passive investments?

Would you like to know how to earn passive income “tax-free” for the rest of your life?

Would you like the benefits of real estate ownership without the hassle from tenants and toilets?

Are you looking to lock in gains from the current stock market rally and protect your assets from a stock market price correction?

Do you have access to at least $30,000 in an IRA, 401(k), checking account, real estate equity, or stock portfolio?

If you answered yes to at least one of the above questions, this 60 minute FREE webinar is for you (a $99 value – FREE!).

In this FREE 60 minute webinar presented by uDirect IRA, Keystone CPA, August REI, and Hassle-Free Cashflow Investing, you’ll learn:

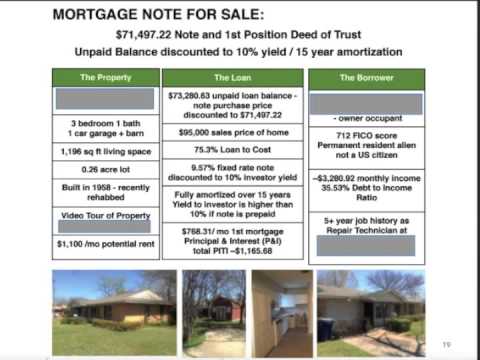

how to make money as the bank by acquiring income producing promissory notes secured by a mortgage or deed of trust

why now is the best time in the market cycle to acquire mortgage notes

how to use mortgage notes to create a portfolio of tax-free and tax-deferred passive income for life

how to acquire rental properties for pennies on the dollar using the hassle-free “loan to own” investment strategy

which states are investor friendly for owning mortgage notes and which states to avoid

the seven most important questions to ask when analyzing the purchase of a mortgage note

four weird strategies for borrowing money at a low interest rate to invest at a higher interest rate

why the most savvy investors are buying real estate outside of their IRA and buying mortgage notes inside their IRA but usually not the other way around

three tax strategies for maximizing your after tax profits as a mortgage note investor

tips for working with a note servicing company to make mortgage note investing hassle-free

Meet the faculty for this event:

Kaaren Hall, president of uDirect IRA Services, has helped thousands of Americans invest their IRA outside of the stock market into real estate, land, private notes & more to improve their financial future.

David Campbell, founder of Hassle-Free Cashflow Investing, has helped hundreds of individual investors like you acquire turnkey rental properties and income producing mortgage notes with less hassle. As a principal or key advisor to hundreds of millions of dollars of real estate transactions, David has a unique ability to simplify complex financial ideas into easy to follow action steps.

Amanda Han, CPA, Director of Business Development for Keystone CPA, brings over 18 years of experience in taxation and accounting with special emphasis in real estate and individual tax planning. Amanda is a leading expert on self-directed retirement investing. Keystone’s professional CPAs provide top-notch financial and tax solutions in assisting clients achieve maximum profitability on their businesses and investments.

Amy Sayre is President of August REI, a Residential Loan Servicing Company. August REI is a nationally registered, bonded and insured, state licensed residential mortgage loan servicing company that acts as a logistics intermediary between private Lenders and Borrowers. Amy is a recognized expert in debt collection and mortgage loan servicing compliance. …(read more)

LEARN MORE ABOUT: IRA Accounts

CONVERTING IRA TO GOLD: Gold IRA Account

CONVERTING IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

0 Comments