Freedom in retirement starts with freedom in investing.

While every IRA has tax advantages, only a self-directed IRA has the advantage of breaking free from the confines of Wall Street to work harder and smarter in the investment of your choosing.

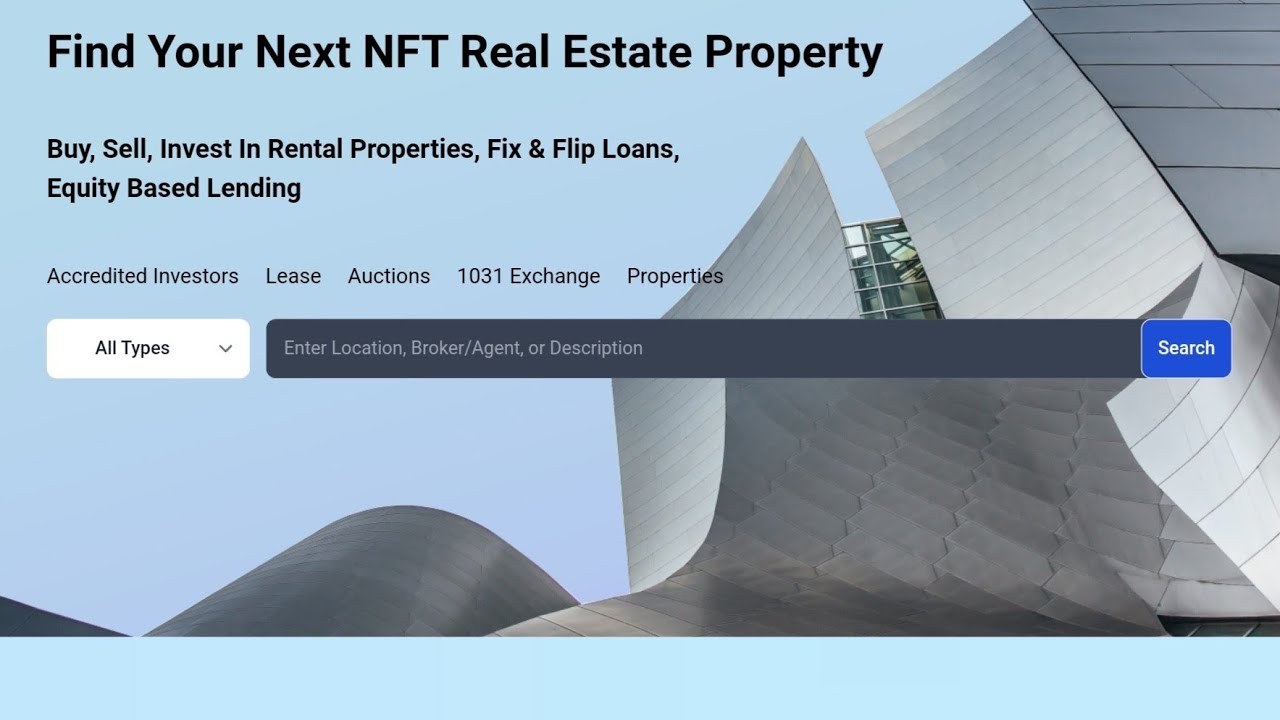

●MORTGAGE LOANS

●RENTAL PROPERTIES

●FIX-AND-FLIP PROJECTS

●BUSINESS STARTUP

●BUSINESS CAPITAL INFUSION

#SelfDirectedIRA #realestateinvesting #taxadvantagestrategy…(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Self-directed IRA real estate investing is a way for individuals to use their retirement savings to invest in real estate. This type of investment allows the investor to have more control over their retirement funds and gives them the ability to diversify their portfolio.

With a self-directed IRA, individuals can invest in a wide range of real estate options, including rental properties, commercial buildings, and even vacant land. This flexibility allows investors to choose the type of real estate that best fits their investment goals and risk tolerance.

One of the key benefits of self-directed IRA real estate investing is the potential for high returns. Real estate has historically been a stable and profitable investment, with the potential for long-term appreciation and rental income. By investing in real estate through a self-directed IRA, individuals can take advantage of these potential returns and grow their retirement savings.

Another benefit of self-directed IRA real estate investing is the ability to take advantage of tax benefits. Investments made through a self-directed IRA are tax-deferred, meaning that any income or gains generated by the investment are not taxed until they are withdrawn from the account. This can result in significant tax savings and allow investors to grow their retirement savings more quickly.

However, there are also risks associated with self-directed IRA real estate investing. Real estate investments can be illiquid, meaning that they may be difficult to sell quickly if needed. Additionally, real estate investments can be affected by market fluctuations and economic conditions, which can impact the value of the investment.

Before embarking on self-directed IRA real estate investing, individuals should carefully consider their investment goals, risk tolerance, and financial situation. It is important to conduct thorough research on potential real estate investments and seek advice from financial professionals to ensure that the investment aligns with their overall financial strategy.

In conclusion, self-directed IRA real estate investing can be a valuable tool for individuals looking to diversify their retirement savings and potentially generate high returns. By carefully evaluating potential investments and seeking advice from financial professionals, individuals can take advantage of the benefits of real estate investing while minimizing risks.

0 Comments