…(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Monthly Payment Present and Future Value Interest Rate Inflation Investment Time Value of Money

When it comes to investing and managing finances, there are several important concepts to understand. Two of the most fundamental concepts are time value of money and inflation. Both of these concepts are crucial to understanding how to make investments that will provide future security.

The time value of money is the idea that money is worth more today than it will be in the future. This is because money can be invested and earn interest. Therefore, a dollar today is worth more than a dollar in the future. The amount that money will be worth in the future is known as its future value. The present value of an investment is the amount that it is worth today.

Future value and present value are important concepts when it comes to monthly payment plans. For example, if you take out a loan and agree to make monthly payments, the present value of the loan is the total amount of money that you received, while the future value is the total amount that you will have to pay back, including interest.

The interest rate is another important factor to consider when investing or taking out a loan. Interest rates can vary greatly depending on the type of investment and the risk involved. Higher interest rates generally mean higher risks, but also higher potential returns.

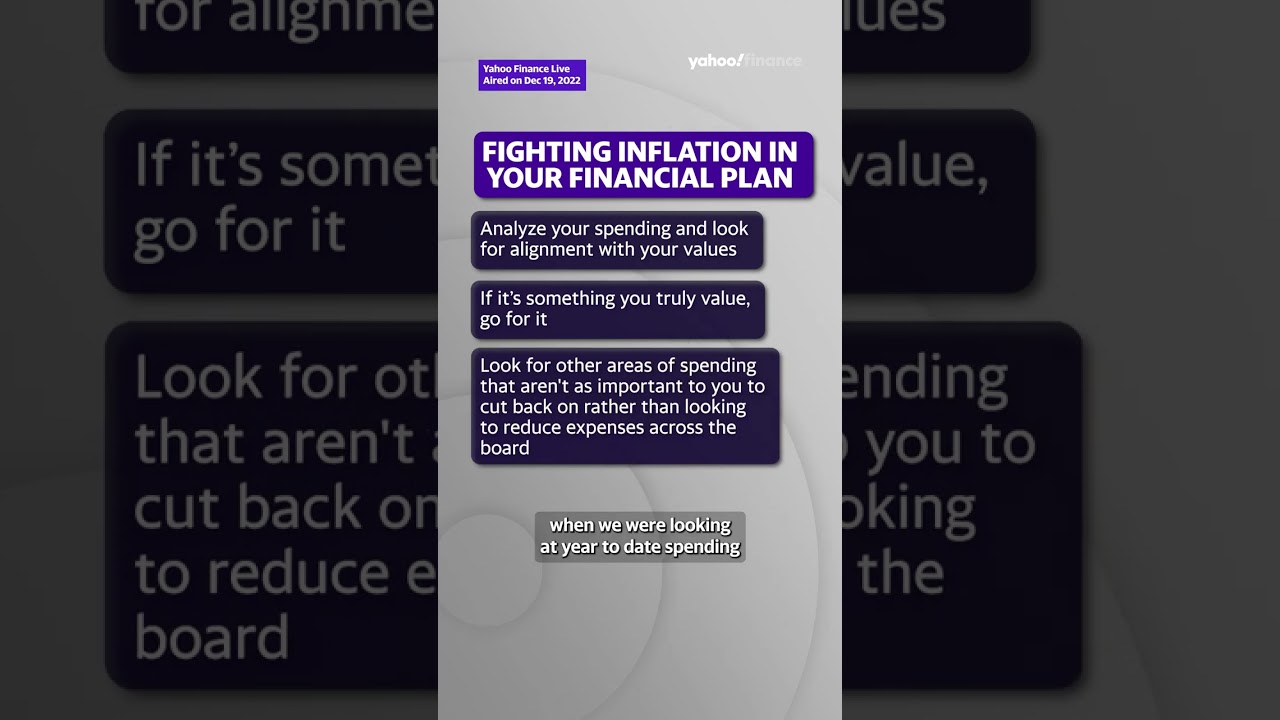

Inflation is a crucial factor to consider when investing or planning for the future. Inflation refers to the rise in the cost of goods and services over time. This can lead to a decrease in the purchasing power of money over time. Therefore, when making investments, it is important to take inflation into account and seek out investments that will provide a return that is higher than the rate of inflation.

When investing, it is important to consider the expected return on investment, the time horizon, and the risks involved. Investments with a longer time horizon generally provide higher returns, but also carry higher risks. The key is to find a balance between risk and reward that is appropriate for your individual situation.

In summary, the concepts of monthly payment, present and future value, interest rate, inflation, investment, and time value of money are all crucial to understanding personal finance and investment strategies. By taking these factors into account, individuals can make informed decisions and plan for a more secure financial future.

0 Comments