FULL VIDEO HERE:

🚩This is Part 1 401(k) vs. Pension Hybrid) of a FIVE-PART SERIES (Other 3 Parts See Below)

How to Recession-Proof Your Finances and Income

Would you like to protect your PRINCIPAL from ANY market crash, AND have INCOME that is GUARANTEED in WRITING to be RECESSION-PROOF? Would you like to learn about a Hybrid Pension, where you combine the concept of a Traditional Pension and your current savings or 401(k)?

Would you like to protect your PRINCIPAL from ANY market crash AND have INCOME that is GUARANTEED in WRITING to be RECESSION-PROOF?

Would you like to learn about a Hybrid Pension, where you combine the concept of a Traditional Pension and your current savings or 401(k)?

In this video, we discuss what this Hybrid Pension is and how this GUARANTEE in WRITING will NOT ONLY protect your principal but also provide INCOME like a government or union worker, yes, income guaranteed for life!

Our goal through this video is to have a clear WRITTEN STRATEGY on how to RECESSION-PROOF your INCOME AND the lifestyle you want in your retirement.

========================================================================

🚩Part 2

HOW The 4% Rule CAN MAKE YOU BROKE! (Early Retirement Recession Risks)

🚩Part 3

THE BEST 3 Buckets Strategy RECESSION-PROOF Finances & Income (5-Simple Steps!)

🚩PART 4

What is an Annuity & How does it work? (5 Types to Learn)

========================================================================

Contact Us (No Cost & No Fee)

Your Retirement Advisor (KCIIS, LLC)

Kai & Ann Chung & Gracie (The Retirement Puppy)

408-502-7080

www.RetiringOptions.com

KC Independent Insurance Solutions, LLC

========================================================================

#pension #retireearly #earlyretirement #401k #annuity #recessionproof #guaranteedincome #KaiChung #KCIIS #AnnChung…(read more)

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

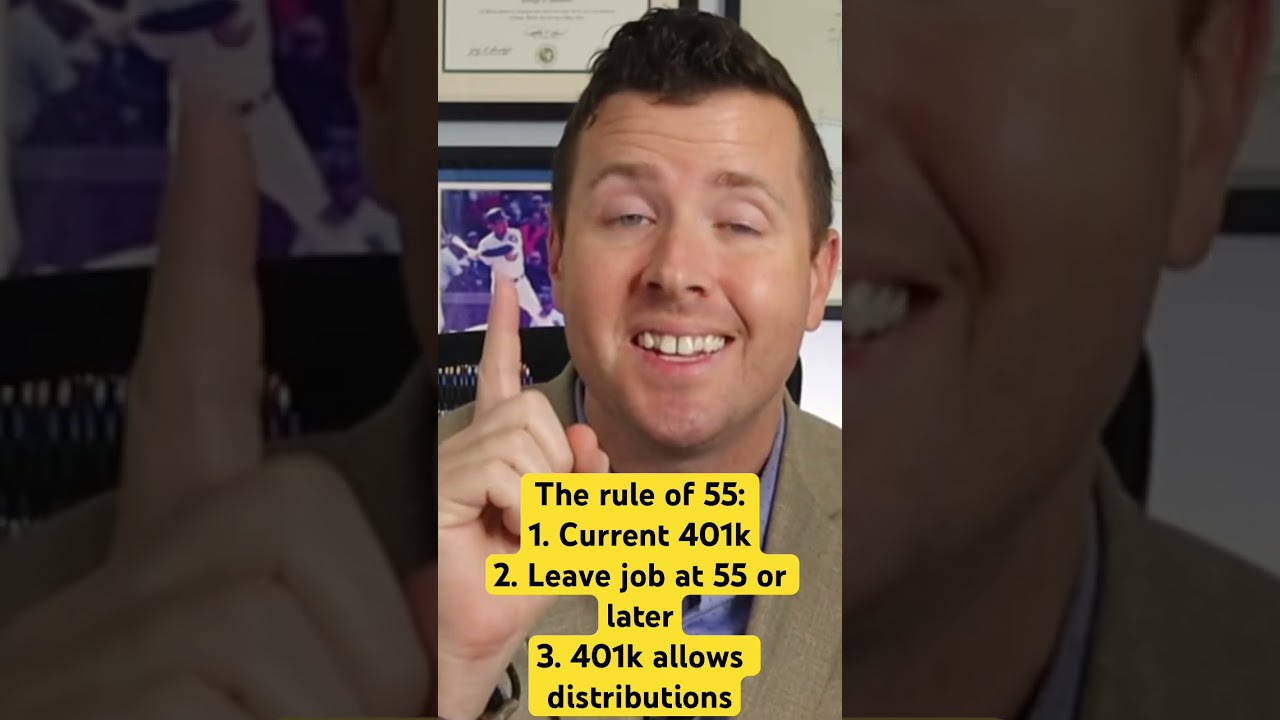

When planning for retirement, one of the most important decisions to make is how to save for it. The most common way to save for retirement in the United States is through a 401K plan. But are these plans really the best way to retire?

On the surface, 401K plans seem like a great way to save for retirement. They offer tax-deferred contributions, which means that the money you put into your 401K is not taxed until you withdraw it during retirement. This can save you thousands of dollars in taxes over the years.

Additionally, many employers offer matching contributions to their employees’ 401K plans. This means that if you contribute a certain amount to your 401K, your employer will match that contribution up to a certain percentage. This essentially doubles your savings potential.

However, there are some downsides to 401K plans. For one, they are not very flexible. Once you contribute money to your 401K, you cannot withdraw it without penalties until you reach age 59 and a half. This can be problematic if you need the money for emergencies or unexpected expenses.

Another issue with 401K plans is that they are subject to market fluctuations. If the stock market crashes or experiences a downturn, your investments in your 401K can lose value, which can be devastating to your retirement savings.

So, are 401K plans the best way to retire? It really depends on your individual financial situation and your retirement goals. If you have a stable income and can afford to contribute to a 401K plan consistently over the years, it can be a great way to save for retirement. However, if you need more flexibility, or if you’re not comfortable with the risks associated with investing in the stock market, there may be other retirement savings options that are a better fit for you.

Ultimately, the key to a successful retirement is to start saving early and to be proactive about your financial planning. Whether you choose a 401K plan or another retirement savings option, make sure you understand the risks and benefits, and have a solid plan in place to achieve your retirement goals.

0 Comments