![]()

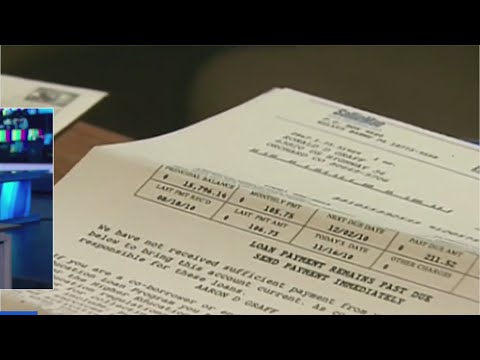

Borrowers will have to start repaying their student loans for the first time in more than three years. But between student loans and the Fed hiking rates, some analysts’ predictions are worrisome. NewsNation business contributor Lydia Moynihan said some analysts fear that this could be the move that sends the economy into a possible recession.

#Recession #StudentLoans #Economy

Watch #MorningInAmerica:

Start your day with “Morning in America,” NewsNation’s live three-hour national morning newscast hosted by Adrienne Bankert. Weekdays starting at 7a/6C. #MorningInAmerica

NewsNation is your source for fact-based, unbiased news for all America.

More from NewsNation:

Get our app:

Find us on cable:

How to watch on TV or streaming: …(read more)

BREAKING: Recession News

LEARN MORE ABOUT: Bank Failures

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

Title: Could Student Loan Repayments Lead to a Recession? | Morning in America

Introduction

Despite the ongoing economic recovery process, concerns over student loan repayments and their potential impact on the broader economy are becoming increasingly significant. With outstanding student loan debt in the United States surpassing $1.7 trillion, individuals, policymakers, and economists are questioning whether this burden could potentially trigger a recession. This article delves into the interplay between student loan repayments and the possibility of a recession in America’s economic landscape.

The Student Loan Debt Crisis

Over the past few decades, higher education costs have skyrocketed, and as a result, more and more students have resorted to taking out loans to finance their education. The consequence of this trend is an astronomical rise in student loan debt, now surpassing credit card and auto loan debt combined. As a result, millions of graduates and young professionals face challenges in managing their finances due to their hefty loan repayments.

It is estimated that approximately 45 million Americans currently bear the burden of student loan debt. The monthly financial obligations can be overwhelming, hindering their ability to invest, save, and contribute to economic growth. This situation raises questions about the wider implications of this mounting debt on the national economy, potentially leading to a recession.

Impacts on Consumer Spending and Economic Growth

One of the primary concerns regarding student loan repayments is the impact on consumer spending, which drives a significant portion of the U.S. economy. With a substantial portion of monthly incomes being allocated towards loan servicing, borrowers often have less disposable income for other purchases. This reduced consumer spending can negatively affect numerous industries, including retail, hospitality, and leisure, potentially leading to job losses and economic contraction.

Moreover, the financial strain caused by student loan repayments reduces the funds available for young professionals to invest. Inability to invest in buying a home, starting a business, or making long-term investments hampers their ability to accumulate wealth and participate fully in the economy.

The Debt-to-Income Ratio and Repayment Patterns

Another factor that contributes to concerns about a potential recession is the high debt-to-income ratios among borrowers. With a significant portion of their income allocated towards loan repayments, young professionals face challenges in qualifying for mortgages or securing other loans, limiting their purchasing power. This can negatively impact the housing market and slow down overall economic activity.

Despite various initiatives aimed at easing the repayment burden, such as income-driven repayment plans, debt forgiveness programs, or refinancing options, these measures only provide temporary relief. Additionally, the current economic environment, combined with the uncertainty caused by the COVID-19 pandemic, has further exacerbated the difficulties faced by borrowers, increasing the likelihood of a recession.

Conclusion

While it remains speculative to definitively state that student loan repayments will directly trigger a recession, the immense burden they impose on borrowers and their potential long-term effects on the national economy are causes for concern. Without addressing the underlying issues associated with ever-increasing student loan debt, the nation may face fiscal challenges, weakened economic growth, and reduced financial mobility for its younger population.

To mitigate these risks, policymakers should prioritize finding solutions that alleviate the burden on borrowers, such as implementing comprehensive loan forgiveness programs, improving college affordability, and enhancing financial literacy programs to prevent future generations from being burdened by excessive student loan debt. By taking proactive steps, America can ensure a brighter and more sustainable economic future, allowing students and professionals to thrive and contribute to a prosperous “Morning in America.”

It definitely won't end well. Consumer spending will decrease causing corporations to cut jobs to protect profits. Student loan repayments being reinstated is definitely a bad idea for everyone and the level of defaults coming could cause a recession.

We already in recession if you're a Democrat you have been got by Joe Biden once again lied to get that vote

America is very, very vulnerable and the current SCOTUS set its next major stumble into motion willingly and knowledgeably

Pay your bills and shut up

Maybe instead of sending bucket loads of cash go Ukraine , put towards Americans !

Thank you for keeping this major issue in the mainstream.

The wife & I are both sweating this one. We’ve been paying through the pause, but still feels like it’s a drop in the bucket.

This is the issue that will sink Uncle Joe in 2024. He really screwed us on false promises.

No problem paying back our debt. It’s the damn interest that is killing us

I think it’s sad we can send billions and trillions of dollars to other country’s and write off the money but we can’t help American people out of debt , we are in bad shape in this country and no help . Over it

Thank you Jesus, $32,000 weekly profits Our Lord Jesus have lifted up my Life.

Ignore your student loans and they will become overwhelming…

Btw – people used to pay the loans when they weren’t reported to credit agencies!

Credit agencies rule the economy and are way out of control – too much power.

Recession?? We are living a the worst recession/ depression already. Get your head out of the sand..idiots

I got my student loans off of my credit report even though I still owned $90k. No you just don’t dispute it either. Theres a bit more that goes into it. My credit score went from a 690 to 786 went it got removed. Thank God.

it's just an idea.. but if we gave families and persons in general income then wouldn't it help pay down our bills? because otherwise… idk what people are going to do, honestly… one thing going wrong… like having to pay another whatever each month… causes homelessness or joblessness or whatever so then it gets worse for everyone except the "elite" right but only for a short time because people everywhere need to survive and I really think it's time that action be taken to 1. eliminate debt for those who qualify 2. give funds to help handle the rise in costs everywhere because one thing that's not gone up anywhere near that rate is wages… and believe me I BELIEVE in my heart that everyone around here… if they COULD… WOULD (tip) more, for instance, but they can't because we're all or almost all in some way in the same boat… 3. Provide opportunity for fair and equitable housing FOR ALL 4. Educate the future generations … we'll all be better for it. If I knew I had a place that I could own again… and give to my girls… and they could get a quality education and oppotunity for meaningful work that makes them happy… that would be everything for us… Most people just want to feel safe and able to provide for their families… Idk what we'd do…. We lost people all over this nation due to disasters and pandemic and stuff… people are coming here everyday and while everything is shuttered… we clamour outside? that's not ok….

Of course whenever it comes to helping ordinary people, the news starts talking about leading to a recession, but no one cares about bailing out the banks or continuing to increase military spending. Not thinking about that the ordinary people would be the ones putting the most money back into the economy and not to some inflated debt.