![]()

Get Access to All Our Trades at

🐦 Follow us on X:

🔵 Follow us on Linkedin:

DISCLAIMER: This video is for entertainment purposes only. We are not financial advisers, and you should do your own research and go through your own thought process before investing in a position. Trading is risky; best of luck!…(read more)

HOW TO: Hedge Against Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

“Nobody Sees It Coming” – A Film That Will Keep You on the Edge of Your Seat

If you’re a fan of suspenseful thrillers, then “Nobody Sees It Coming” is a film that you won’t want to miss. Directed by Jordan Canning, this Canadian psychological thriller will keep you on the edge of your seat from start to finish.

The film follows the story of Sarah, a young woman who is left devastated and widowed after her husband dies unexpectedly. As she struggles to cope with her loss and move on with her life, Sarah begins to uncover dark secrets about her late husband that shatter her perceptions of their relationship.

What sets “Nobody Sees It Coming” apart from other thrillers is its ability to delve deep into the psychological aspects of its characters. The film explores the complexities of grief, trauma, and the lengths that people will go to in order to protect their own secrets.

The cast delivers standout performances that add depth and authenticity to the story. Isabelle Blais shines in the role of Sarah, capturing the character’s vulnerability and strength as she navigates the twists and turns of the plot. The supporting cast, including Alex Ozerov and Kristian Bruun, also deliver compelling performances that add to the tension and drama of the film.

The cinematography and pacing of the film further contribute to its gripping atmosphere. The use of visual motifs and sound design creates a sense of unease that builds as the plot unfolds, keeping viewers guessing and second-guessing the true motives of the characters.

As the film hurtles towards its climax, “Nobody Sees It Coming” expertly ramps up the tension, delivering a twist that will leave audiences reeling. The ending is satisfyingly unpredictable, offering an emotional and thought-provoking conclusion that lingers in the mind long after the credits roll.

Overall, “Nobody Sees It Coming” is a thrilling and engrossing film that is sure to captivate fans of the psychological thriller genre. Its expertly crafted storyline, strong performances, and atmospheric direction make it a must-watch for anyone who enjoys a good mystery.

So grab some popcorn and get ready for a rollercoaster ride of suspense and intrigue with “Nobody Sees It Coming.” Whether you’re watching alone or with friends, this film is guaranteed to keep you guessing until the very end.

It’s coming. Any day now. Chapter 3 act 4

You have to have a big enough reason for something so crazy to happen…. we just came out of one from the pandemic. Not gonna happen until the end of the decade. Just like the roaring twenties. Were gonna have monsterous prosperity soon into a cataclasymic breakdown. But itll be a while.

Hindsight 20/20. Conclusions 50/50. Value 0.

Does this trend hold up using EV/EBIT rather than PE ratios?

Bullshit analysis, this channel has been predicting "huge market crash" from the beginning of year 2023, however we've only seen market went up over 20% since then.

Great content, if only you could make better titles 🙂

When is there not fear if you turn on CNBC it’s just the latest instance of what is fearful but if you zoom out far enough, none of it matters, it just keeps going up eventually so in a small timescale yes, your video is correct but it do does not actually matter what does matter is how many jobs will be left once AI’s really functional

2 years later massive bull run and yoir still at it

Thanks for this great video – I should say thank you for this extraordinary learning opportunity.

I love the thumbnail as well! #IWasThere

Sometime after the election it'll crash, especially if Trump gets elected.

The fed currently has no plans to raise interest rates though right? I imagine they'll at least keep them steady until after the election

Market is still going up so you're beating a dead bird theoretically.

end of the year, the FED will realize that all of the economic data are fake and they will raise interest rates again

Share and stock market is so good for makeing a man rich

I have limited knowledge but I think you're not adjusting for technology, back in 20s, 40s and 70s and even 90s there wasn't the same level of tech that allowed for robust growth which is there now, leading to higher revenues especially from tech.

You need to adjust for these changes which I don't quite see in the analysis

When there is complecency, this is when the unexpected happen over an insignificant news that no one thought about it

I learned nothing watching this.

Markets ALSO sell off AFTER rates start UNinverting. Rates have been inverted for almost two years now but are heading back into normalcy. Once this crosses over to uninversion, stocks have historically sold off.

Confused because it's always AFTER rates begin getting CUT that the market begins to drop. This is because the market recognizes that the Fed "must see something" not great going forward…

Prediction is a waste of time

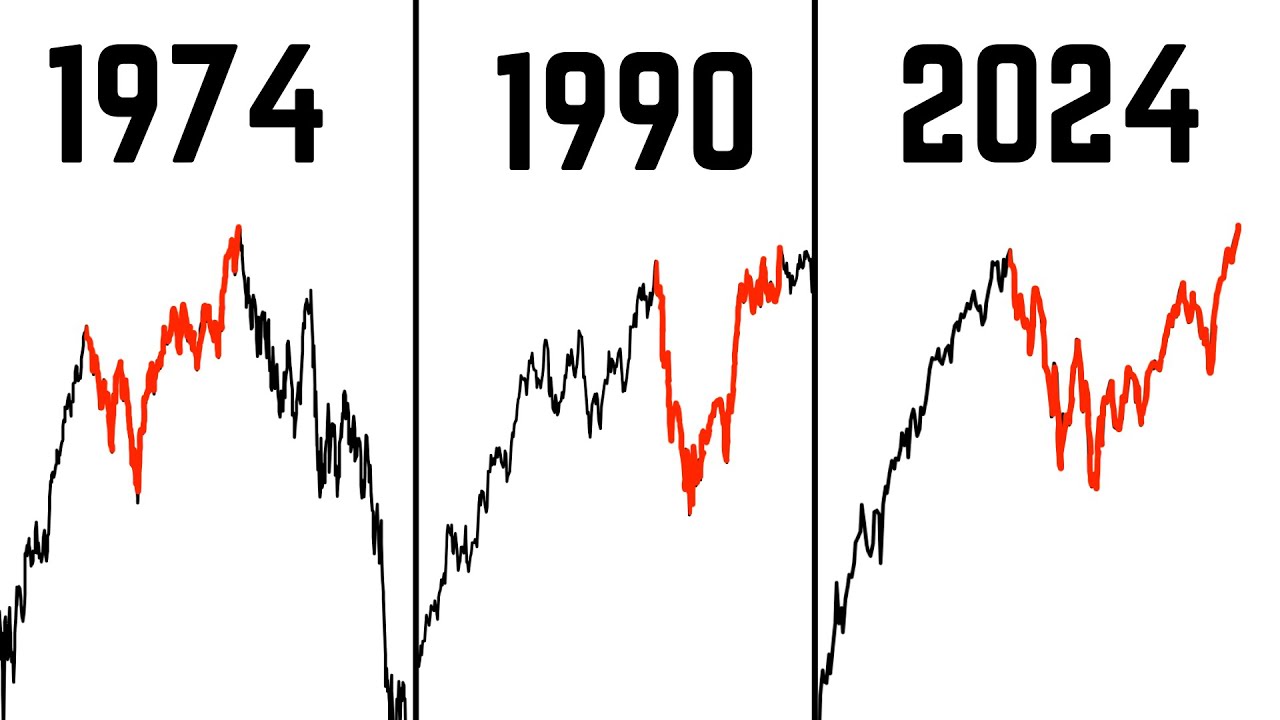

GOTs seems to be mentioning 1990 a lot lately, but I'm not sure he was alive in 1990. There were a lot of things going on, most notably the Japanese bubble popped and took down all of Asia along with it (mass dumping of products below cost around the world). Then the US had a savings and loan crisis, Saddam did his thing (i.e. oil shot up), and the markets reached their 1987 peak again (a natural place for the markets to recoil from). None of that means GOTs 1990 analysis is completely invalid, it just seems way over simplified relative to all the dynamics at play.

Earnings are merely the last shoe to drop. Commercial Real estate is tanking, banks are getting hammered, the consumer is completely tapped out and being crushed by inflation, Car repos are soaring. It’s only a matter of time until corporate earnings Similarly implode.

Peter you're acting as if only the Fed could cause interest rates to rise.

Does it occur to you that the Fed could lose control over long term rates?

i highly doubt the fed will cut rates this year.