![]()

3/25 UPDATE: You Invest Trade and You Invest Portfolios have been rebranded to J.P. Morgan Self-Directing Investing and J.P. Morgan Automated Investing. The accounts remain largely unchanged outside the rebranding.

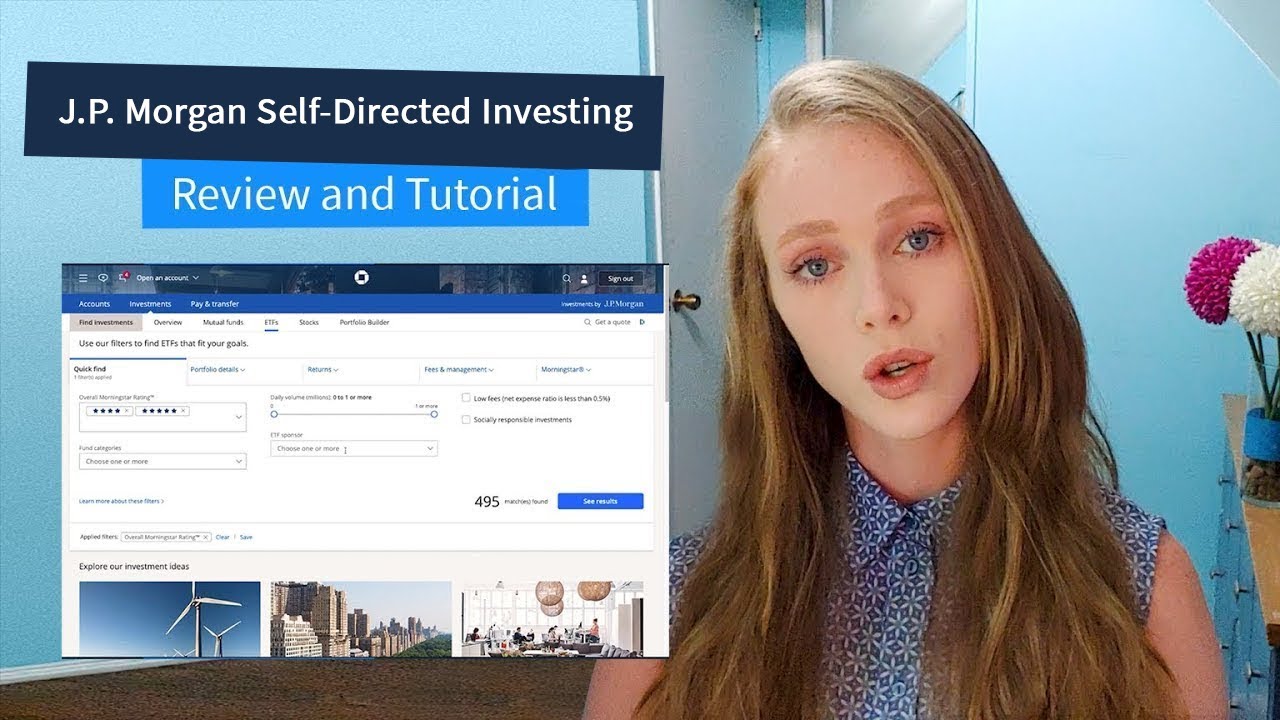

JP Morgan’s Chase You Invest can help new and experienced traders get started with commission-free trades and hands-off robo-advising. Watch our tutorial on how to use Chase You Invest, and read our review:

🔍Get straight to it:

00:14 What is Chase You Invest?

00:33 How much money you need to invest

01:00 Who should use Chase You Invest?

01:40 How to use Chase You Invest

Advertiser disclosure: INVESTMENT PRODUCTS: NOT A DEPOSIT • NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Millions of Americans use Finder to help them make better decisions. We can help you too. We understand that making everyday life decisions such as finding a credit card, buying a home and getting health insurance can be daunting. That’s why we’re here. Our goal is to help you navigate those complex decisions by making them less of a chore (and hopefully less of a bore, too!) Visit us at

The people in this video represent Finder, and all opinions are their own. Brokerage account providers may be advertisers on Finder and may compensate Finder when you sign up for an account through the site. Carefully read all terms and conditions before applying.

#chaseyouinvest #chaseyouinvesttutorial #chaseyouinvestreview #finder…(read more)

LEARN MORE ABOUT: IRA Accounts

INVESTING IN A GOLD IRA: Gold IRA Account

INVESTING IN A SILVER IRA: Silver IRA Account

REVEALED: Best Gold Backed IRA

In today’s fast-paced digital world, online investing has become increasingly popular, offering individuals the opportunity to manage their finances from the comfort of their own homes. One such platform that has gained popularity is J.P. Morgan Online Investing, formerly known as Chase You Invest. In this article, we will provide a comprehensive review of this online investing platform, including a tutorial on how to get started.

J.P. Morgan Online Investing is a brokerage platform that allows users to trade stocks, ETFs, options, and mutual funds online. With competitive pricing and a user-friendly interface, it has become a go-to option for many investors looking to take control of their financial future.

One of the standout features of J.P. Morgan Online Investing is its low commission fees. For stock and ETF trades, the platform charges a flat fee of $0 per trade, making it an affordable option for both beginner and experienced investors. Additionally, options trades are priced at $0.65 per contract, with no base fee. This pricing structure sets J.P. Morgan Online Investing apart from many other brokerage platforms that charge higher fees for trading.

Another key feature of J.P. Morgan Online Investing is its research and educational tools. The platform offers a wide range of resources for investors to stay informed and make smart investment decisions. From analyst reports to market data and insights, J.P. Morgan Online Investing equips users with the information they need to navigate the stock market confidently.

Now, let’s dive into a step-by-step tutorial on how to get started with J.P. Morgan Online Investing:

1. Create an account: Visit the J.P. Morgan Online Investing website and click on the “Open an account” button. You will be prompted to enter your personal information, such as name, address, and Social Security number.

2. Fund your account: Once your account is set up, you will need to fund it to start trading. You can transfer funds from your bank account to your J.P. Morgan Online Investing account easily.

3. Explore the platform: Take some time to familiarize yourself with the platform and its features. You can access research tools, place trades, and monitor your portfolio all from the dashboard.

4. Start trading: Once you feel comfortable navigating the platform, you can start trading stocks, ETFs, options, and mutual funds. Use the research tools available to make informed investment decisions.

Overall, J.P. Morgan Online Investing is a comprehensive and user-friendly platform that caters to investors of all experience levels. With low fees, a wide range of investment options, and robust research tools, it provides a solid foundation for individuals looking to grow their wealth through online investing. Whether you are a novice investor or a seasoned trader, J.P. Morgan Online Investing offers the tools and resources you need to succeed in the stock market.

Thanks for mentioning the 0.35% Annual Management Fee. I 'm leaning toward Fidelity, Schwab or Vanguard, which to my knowledge, charge NO annual fees for a Self-Directed account.

How can I delete my investment account

While trying to build passive income and prepare for retirement, It’s important to choose stocks that are expected to hold up in inflationary environments. To combat the negative effect of inflation, it’s a good idea to diversify your portfolio across different asset classes, such as stocks, bonds, and real estate, since this can help protect your portfolio against inflation. I have seen people making up to $800k in a month during high-inflation