In today’s video, Adam Bergman, Esq. and Isaac Rodriguez, a client of IRA Financial, discuss taking out a loan with a SDIRA versus a Solo 401k, and potential tax consequences of each.

—

Learn more about the Self-Directed IRA:

Learn more about the Solo 401(k):

—

Discover more videos by IRA Financial:

Subscribe to our channel:

—

About IRA Financial:

IRA Financial Group was founded by Adam Bergman, a former tax and ERISA attorney who worked at some of the largest law firms. During his years of practice, he noticed that many of his clients were not even aware that they can use an IRA or 401(k) plan to make alternative asset investments, such as real estate. He created IRA Financial to help educate retirement account holders about the benefits of self-directed retirement plan solutions.

IRA Financial is a retirement account facilitator, document filing, and do-it yourself document service, not a law firm. IRA Financial Group does not provide legal services. No attorney-client relationship exists between Client and IRA Financial, its management, salespersons or IRA Financial’s in-house legal counsel. IRA Financial Group provides IRA retirement facilitation service and CANNOT provide Client with legal, investment, or financial advice. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.

IRA Financial is not engaged in rendering legal, accounting or other professional services. If legal advice or other professional assistance is required, the services of a competent professional person should be sought. (From a Declaration of Principles jointly adopted by a Committee of the American Bar Association & a Committee of Publishers and Associations.). The scope of Professional Services does not include the costs of any custodian related services.

Learn More: …(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Using a Loan with a Self-Directed IRA

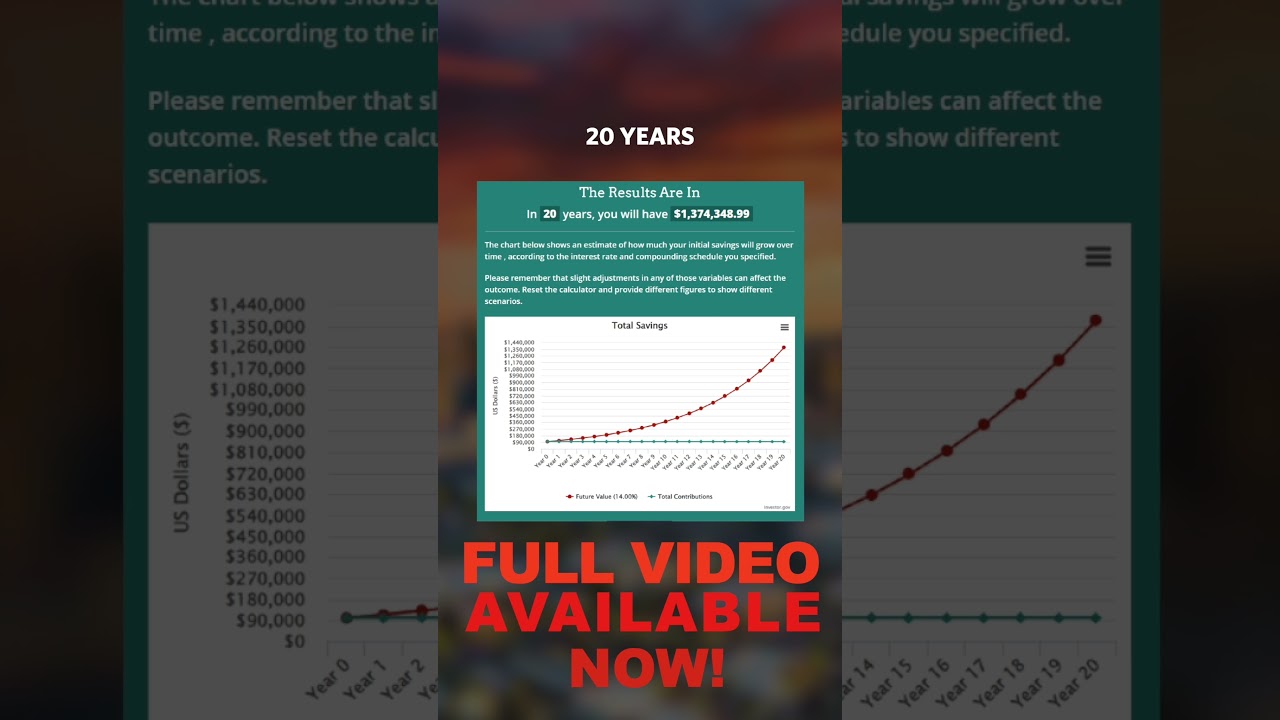

Saving for retirement is a crucial part of financial planning. One way to maximize your retirement savings is by using a Self-Directed Individual retirement account (IRA). A Self-Directed IRA allows you to invest in a wide range of assets beyond traditional stocks, bonds, and mutual funds. One of the lesser-known but highly valuable features of a Self-Directed IRA is the ability to use a loan to leverage your investments.

A loan within a Self-Directed IRA is commonly known as a non-recourse loan. Non-recourse loans are loans in which the collateral (e.g., real estate or other investment property) secures the loan, and the lender has no recourse against the borrower personally. This means that if the borrower fails to repay the loan, the lender can only seize the collateral and cannot go after any other assets or income belonging to the borrower.

Using a loan within a Self-Directed IRA can offer several advantages. Firstly, it allows you to access additional investment capital without having to liquidate other assets within your IRA. This is particularly useful if you have limited funds but want to invest in higher-priced assets such as real estate or private equity. By leveraging a loan, you can amplify your purchasing power and potentially generate higher returns on your investments.

Secondly, using a loan can provide tax advantages within your Self-Directed IRA. Traditional IRAs offer tax-deferred growth, which means you don’t have to pay any taxes on the gains within your retirement account until you start making withdrawals. By using a loan within your Self-Directed IRA, you can generate additional income from your investments without triggering any immediate tax liabilities. This can help you grow your retirement savings more effectively.

However, it is important to note that there are rules and restrictions when using a loan within a Self-Directed IRA. Firstly, the loan must be a non-recourse loan, meaning the lender’s only recourse in case of default is the collateral itself. Secondly, the loan proceeds cannot be used for prohibited transactions, such as acquiring assets for personal use or benefiting disqualified persons, such as yourself or certain family members.

Additionally, you should carefully consider the terms and conditions of the loan, including interest rates, fees, and repayment terms. It is advisable to work with a financial advisor or an IRA custodian specializing in Self-Directed IRAs to ensure compliance with the IRS regulations governing Self-Directed IRA loans.

In conclusion, using a loan within a Self-Directed IRA can be a powerful strategy to increase your investment opportunities and potentially boost your retirement savings. By leveraging non-recourse loans, you can access additional capital without liquidating your existing IRA assets, and potentially enjoy tax advantages. However, it is important to understand the rules and restrictions associated with using a loan within a Self-Directed IRA and consult with professionals to ensure compliance and maximize your retirement benefits.

0 Comments