![]()

The March jobs report has given economists and analysts reason to reconsider their predictions about an impending recession. According to Seth Harris, a prominent economist, the latest report “kills the argument” that a recession is on the horizon.

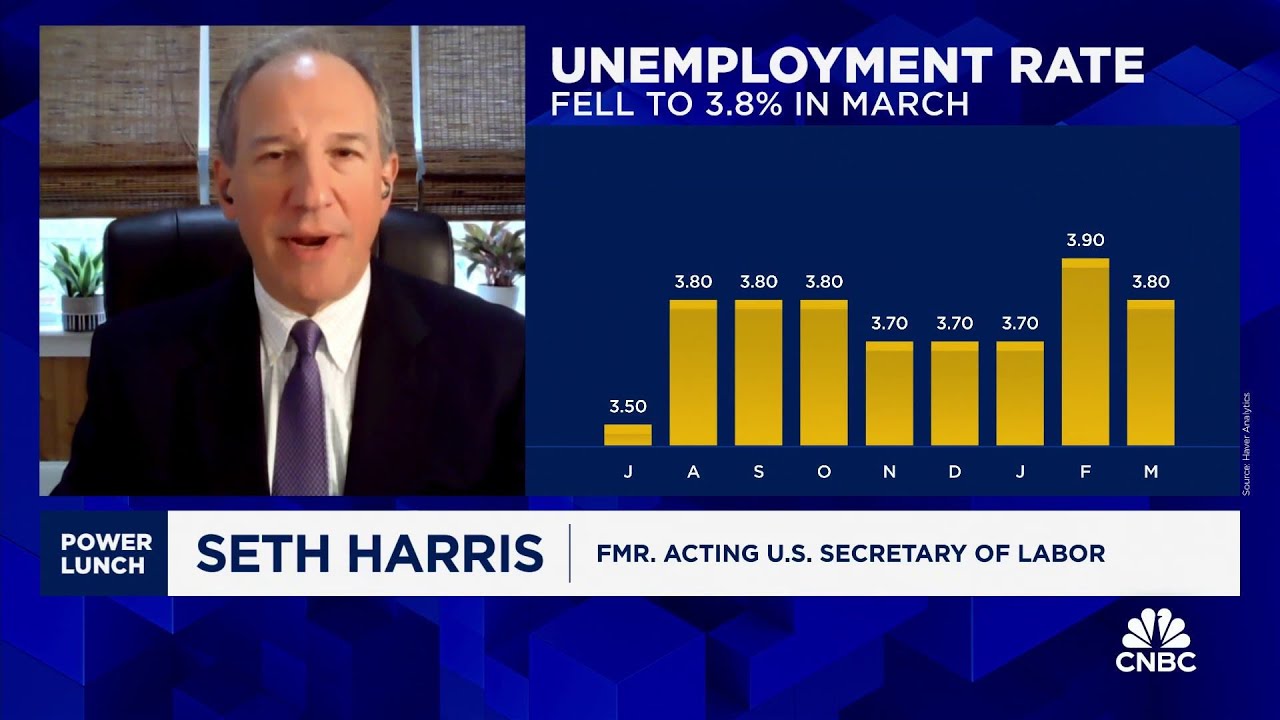

The March jobs report, released by the Bureau of Labor Statistics, showed that the U.S. economy added a whopping 196,000 jobs last month. This figure far exceeded expectations and is a sign of strength in the labor market. Additionally, the unemployment rate remained steady at 3.8%, close to a 50-year low.

Harris argues that these strong job numbers indicate that the economy is in much better shape than previously thought. He points to other positive indicators, such as rising consumer confidence and strong wage growth, as further evidence that a recession is not imminent.

In contrast to previous months, where economists were concerned about slowing economic growth and trade tensions, the March jobs report provides much-needed reassurance. Harris suggests that the Federal Reserve may now reconsider its plans to cut interest rates, as the economy appears to be on solid ground.

While the March jobs report is certainly good news, Harris cautions against complacency. He notes that there are still risks to the economy, such as the ongoing trade dispute with China and slowing global growth. However, he believes that the positive trends in the labor market are a strong indication that the U.S. economy is resilient and may continue to expand in the coming months.

Overall, the March jobs report has injected optimism into the economic outlook and challenges the narrative of an impending recession. As Seth Harris argues, the strong job numbers and other positive indicators suggest that the U.S. economy is in a much healthier position than previously thought. It remains to be seen whether this trend will continue, but for now, the March jobs report offers a glimmer of hope for a robust and growing economy.

BREAKING: Recession News

LEARN MORE ABOUT: Bank Failures

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

Very strong economy are you huffing spray paint ?

they can say this all they want and point to whatever numbers… lower class people are working multiple part time jobs and white collar workers can’t get one period.

Don’t care what you call it. Lot’s of people out of work. Fake job postings commonplace. Basic costs of living are untouchable.

Actually, the jobs reports strengthens the argument that recession is coming. Here's why:

According to CNBC, “Gains tilted heavily to part-time workers in the household survey. Full-time workers fell by 6,000, while part-timers increased by 691,000. Multiple job holders rose by 217,000, to 5.2% of the total employment level.” This means that businesses are struggling and are either laying off workers or changing full-time work to part-time work. As a result, the employees are working additional part-time jobs. The additional part-time jobs is what's driving the unemployment numbers down. It's true that overall jobs went up, but when you dig into the details, you see an increase in the amount of full-time jobs lost and an increase in people needing 2+ part-time jobs. And that is NOT indicative of a strong economy. That is indicative of businesses struggling. I cannot believe that people do not understand this.

$3 T added to public debt in a year. $1 T in last 100 days. Oil going up, so will inflation. Fed is caught between a rock and a hard place. If they cut, they pour kerosene on inflation. If they maintain, raise rates, Regional Banks fall like dominos.

Gold signaling major problems.

Jobs created are predominantly government and part time. These suits are out to lunch.

A broader measure that includes discouraged workers and those holding part-time positions for economic reasons held steady at 7.3%.

Um are we going to talk about the chart being misleading. Why is January so low on the chart when the numbers are so close? CNBC is awful.

Just started reading and hearing this stupid people news talking about having a great economy and also one in the rates to get cut that inflation will higher. They don’t know what the hell they’re talking about.