![]()

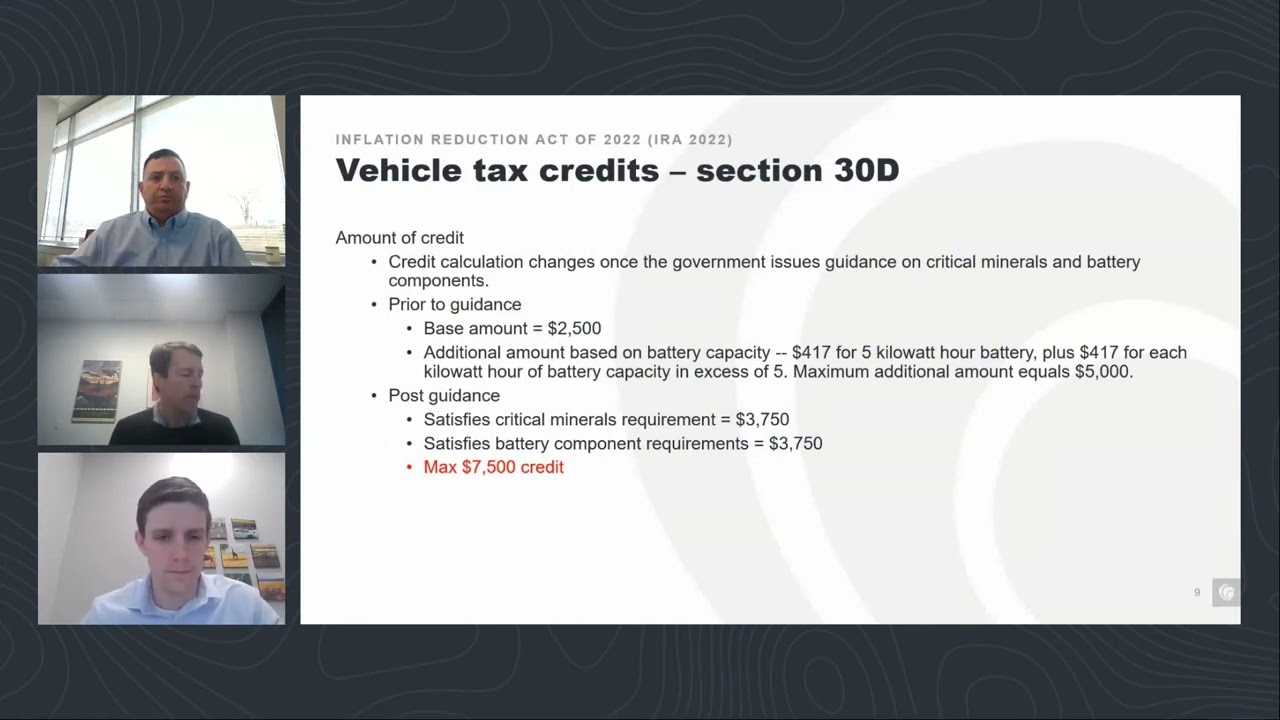

Hear from dealership specialists on how Inflation Reduction Act tax credits are impacting auto dealerships and how you can take advantage of various credits. Explore more:

Recorded on: 2/15/2023…(read more)

LEARN MORE ABOUT: IRA Accounts

CONVERTING IRA TO GOLD: Gold IRA Account

CONVERTING IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

The Inflation Reduction Act (IRA) is a government initiative aimed at reducing inflation and promoting economic stability. One key aspect of the IRA is the provision for tax credits for businesses that actively contribute to inflation reduction efforts. Dealerships can benefit from these tax credits by implementing strategies to maximize their IRA credits.

One way for dealerships to maximize their IRA credits is by investing in energy-efficient technologies. By upgrading to energy-efficient lighting, heating, and cooling systems, dealerships can reduce their energy consumption and carbon emissions, which in turn can earn them tax credits under the IRA.

Another way for dealerships to maximize their IRA credits is by implementing sustainable practices in their operations. This can include reducing waste, recycling materials, and using environmentally-friendly products. By demonstrating a commitment to sustainability, dealerships can earn IRA credits and also appeal to environmentally-conscious consumers.

Additionally, dealerships can maximize their IRA credits by investing in employee training and development. By providing employees with opportunities to enhance their skills and knowledge, dealerships can improve their productivity and efficiency, ultimately leading to cost savings and potential tax credits under the IRA.

Furthermore, dealerships can also maximize their IRA credits by participating in government-sponsored inflation reduction programs. By partnering with government agencies and organizations that promote sustainable practices and economic stability, dealerships can access additional resources and support to further enhance their efforts in reducing inflation.

In conclusion, the Inflation Reduction Act presents a valuable opportunity for dealerships to not only contribute to inflation reduction efforts but also benefit from tax credits. By implementing energy-efficient technologies, sustainable practices, employee development initiatives, and participating in government programs, dealerships can maximize their IRA credits and position themselves as leaders in promoting economic stability and sustainability. It is essential for dealerships to proactively engage with the IRA and leverage the available resources to ensure long-term success and growth.

0 Comments