![]()

/////////////////////////////////////////////////

Get answers FASTER…

Join this channel to get access to perks:

Chat on discord:

Join Link

Support on Patreon:

Get IRS FORM W4 TAX WITHHOLDING HELP HERE STARTING AT $39. bit.ly/3FJ6w8U

—————————————————–

Are you ready for professional investment advice? We can help you with financial planning and asset management. Let us guide your investments to your financial freedom. START HERE

Our financial planning process is an ongoing relationship because as you grow, your financial plan grows with you. At Sickle Hunter Financial Advisors, we believe that saving and making sound financial decisions will help improve your life’s changing needs and objectives. Retirement, college planning, wealth building, social security, and career benefit packets are only a few of the financial decisions that you may face in your lifetime and we’re here to help guide you.

TRAVIS T SICKLE, CFP®, EA®, AAMS®, CRPC®, RICP®

CERTIFIED FINANCIAL PLANNER™

Company Website:

twitter: @travissickle

Instagram:

Facebook:

LinkedIn:

Sickle Hunter Financial Advisors

1646 W Snow Ave.

Suite 144

Tampa, FL 33606

——————————————————-

Gear Used in Videos

Partnership referral links

Aura Identity Theft Protection *Up to 50% off* HTTPS://www.aura.com/travis

Bitcoin IRA

All Amazon links are affiliate links

____________________________________________________________________________

Information in this video is for educational and entertainment purposes only.

sicklehunter.com/disclosures

____________________________________________________________________________

#travissickle…(read more)

LEARN MORE ABOUT: Keogh Plans

REVEALED: How To Invest During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

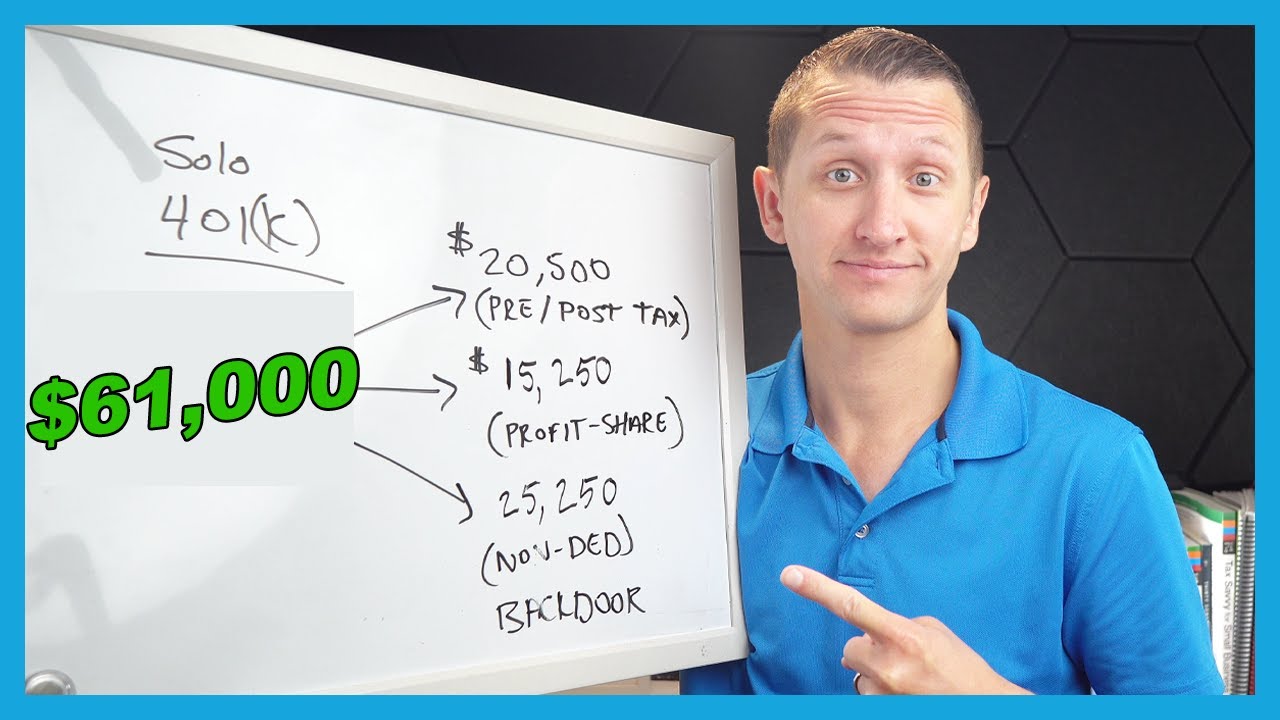

How to Save the Highest Amount into Your SOLO 401k

For self-employed individuals, saving for retirement can be a significant challenge. With the absence of employer-sponsored retirement plans, it’s up to the individual to find ways to save for the future. One popular option for self-employed individuals is the SOLO 401k, a retirement savings plan designed specifically for the self-employed. If you’re looking to maximize your retirement savings, here are a few tips on how to save the highest amount into your SOLO 401k.

1. Maximize Your Contribution Limits

The first step to saving the highest amount into your SOLO 401k is to understand the contribution limits. As of 2021, the contribution limits for a SOLO 401k are $19,500 for individuals under 50, and $26,000 for individuals 50 or older. In addition to the employee contribution limits, you can also make employer contributions of up to 25% of your net self-employment income. By maximizing both your employee and employer contributions, you can take advantage of the higher contribution limits and save more for retirement.

2. Set Up Automatic Contributions

One of the easiest ways to ensure that you’re saving the highest amount into your SOLO 401k is to set up automatic contributions. By setting up automatic contributions, you can consistently save a portion of your income without having to think about it. This can help you stay on track with your retirement savings goals and maximize your contributions over time.

3. Make Catch-Up Contributions

If you’re 50 or older and looking to boost your retirement savings, you can take advantage of catch-up contributions. By making catch-up contributions, you can contribute an additional $6,500 on top of the regular contribution limits. This can help you save even more for retirement and make up for any lost time in saving for the future.

4. Consider Roth Contributions

Another way to save the highest amount into your SOLO 401k is to consider making Roth contributions. While traditional SOLO 401k contributions are made with pre-tax dollars, Roth contributions are made with after-tax dollars. This means that while you won’t receive an immediate tax benefit, your withdrawals in retirement will be tax-free. By making Roth contributions, you can maximize your retirement savings potential and create a tax-efficient income stream in retirement.

5. Take Advantage of Profit-Sharing Contributions

If your business is doing well and generating a profit, you can also make profit-sharing contributions to your SOLO 401k. Profit-sharing contributions can allow you to contribute up to 25% of your net self-employment income as an employer contribution. This can help you save even more for retirement and take advantage of any additional profits your business generates.

In conclusion, saving the highest amount into your SOLO 401k is an important goal for self-employed individuals. By understanding the contribution limits, setting up automatic contributions, making catch-up contributions, considering Roth contributions, and taking advantage of profit-sharing contributions, you can maximize your retirement savings potential and create a secure financial future. Whether you’re just starting to save for retirement or looking to boost your existing savings, utilizing these tips can help you save the highest amount into your SOLO 401k.

As a sole proprietor, what counts as salary for the 20%? Does the 30k(over 50) contribution count towards salary or does it get taken off salary and 20% of that number?

Absolutely amazing and love your quick yet super concise and clear delivery of the information. No filler, no waste, just pure gold. Appreciate you Travis.

If your business takes a loss on the year can you still contribute to your solo 401k?

Thanks so much for your videos Travis. They are extremely helpful and informative.

In a S-Corp, if made my W2 – $20,500 and then deferred the whole amount, my taxable personal income would be $0. Would I then be able to also business expense the profit-sharing match of $5125, which is 25% of $20,500? Am I thinking of this in the right way? I see $25,125 as wages and employer contribution which would reduce my S-Corp Net Income and my personal income would be $0 because of my elective deferral.

Hi Travis and thanks for the video. I have a W2 job as well as a sole proprietorship side hustle. I’ve contributed about 5k so far for the year toward my W2’s 401k. Can I discontinue contributing toward that 401k and put the remaining of the 22.5k into a solo 401k for 2023? TIA!

Hello Travis. Thanks for all your videos. Question. I have a contract job each time, can I contribute in Roth 401K just on my own in Vanguard?

Are all of the contributions coming from the company's bank account considering you have roles both as employer and employee in a S corp? Thank you.

If my husband is also getting paid a w-2 from my LLC/S-Corp, can he contribute to the 401k as well? If so, how much?

hello Travis, if a schedule C business has operating loss before the owner makes any solo k employee contributions this year, can he still make the solo K employee contribution for that year?

If my payroll is 162,000 on my Scorp to be able to contribute the max amount to my solo 401k, aren’t my federal tax deductions on my 401k contributions offset by additional payroll taxes?

Hello Travis, thanks for the explanation. But I have one question on the numbers. You were using 0.92935, but do you mean the 7.65% employer part of the social security and Medicare tax? If so, then should the number be 0.9235? I think your calculation is using 7.065%

Thank you

I have LLC and file as s Corp. I took a paycheck every month. Do I have to state something in paycheck for employee side contribution? Can I just Amend W2 with my contribution amount?

What if you have a LLC

Travis, thank you for the video. I have a question for you. I made my first 2021 non-deductible IRA contribution, $7K, on 4/15/22. The amount is sitting in money market with Fidelity. I earned $114.89 interest and now the account has $7114.89. From your video, I learned that I can convert this non-deductible IRA to ROTH IRA, correct? What do I do with my interest earning? Do I have to pay tax on this conversion?