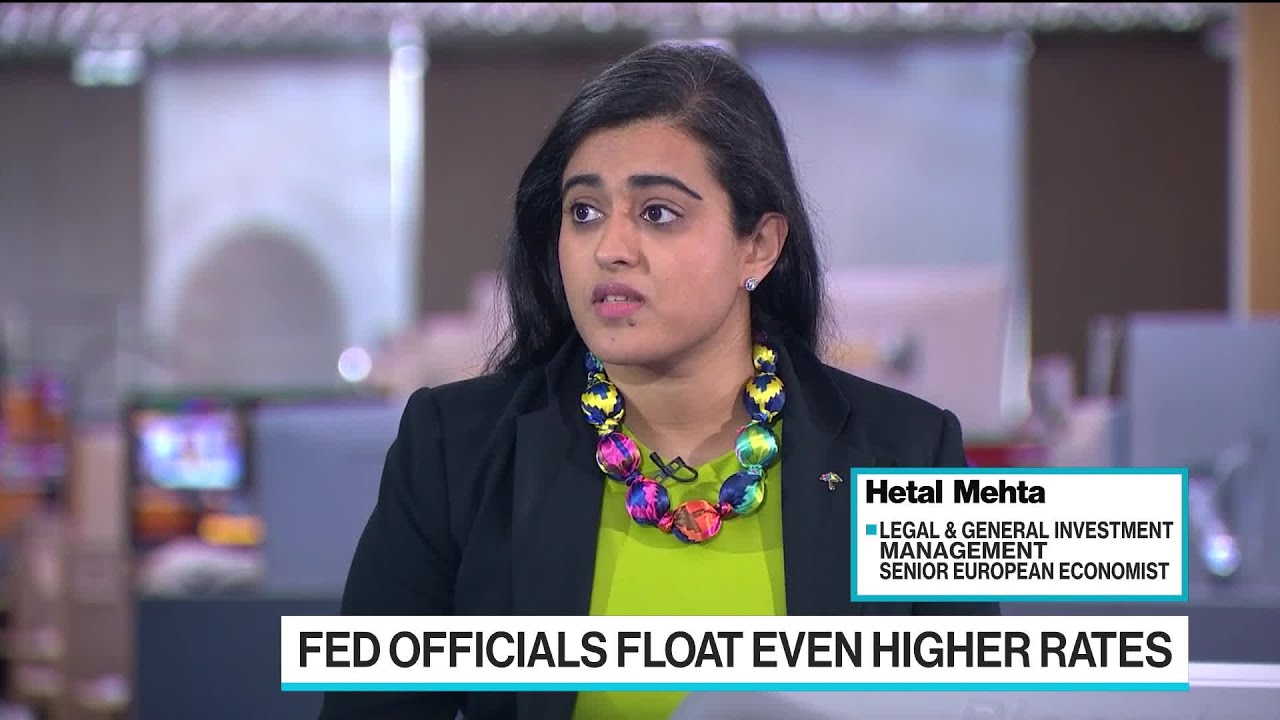

Hetal Mehta, Legal & General Investment Management Senior European Economist, discusses US inflation, global labor market dynamics and the UK economy. She speaks with Bloomberg’s Francine Lacqua on “Bloomberg Surveillance: Early Edition”

——–

Follow Bloomberg for business news & analysis, up-to-the-minute market data, features, profiles and more:

Connect with us on…

Twitter:

Facebook:

Instagram: …(read more)

BREAKING: Recession News

LEARN MORE ABOUT: Bank Failures

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

In a recent interview with CNBC, Sonal Desai, Chief Investment Officer at Lombard Odier Investment Managers, talked about the need for a recession to combat inflation. According to Desai, inflation has been brewing for quite some time now and the only effective way to tamp it down is with a recession.

Desai’s comments have sparked a broader discussion on the same topic. As per Sonal Mehta, Senior Portfolio Manager at Legal & General Investment Management, a recession is indeed necessary to get all the inflation out. Mehta has further expounded on this view stating that “recession can bring that dislocation, that disruption that allows for price discovery and for all things to kind of reset and recalibrate”.

Mehta elaborated that the economic data before the coronavirus outbreak suggested that the global economy was already on shaky ground. There was a lot of exuberance in the equity markets with very low yields, and when yields go low, people reach for yield in riskier parts of the market. The economy was heading for a recession without knowing exactly when it might happen.

Then came the pandemic, which created a large-scale supply shock to the global economy, causing massive dislocations in the markets. This led to fears of a deflationary environment, which moved central banks to take decisive action to create a lot of liquidity to ease financial conditions.

Mehta also warned about the risks of not allowing a recession to occur. Governments have been providing huge amounts of fiscal stimulus via infrastructure, direct payments to households and businesses, and various other support measures. This massive stimulus has kept the economy afloat and been able to avoid a recession for now.

However, she also points out that unless a recession is allowed and the market is given a chance to reset itself, the stimulus will have to continue indefinitely, which is neither sustainable nor healthy. This will increase the risk of even higher inflation in the long run, which could have much worse consequences.

In conclusion, the call for a recession to combat inflation is a contentious one. It may seem counter-intuitive to suggest that an economic downturn would be desirable, but Mehta believes it is a necessary act for the long-term health of the economy. A recession will allow for a reset of prices and help bring inflation under control, which ultimately benefits everyone.

Is this a woman or a Chrismas Tree? Since when does it take a recession to squeeze (lol lol) inflation out of the system?

Hasn't the inflation been triggered by the deliberate breakdown of the economy? Spend more than you create and you are in trouble. It does not take any academic education to come up with that wisdom. But it takes an academic education to believe that turning facts around to fit a political agenda will be unnoticed by the stupid taxpayers.

If there is a recession make sure you have got cash on you. Not in the bank.

Banks branches are closing and soon savers will have limits on money they can take out.

The FED should give the people back their gold and silver to stop the Marxism.

Sonne in himmel scheint nicht

Spricht geschiechten zucker u mehl u salz aufgaben lernen wasser

J

..Nobody can become financially successful overnight. They put in background work but we tend to see the finished part. Fear is a dangerous component, hindering us from taking bold steps we need in other to reach our goals. you have to contend with inflation, recession, decisions from the Feds and all. I was able to increase my portfolio by $289k in months. You have to seek for help in the right places

so they know whats gonna happen???LMFAO!

A lot of folks have been going on about a January rally and said stocks that would be experiencing significant growth these new year season, any idea which stocks this may be? I just sold my home in the Boca Grande area and I’m looking to remunerate a lump sum into the stock market before stocks rebound, is this a good time to buy or no?

what a shameful analysis. What a bad analysis by Metal Mehta and bringing back recession.

Nope, remember many are living in the world of illusion, a System going around to keep the ant farm i mean society in Order. 5 cents used to buy a bag of groceries, coins back then we're once made with real copper, gold and real metals. This is because gold standards ended, so the coins you see now looking like plastic lost the value, same as a dollar bill, it's worth less. So 1 dollar us is really 50 cents. So inflation happens, even if you raise minimum wage, it's not the entire value, so as rent and everything goes up, it doesn't matter, because the dollar is not gold standard. When we do Taxes, it should be tripple if not 4x more because the dollar is not gold standard. If America changes, then a dollar should buy weeks of food, and we work less, because the dollar and coins are back to gold standard. Now old coins are more valuable, but just to auction and collect while society slaves 9 to 5. Money is regulated, see that machine just constantly Printing?

Lot of bullsh!t in the world.. Humanity needs a reset.. that's the biggest need of the hour..

From my perspective, this highlights the importance of having a competitive advantage as investors. Merely mirroring the market strategies of others is insufficient in achieving optimal results. I am currently grappling with the decision to invest in the current market, as it presents both uncertainty and opportunity. Could you share your insights on this matter?

Whimsical comments are coming form arbitrary persons. These opinions are not coherent.

Recessions are undesirable because they can lead to high levels of unemployment, reduced economic growth, and widespread economic hardship. While a recession can help to reduce inflation in the short term by reducing demand for goods and services, it is not a sustainable or desirable long-term solution.

Policies should not have gotten us into this mess in the first place! Instability causes chaos!

I agree their is way froat in this market

What?

I THINK DIVERSIFYING INTO OPPORTUNITIES IN THE MARKETS USING A TRUSTED BROKERAGE PLATFORM ALWAYS HELPS TO SIMPLIFY INVESTING AND BUILDING RELIABLE FINANCIAL STANDPOINTS, I RECOMMEND THE SMTINESTMENTSPTY PLATFORM.. I HAVE BEEN ABLE TO COMPUND OVER $350K IN PROFITS

More digs about brexit, it's not a worker shortage it's a skills shortage because British companies won't invest in training their workforce.

They would rather have an immigrant do it cheaply and keep hiring new immigrants rather than upskill a British citizen who will want more money!

One part of the inflation is structural and linked to fossil fuel progressive scarcity so recession won't make go away the problem. The lack of energy is contaminating the price rise of many products and thinking that recession will solve this issue is stupid.

Prices won't go down, but they won't go up either. They'll just stay where they are currently for a while. The damage is already done.

They ruin the economy and then force a recession to fix issues they created. They should all lose their jobs.

I feel sad that even though I am lnvesting, I don't have the brain power to dig through how each company is doing, is this a good time to buy st0cks or not, my reserve of $450K is laying waste to inflation and I don't know what to do at this point tbh, I need solid data on market trajectory

Ie, we need to hurt poor folks so that they can't manage an economic footing to overthrow rich folks

A trip to the toilet is necessary to get all the poo out of my bowels

Yes being a student of history this is correct but we are not in historic times and the next few years will surprise even the very wise

__ КАКВО Б,,€"Ш,,€" КАЗАНО ЗА: __/

__ ,,ВАК,,$"ИНОТ,,€" ПРОТИВ_____/

__ МАЛАРИЯ" ________________/

____________________________/

finally thank you

Deep recession will take at least 2 years for the inflation to come down like in the history of the great depression. As per Briton the Brexit deal already a shot on 1 leg and the blowing up the nordstream pipeline is like shooting the other leg too. And in the process one of the major energy suppliers of Briton is Scotland, if their independence gets approved, energy will just skyrocket for Briton even more.

My crystal ball is in the shop, but only a blind person could see that the GBP is going one way in the next 18 months. Will it 'achieve' parody to USD? My senses say yes, but then again, I'm still a stopped clock rusting with its hands on one time.

The numbers are rigged and the reports are rigged as well.

We need a deep deep deep recession.

Atleast 20% unemployment and fed funds rate at 13%

Finally a realistic person. Recession isn’t imminent, but we’ll see pain starting next year. Maybe by q2 Powell cuts.

Shorty rocking the christmas tree ornament necklace

FED at neutral rate.

I don't know who needs to hear this but stop saving all your money. Venture into Investing some, if you really want financial freedom.

U.S. jobs market looks great, but layoffs at Google, Amazon and other big firms tell a different story.

For the majority of a portfolios' position, it seems that sitting in short term Treasuries is the best play until the Fed rate pivot. All metrics are pushing the Fed to ratchet up rates and/or hold for even longer at the terminal.

She is a goverment op stop Biden and friends from spending trillions and you stop inflation

The government fights inflation by raising interest rates, putting people into poverty. As if the inflation alone is not enough to put people into poverty.

Let me ask you this…

1. Who pumped trillions of dollars in the money market?

2. Who set interest rates to almost zero percent for a very long period of time?

3. Who told people to stay at home during the pandemic, pushing for 2,3,4 jabs. People losing their jobs ad businesses.

4. Who started a proxy war with Russia (and no, it was not Russia) keep comments to yourself if that is your response.

5. Who instigated a global and energy and food crisis leading to even more inflation bringing us back full circle.

One last question….

6. Who is being punished for all of this?

That’s not how anything works you ugly turd

Like Powell said we can always cut… If we overdo it.. so just jack rates up.

Hey Brexit voters, you decided to jump out of the Europe airplane without a parachute!

You have the consequences. Once you've put your hand to the plough, there's no turning back!

A recession is also necessary to get rid of zombie companies, meme stocks and cryptos.