![]()

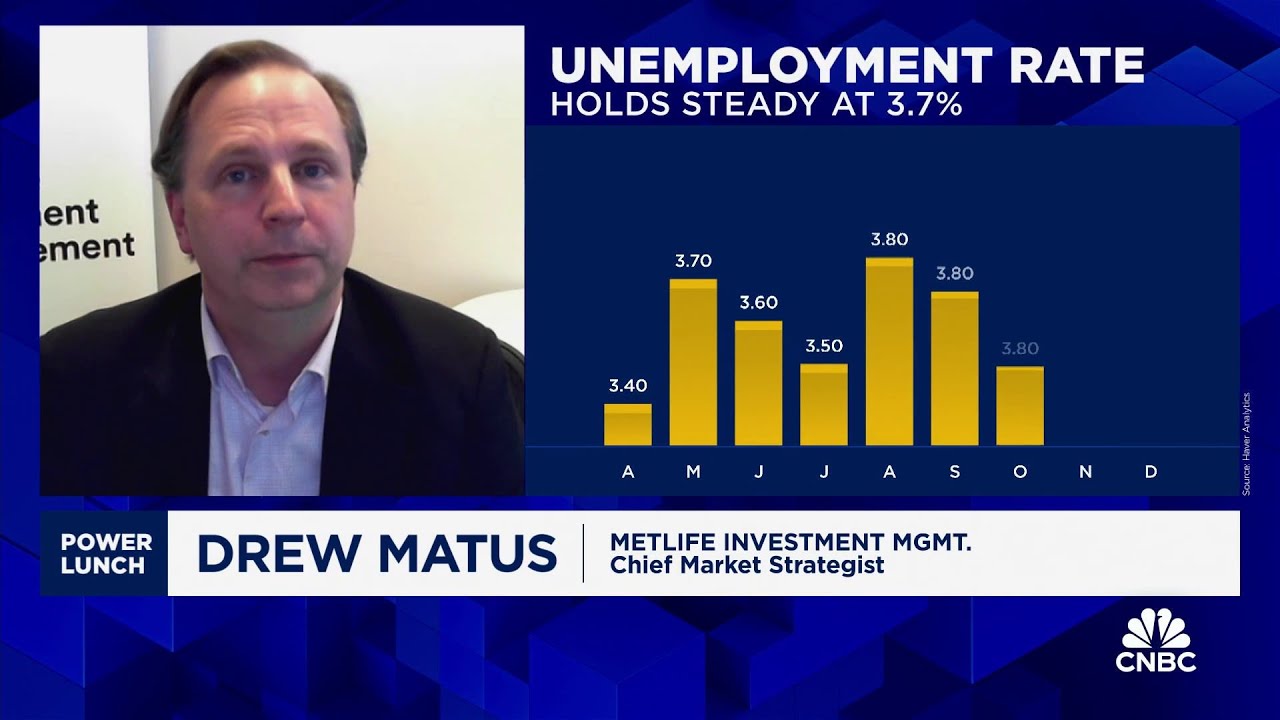

According to Drew Matus, chief market strategist at Metlife, there are expectations of an impending recession in 2024. Matus, a seasoned economist with years of experience in the financial industry, has pointed to several key indicators that suggest an economic downturn may be on the horizon.

One of the main factors contributing to this prediction is the current state of the global economy. Matus has highlighted concerns about slowing growth in major economies such as the United States and China, which could have a ripple effect on markets around the world. Additionally, rising inflation rates and geopolitical tensions are also contributing to the uncertain outlook for the future.

Matus has also pointed to the Federal Reserve’s monetary policy as a potential catalyst for a recession. With interest rates already at historic lows and the Fed looking to raise rates in the near future, Matus believes that tighter monetary conditions could put further strain on the economy and potentially lead to a contraction.

While Matus’s prediction of a recession in 2024 may seem alarming, it is important to remember that economic forecasts are not set in stone. There are many variables at play, and unforeseen events could always change the trajectory of the economy. However, it is crucial for investors and policymakers to take heed of these warnings and prepare for potential challenges ahead.

In light of Matus’s warning, it may be wise for individuals to reassess their financial strategies and make any necessary adjustments to protect their assets. Diversifying investments, maintaining a strong emergency fund, and seeking guidance from financial advisors are all prudent steps that can help weather any economic storms that may be on the horizon.

Overall, while the prospect of a recession in 2024 may be cause for concern, it is not a reason to panic. By staying informed, prepared, and proactive, individuals can navigate through uncertain economic times and come out stronger on the other side.

BREAKING: Recession News

LEARN MORE ABOUT: Bank Failures

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

Worries about a potential recession have weakened my investment confidence. I aim to reallocate my $250K portfolio. What's the most effective strategy to hedge my portfolio and generate profits?

We are in one right now. How was this not blatantly obvious to these supposedly educated people?

Some countries have really doubled down on the Kool Aid. Stop listening to your government. Take a walk outside. You can see what's actually going on

No jobs out there so shut up

Why should we listen to the 'experts' when predictions of a recession are continually proven false. They're just fearmongering for clicks, i'm turning this stuff off.

We are in a recession

Finally someone telling the truth.

wrong fool

Its time to crack down on welfare fraud, its making grocery prices to high

Most people think rates will go down… they are going much higher

CNBC IS A

PUBLIC MENACE. Calling for recession for TWO YEARS!

Cashis King to mid summer

I already feel that we are in a recession , but a different way. Everything is too expensive and my savings are dwindling. My pay rate has in creased very little and taxes, insurance, bills, intrest rates, and food has probably increased to 100 percent. Milk is 8 dollars a gallon?! Spam is 4-5 dollars an egg, 1 rib eye steak is 20 dollars? 10 years ago it was all half the price. My home insurance was 800 dollars a few year and now it’s 2100. I understand inflation , but that much is not normal.

Or even more intelligently, hold current interest rates longer and let inflation continue to come down.

Drew have you considered a frontal lobotomy?? 6 rate cuts is NOT GOING TO HAPPEN