💰 Copy Crypto Experts And Make Good Money

Earn $153 Welcome Bonus Using Our Link –

🔥 FREE $100 Reward With iTrust Capital IRA Crypto Account:

💰 Make Steady Money With Our Tested-Profitable CryptoTrading Bot

💠 Best Crypto Exchange For Canadians –

👉 Checkout Our Animated Metaverse/NFT Channel

👉 Finance And Global Economics Updates On Our 2nd Channel –

👉 Enjoy Our Wojak Crypto Memes Videos –

DISCLAIMER: We may receive a small commission for any purchases made through our affiliate links.

Thanks For Watching Our Video 🤗

Please, like, comment, subscribe, and ring the bell! EVERYTHING helps us grow!.

Subscribe Here:

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

#bitcoin #cryptonews #savvyfinance

Welcome to “Savvy Finance 🤝

This channel is all about being savvy with your finance 💰.

We create and share videos about investments and how best you can put your money to use, in order to bring in more money. We love cryptocurrencies and the stock market and so, we share a lot of crypto and stock market videos,, including bitcoin, ethereum, Cardano ADA, and other altcoins.

We do a lot of research to bring you valuable and useful information, as well as sharing videos from many experts, including Michael Saylor, Raoul Pal, Plan B, Willy Woo, Charles Hoskinson, Max Keiser, Cathie Wood, Lyn Alden, Bitboy Crypto, Coin Bureau and many others.

#Bitcoin #Cryptocurrency #Invest #Ethereum #Crypto #entrepreneur #business #success #investment #finance #bitcoins #Stockmarket #Bestcryptocurrency #BitBoy #AltcoinDaily #Coinbureau #CryptoNews #btc #eth 👨🏫.

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

🎦 Video footage and Background music: all video footage and background music used is either licensed through either CC-BY or from storyblocks

👉 FINANCIAL DISCLAIMER

This channel is intended to share tips and investment videos by experts. We DO NOT GIVE FINANCIAL ADVICE! Please consult a licensed financial advisor and do your own research before making any financial action.

Never buy crypto just because you see a YouTuber talking about it. Always do your own independent research before investing in any coin.

For transparency, our crypto portfolio comprises mostly bitcoin, Cardano, ethereum, and xrp….(read more)

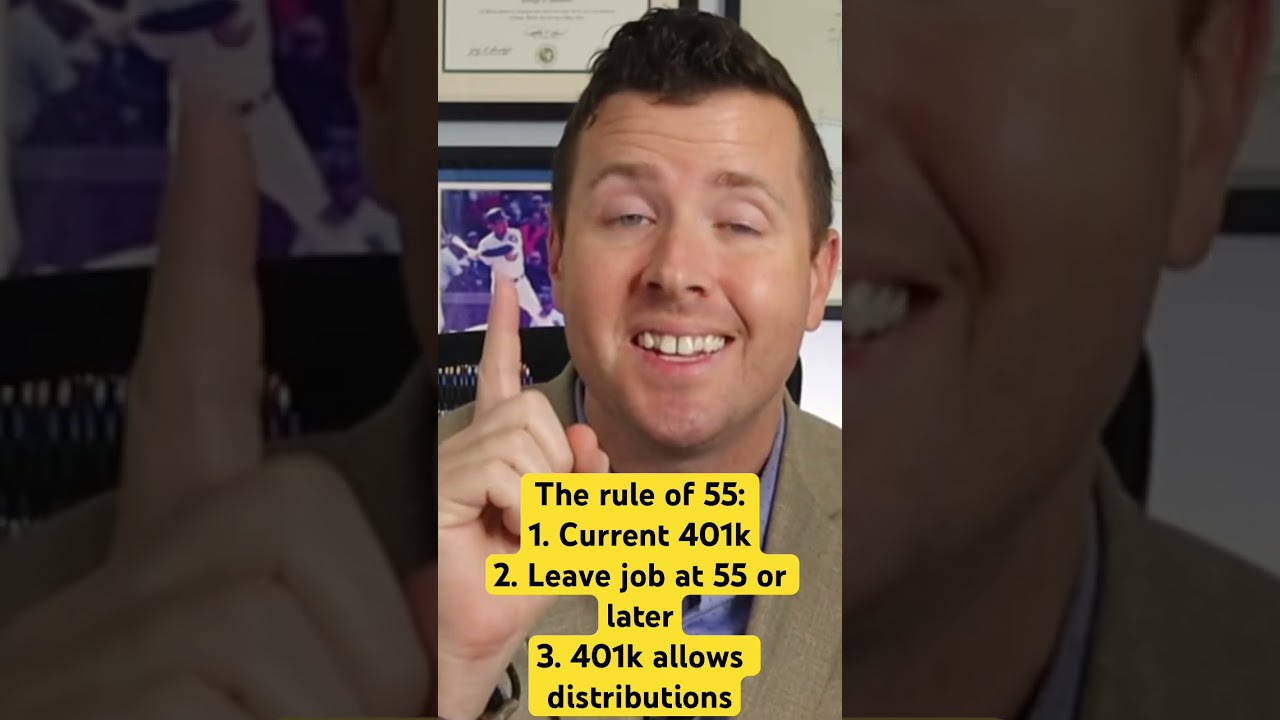

LEARN MORE ABOUT: 401k Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

In a move that is sure to raise eyebrows on Wall Street, Fidelity Investments, one of the largest financial services companies in the world, has announced that it will be offering bitcoin to its 401k investors. The decision comes as the demand for cryptocurrencies continues to rise, and traditional financial institutions begin to take notice.

Fidelity’s decision to offer bitcoin to 401k investors is significant for a number of reasons. Firstly, it marks a major milestone for cryptocurrencies, which have traditionally been viewed with skepticism by many mainstream investors. Secondly, it demonstrates that Fidelity is committed to staying ahead of the curve when it comes to the latest investment trends.

According to Fidelity, the decision to offer bitcoin to 401k investors was driven by customer demand. The company surveyed its customers and found that a majority of them were interested in investing in the cryptocurrency. Fidelity also cited the fact that bitcoin has outperformed traditional assets like stocks and bonds over the past decade, making it an attractive investment option for long-term investors.

While Fidelity’s decision to offer bitcoin to 401k investors may be seen as a positive development for the cryptocurrency industry, not everyone is convinced that it is a wise move. Michael Saylor, CEO of MicroStrategy, a company that has invested billions of dollars in bitcoin, expressed reservations about the decision in a recent interview.

Saylor argued that offering bitcoin to 401k investors was a risky move, as many of these investors may not fully understand the risks involved in investing in the cryptocurrency. He also expressed concern about the potential for market manipulation, citing the fact that bitcoin is subject to wild price fluctuations and can be influenced by factors like social media activity and news headlines.

Despite these concerns, it is clear that Fidelity’s decision to offer bitcoin to 401k investors is a significant step forward for the cryptocurrency industry. It is an indication that even established financial institutions are beginning to recognize the potential of cryptocurrencies, and are willing to take risks to get ahead of the curve.

As more companies follow in Fidelity’s footsteps and start offering cryptocurrencies to investors, it is likely that we will see increased mainstream adoption of bitcoin and other digital assets. While there are certainly risks involved in investing in these assets, the potential rewards are high, and it seems that many investors are starting to realize this.

10 : DOMINO effect soon !

8

Yay he said crypOcurrecies instead of cryptAcurrencies! He’s not a robot after all!!!

Where did Michael Saylor react in this video ??!!

No doubt ..screw vanguatd…

Yeahhhhhh!!!!!!

Why would anyone trust a large crooked and corrupt financial entity like fidelity or any others for that matter who take and profit from mine/others hard earned money. One sided institution like them are one of the reason we have such a huge divide between the super rich and us poor people with NO MIDDLE CLASS in-between. They can't be trusted for shit and yet we are to trust them with our bitcoin?? Again they profit and we get heavily tax.

I looked into cashing out 401k from principal only to learn they tax 30% for early withdrawal. 20% Fed, 10% state, $75 to cut a check, then during tax time, I would be forced to again pay taxes on that same money. It is a joke!

The game is and has always been rigged in their favor and we are constantly left holding the bag. I'm glad everyone's excited over the large amount of money they bring into Bitcoin, But… they have had their time to take and take and take while doing nothing positive for this world except mastering loop wholes and keeping the rich stupid rich.

Hopefully, my plan does the same.

Still not an etf

So bulllish !!

Your move, Vanguard.

You selling bitcoins ? So many people spot check your wallets ,not sure it’s true

Yep, its finally crashing.

HyperBitCoinization: Where BitCoin surpasses all global currencies, including the US dollar, to become the World’s Reserve Currency.