![]()

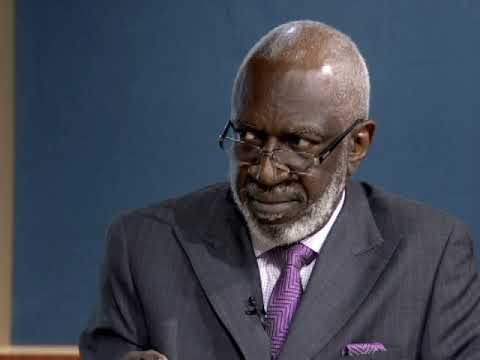

We help people who are entering retirement or want good retirement strategies to create retirement monies they can never outlive. Visit me at my office for a free consultation! Call: 1-833-313-7233

***Connect with us on Facebook: ***

*** Visit us online at www.JustAskFreeman.com ***

Financial Sources Inc.

6111 Ivy Ridge Ct

Upper Marlboro, MD 20772

Phone: (301) 627-0123

www.JustAskFreeman.com…(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

Individual Retirement Accounts (IRAs) are a popular retirement savings option for many individuals. An IRA rollover can be a beneficial way to transfer funds from one retirement account to another without incurring taxes or penalties. However, there are specific requirements that must be met in order to execute a successful IRA rollover.

The first requirement for an IRA rollover is that the funds must be transferred within 60 days of being withdrawn from the original account. This timeline is crucial in order to avoid the funds being classified as a taxable distribution. If the funds are not transferred within this timeframe, they may be subject to income tax and potentially early withdrawal penalties.

Another important requirement for an IRA rollover is that the funds must be rolled over into a similar type of retirement account. For example, if the funds are coming from a traditional IRA, they must be rolled over into another traditional IRA. The same goes for Roth IRAs, 401(k)s, and other retirement accounts. Mixing different types of retirement accounts during a rollover can lead to complications and potential tax implications.

Additionally, it is important to note that there are limitations on how often an individual can perform an IRA rollover. The IRS restricts individuals to one rollover per IRA account within a 12-month period. This means that if you have multiple IRAs, you can only perform one rollover per year for each account. Violating this rule can result in the funds being classified as a taxable distribution.

Furthermore, when executing an IRA rollover, it is crucial to follow proper procedures to ensure that the transfer is processed correctly. This may involve completing specific forms provided by the financial institution where the funds are being transferred. It is important to carefully review and submit all necessary paperwork to avoid any delays or errors in the rollover process.

Overall, IRA rollovers can be a valuable tool for individuals looking to consolidate their retirement savings or transition funds to a new account. By understanding and following the requirements for an IRA rollover, individuals can ensure a smooth and successful transfer of their retirement funds. It is recommended to consult with a financial advisor or tax professional to navigate the rollover process and avoid any potential pitfalls.

0 Comments