![]()

#theartofwealthbuilding #nationalpensionscheme

National Pension System Trust is a specialised division of Pension Fund Regulatory and Development Authority which is under the jurisdiction of Ministry of Finance of the Government of India.

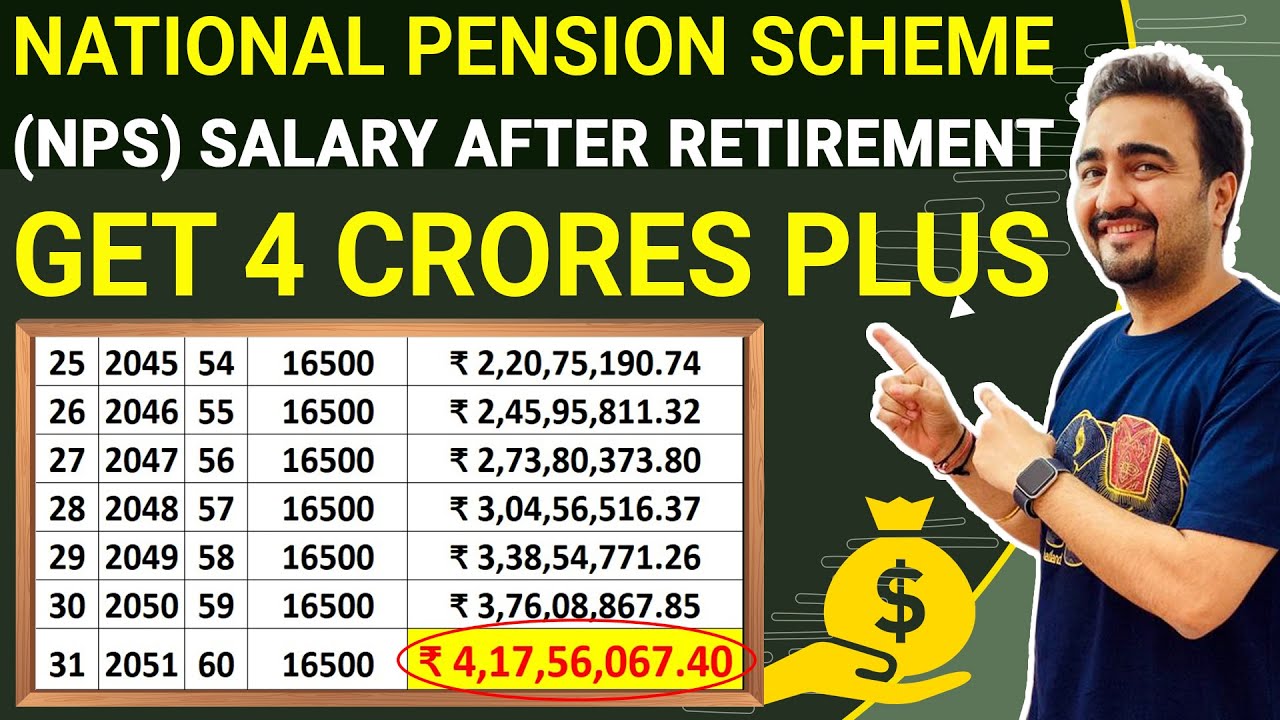

A subscriber can contribute regularly in a pension account during their working life, withdraw a part of the corpus in a lumpsum and use the remaining corpus to buy an annuity to secure a regular income after retirement.

✅To Consult Bhaven, CFP for your personal financial planning, click on the below link

✅ Or WhatsApp on – 9004789500

✅ Join our you-tube channel membership to get one stock recommendation each month for long term investing, click the link below

✅join exclusive telegram channel –

✅ VISIT OUR WEBSITE –

✅ Instagram, for passive income tips –

✅ facebook for, wealth creation tips-

✅ Join our exclusive, Facebook group

✅ To open an account with ZERODHA and invest in direct mutual funds, click on the below link(affiliate) …(read more)

LEARN MORE ABOUT: Retirement Pension Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Sir I have opened nps account on 4/11/2022 and on the same day i have deposited 50k on tier 1 .. but when I log in to account till date it is showing zero balance zero holdings

अरे फार्म भरना बताओ जो किसी शॉप पर लोकल में काम करता है उसके लिए एक दूसरे के वीडियो की नकल करके वीडियो बनाते रहते हो

I have come to realize that as a beginner you will achieve close to nothing investing in the vast stock market all on your own, that's why there are professional stockbrokers and account managers to assist beginners to achieve their financial and stock investment goals.

Thanks. It is the most informative video on YouTube about NPS.

Mai saudi me job karta hun

Mai khol sakpta hun nps account

Mai Mumbai se hun

Baki ka 40%kya nominee ko milega

NPS is a shit. I would rather invest in direct Equities. I don't care about tax savings.

I would easily beat those fund managers. Those funds managers would find it very difficult to generate even 15% because of the fund size. Whereas I can easily generate 20% by learning about stock market.

Small cap can deliver multibaggers and those fund managers can't invest the entire amount in small caps as they have restrictions but there is no restrictions on my style of Investment.

What happens to the remaining 40% amount which govt. holds to give u pension after death? Will the nominee get that money back?

sir agar koi 62 me death ho jai to balance amount ka kya hoga

One thing which you said wrong was there is no limit on 80ccd(2). There is upper limit of 7.5 lakhs.

I have joined in government service in the year 2005 , December. I'm going to retire after 11 years that is in 2033 . What will be my pension. Presently I'm receiving 90000 after deduction

Very Nicely & Cut clearly Explained sir..

NPS mins. Mis dhokha ops. Lagu ho

Please explain about balance of 40 %amount, after death of account holder who will hold balance of 40%principal amount

अरे फार्म भरना बताओ unemployed vaalon ko

Tyre 1 account nahi hota janaab, tea er 1 account hota hai.

2004 ma jo capf ma bharti hue the Inka nps ma total abhi dikha raha h 19 lakh rupe 2 saal nokri aur bachi h toh maximum 25 lakh sa uper toh jaye ga nahi isme kitna pension mile ga koi bta sakhta hai

सभी डाउट क्लियर हो गए मेरे। थैंक यू

Nps ko bakwas batana hai sir

Anuman ki dhanrashi kisi ko nahi milti

Mera jo 2014 sai abhi tk, 8% he return d rha hai cagr.

Isse upar ka return milega bhool he jau.

10% impossible hai…for a govt. Employee , jiske pass option nhi to change his investment ratios.