This is The Home of Sugar, Spice and Everything Nice!

Tune in Nairobi 94.4 • Mombasa 87.9 • Nakuru 96.0 • Eldoret 96.7 • Nyeri 90.9 • Kisumu 102.5 • Malindi 97.7. Always LIVE on …(read more)

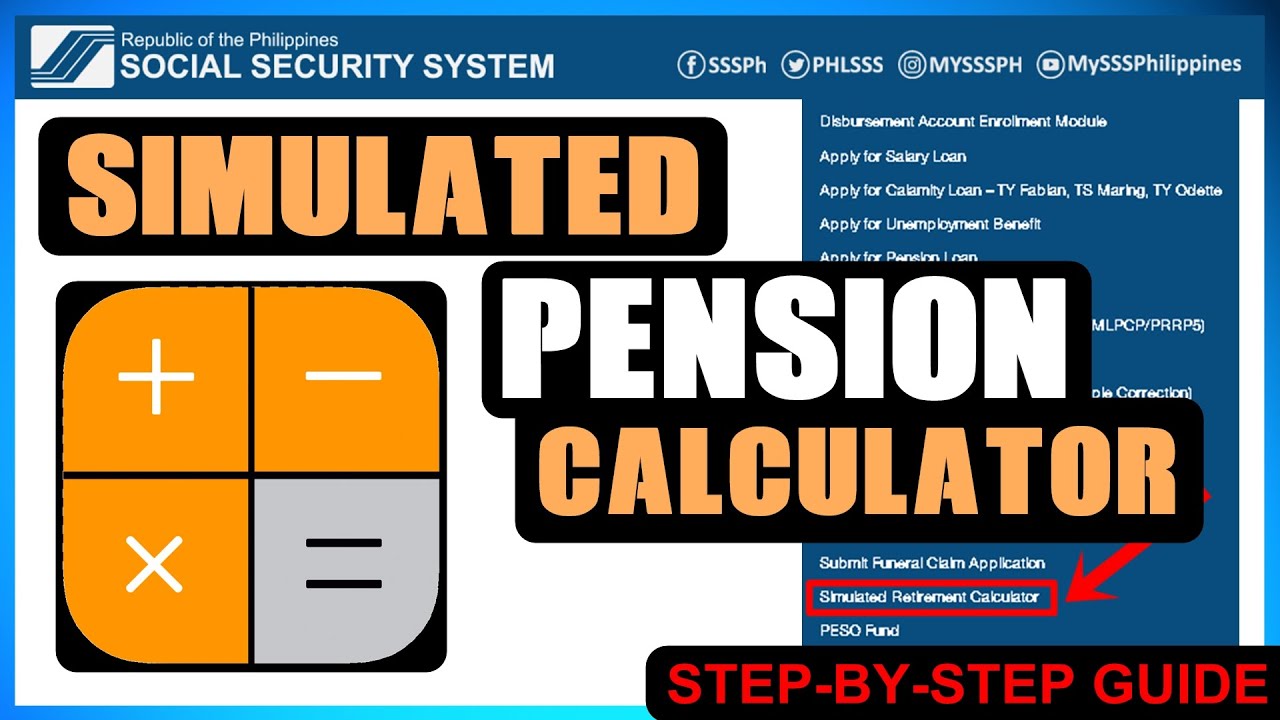

LEARN MORE ABOUT: Retirement Pension Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

As retirement approaches, individuals often have to make crucial decisions on how to allocate their pension savings to ensure they can comfortably sustain their lifestyle. Investing in a rental house and purchasing post-retirement medical cover are two options that can provide financial security and stability during retirement.

Investing in a rental house can generate stable income in retirement, allowing retirees to supplement their pension income. Rental income can help retirees cover their living expenses, pay off debts, or enjoy their leisure time. Additionally, a rental property can appreciate over time, providing retirees with the opportunity to sell their asset for a potentially significant profit.

Before purchasing a rental property with pension savings, retirees must consider the associated costs and risks. They must ensure the rental property generates enough income to cover the cost of the mortgage, maintenance, and other expenses. Retirees must also be prepared to handle tenant vacancies, unexpected repairs and maintenance costs, and fluctuating interest rates.

Another important aspect of retirement planning is purchasing adequate health insurance coverage. Retirees must consider post-retirement medical expenses, which can be significant, and may even exceed the value of their pension savings. Health insurance policies can help protect retirees from these expenses, as well as provide peace of mind knowing that any unexpected medical costs will be covered.

Retirees must choose policies with suitable coverage levels and premiums that fit their budget. They can also explore options like Medicare, which provides coverage for medical costs, including hospital and physician services, prescription drugs, and preventive care.

In conclusion, investing pension savings in a rental property and purchasing post-retirement medical coverage can provide significant financial benefits in retirement. However, retirees need to weigh the associated costs and risks thoroughly and seek professional advice to ensure their financial security is protected. With proper planning, retirees can enjoy their retirement years without financial concerns.

A great and informative discussion indeed!