![]()

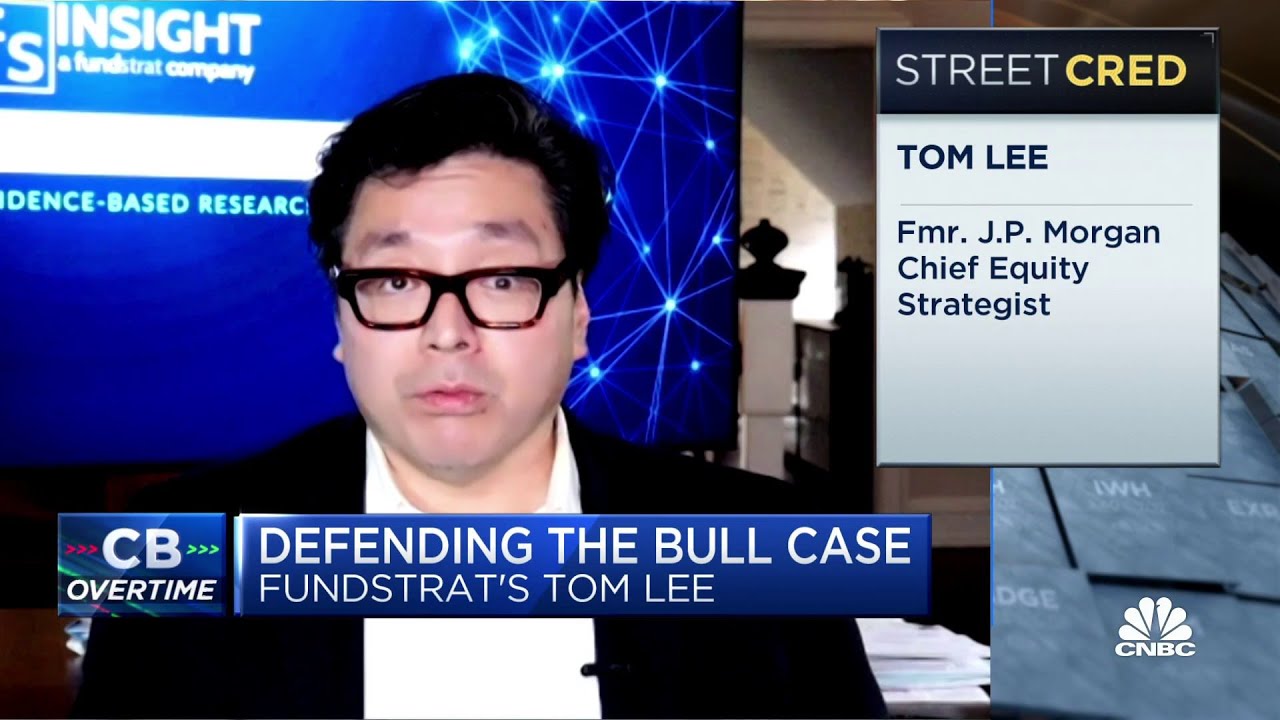

Tom Lee, Fundstrat managing partner, joins ‘Closing Bell: Overtime’ to defend his bullish call on the market. For access to live and exclusive video from CNBC subscribe to CNBC PRO:

» Subscribe to CNBC TV:

» Subscribe to CNBC:

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

The News with Shepard Smith is CNBC’s daily news podcast providing deep, non-partisan coverage and perspective on the day’s most important stories. Available to listen by 8:30pm ET / 5:30pm PT daily beginning September 30:

Connect with CNBC News Online

Get the latest news:

Follow CNBC on LinkedIn:

Follow CNBC News on Facebook:

Follow CNBC News on Twitter:

Follow CNBC News on Instagram:

#CNBC

#CNBCTV…(read more)

LEARN ABOUT: Investing During Inflation

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Hahahaha. He thinks people are performing some sort of analysis on this “market”? It’s now boiled down to the truth for these Wall Street so called gurus and the retail crowd. It’s where dumb money meets crooked money. They are fed betters. That’s it. Inflation at 20% and this “guru” is focused on the incremental fed hikes. Until ffr gets above inflation the discount rate is inflation. Duh.

Stop bringing this POS on.

Stocks have been a good buy lately, especially dividend stocks. In the end Lee will be right, but lately he sure has been wrong.

If you wanna be successful, you most take responsibility for your emotions, not place the blame on others. In addition to make you feel more guilty about your faults, pointing the finger at others will only serve to increase your sense of personal accountability. There's always a risk in every investment, yet people still invest and succeed. You must look outward if you wanna be successful in life.

Very well articulated; I wish I had more time for trial and error, but I'll be 56 in November and I need ideas and advice on what investments to make to set myself up for retirement, especially with the looming inflation and recession; my goal is to have a portfolio of at least $500k at the age of 60.

Is it just me, or are Tom Lee`s glasses getting thicker every time he comes on.

Wrong

More comedy. Please. Keep talking up, eventually like today it's up, thanks to Oil. But look at commodities today, major rise in inflation as a result. Good time to buy will be when markets stable in the late winter 2023 at this stage. Inflation will rise again as its a bipolar market for demand and supply, and USD denominated assets may be diminished due to diversification of production globally over the current political regimes in the G20s in past few years, hence as other countries rates increase, the US currency will drop slowly causing inflation to be imported once again. Expect a possible mitigation of inflation for a quarter, but then a rise. This is still a year out before its under control mostly, hence rates expected to hit as much as 6% by mid 2023. The political risks however will play a pivotal role in the coming months as to where the indexes head, outlier events. Only accumulate strategic equities on major dip weeks, and nothing more for now.

CNBC needs to stop putting Tom Lee on the air!!!

November of 2021's Credit Suisse research: AMZN to $4100, with their other top picks being NFLX @ $740, Teledoc @ $208, Square @ $300, and UPS. All of these analysts are/were very young, and extremely wrong.

Spot <on! You are getting good at being ahead of the trend. Good job man! You nailed it. How do we go into recession with home prices not going down . Loans are secure compared to 2008 or people/ corps paying cash. Massive transfer of funds to homes. Wouldn’t there have to be massive drop in home prices & increase of inventory if recession is here. You need to consider that inflation may be causing the consumer to spend at or above previous levels even if they are actually buying less bc everything costs more. Not sure that is a good indicator for the current state of things. So if people know that inflation is here and gets up every month. When would you buy stuff you wanted to buy for a while. Yes, NOW because it will get more expensive next month. So if people spend like crazy it's not a sign that inflation is going away, it's a sign that inflation will increase and at some point the people stop spending because inflation is so high they just can't or don't want to pay the high prices anymore. Most of us are pro-crypto because it represents financial independence from the government. Several of our states are looking to add the right to use crypto to their state constitutions. My state of ND is putting together a BTC farm with the state government's blessing as well. It really boils down to time regardless of how long, BTC will eventually win. All roads lead to Bitcoin! BTC originally set to work outside the system, but is currently using fiat on/off ramps b/c it's necessary for more adoption. It's unfair on how things have turned up to be due to the recent world pandemic things has been so difficult but BTC trading has helped me maintain financial stability. Although I believe that the benefits of successful trading come from an expert and that is why I made huge profits with the help of Mrs. Robin Moore, she is a genius and that is why I always advise beginners/investors to trade with professionals like her. So far I have been able to increase my trading portfolio from day trading with 4.07 btc to over 17.01 btc with the accurate trading signal given to me by a veteran trader and signal provider Mrs Robin Moore and I'm an attestant to the accuracy of her trading signal. You all in search of a way to recover your looses from the crash and accumulate more profits can reach out to her for profitable trading system on Telegram @moorerobin ** for any crypto related issues .

Trade and investments work hand in hand essentially because they both intercede each other to produce wealth or riches. More the reason why it should be ran professionally to avoid consecutive losses and achieve the named goal.

Every time I see an investor complain about losing money it immediately reminds me of my early days before I met the pro trader who helped me change it for the better. Start now to speak with a pro to help you earn profits or your complaints might be regular.

F the stock market it's a bunch of BS. The country is a mess just go to the stores people are hurting.

This guy is a joke. He is a broken clock. Always be buying. Thats the bias of most every analyst on CNBC. They always want the little guy to be buying. The only reason the market went up for 12 years is FREE FED MONEY. Now lets see the market provide double digit returns without that. Any idiot can look like a genius going on CNBC telling people to buy when the fed is handing out trillions in free money and keeping rates at zero.

When he declares bear maket, then that day will be the last day of the earth.

I suspect Tom Lee will reincarnate as a bull. Like B.E.E.F. Bitcoin EV Energy and can't remember what was his F

Tom Lee is the realtor of stocks. It’s always a good time to buy.

Lastly I hear his point loud and clear. What he fails to mention though is that the FED isn’t going to “pivot” ( damn they love that word so much). No. They won’t work this hard just to reverse course. Of course they will leave rates around 4%. A far cry from near 0 two years ago. Additionally earnings will continue to disappoint while adjusting from the whiplash effects of the last two years and all the supply chain issues etc.

So even when the fed sees inflation numbers cooling and they follow their plan to stop hiking after 3-4 more upcoming rate hikes, How does that leave us in a raging bull market surging higher like Lee here is so obsessed with. Like why on earth would that be bullish. Sideways at best.

Brooooo The only reason anyone listens to him was because he followed the fed and it’s was obvious when rates were near 0 and unlimited QE that the markets were going higher aka the 2020 March lows!!! Now in this environment the fed is tightening QT with target rate around 4% and he’s still clinging to hopes and prayers that his target on SPY of 470 is met in the next

>3 months!!! Hahahah While the fed continues tightening! I mean this guy was definitely paid off by somebody or he’s just lost his mind. He’s the next Cathy wood.

Lolllllll this guys only claim to fame is he’s a permabull. He said the market will close @ 470 before year end!!! It closed 356 last Friday in September 2022. Dont forget it. There’s a picture of Tom Lee in the dictionary under the word PUMP

This guy is buggin

You’re better off working with an experienced expert rather lose all you’ve worked for trading by yourself. John has been excellent in my opinion and that’s why I’ve never stopped working with him ever since I did my first investment in his platform.

my prediction only why of course! my friendly foes

putin is likely going to be very sneaky,, like compared to Trump warning etc ..mucho worse … China is definitely going to exploit a sleepy Joey your employer lol

cnbc your water supply .. lol drinking cooking whatever,, be on guard my foes!

the only information you cnbc hosts and employees will get are maga extremists in your kids schools and your backyards.. truth never lies Amen

I wasn't financially free until my 40’s and I’m still in my 40’s, bought my third house already, earn on a monthly through passive income and got 4 out of 5 goals, just hope it encourages someone that it doesn’t matter if you don’t have any of them right now, you can start TODAY regardless your age INVEST and change your future! Investing in the financial market is a grand choice I made. Great video! Thanks for sharing!Very inspiring! I love this