![]()

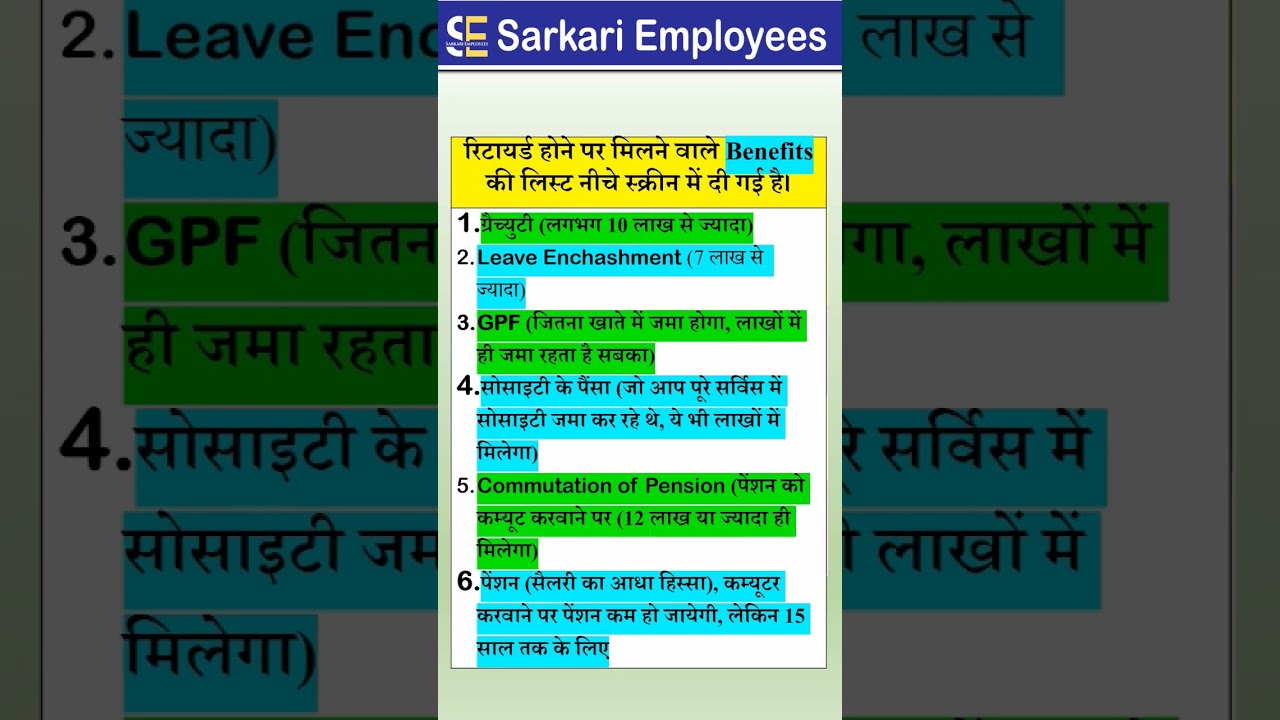

Retirement Benefits #shorts #pension #retirement

Following topic covered in this video:

pension, retirement pension, gratuity, death gratuity, retirement gratuity, commutation of pension, leave enchashment, society,…(read more)

LEARN MORE ABOUT: Retirement Pension Plans

REVEALED: Best Investment During Inflation

HOW TO INVEST IN GOLD: Gold IRA Investing

HOW TO INVEST IN SILVER: Silver IRA Investing

Retirement benefits are an important consideration for individuals as they plan for the future. These benefits provide financial security and stability during a time when individuals are no longer working and earning a regular income.

There are various types of retirement benefits available, with one of the most common being a pension. A pension is a fund set up by an employer to provide income to employees during retirement. This can be in the form of a defined benefit plan, where the employer guarantees a specific amount of income based on factors such as years of service and salary, or a defined contribution plan, where the employer and employee contribute to a retirement account that the employee can draw from during retirement.

In addition to pensions, individuals may also have access to retirement benefits such as Social Security, 401(k) plans, and other savings and investment accounts. Social Security is a government program that provides income to individuals who have paid into the system through payroll taxes. 401(k) plans are employer-sponsored retirement accounts that allow individuals to save for retirement while receiving tax benefits.

It is important for individuals to understand the various retirement benefits available to them and to plan accordingly. This may involve consulting with a financial advisor or retirement planning specialist to determine the best strategy for maximizing retirement benefits. Factors such as age, income, expenses, and retirement goals all play a role in determining the best approach to retirement planning.

Ultimately, retirement benefits are designed to provide individuals with a source of income during their retirement years, allowing them to maintain their standard of living and enjoy their golden years in comfort. By understanding the various options available and planning appropriately, individuals can set themselves up for a secure and financially stable retirement.

Abe thoda padna chahiye school bhi chale Jana

Ab esa nhi h

Ye sub beete jame ki baat hai.

Aaj ke samay me jiyo boss.

Logo ko bahakao nahi.

Tention ke sewaye kuchh nahi hai.

Kyaa itnya say 50yah 100gajj ki jameen mellgee delhi may one karor kaa rate hai

Commute