How to profit with lending in a SDIRA.

Self-Directed IRAs are a great way to diversify your portfolio, giving you control over your retirement. You can tie your lending to a real estate investment which can protect you in the case of a default, and so much more. Watch this quick video and let me know if you have any questions.

FULL LENGTH VIDEO:

IPlanGroup:

INFO KIT:

FEES:

My contact information:

Paul Rink

440-458-2566 call or text

Link to my Facebook page (Give Yourself a Raise), with a more detailed breakdown of outlet finance!

*

*Instagram:

@rinksrentals

*twitter:

@paulrink1

my other channels:

My real estate related topics:

RINKSRENTALS!

My axe throwing business:

MOVING TARGETS MOBILE AXE THROWING!

* Prize Pool referral link

Hi! I’m inviting you to PrizePool, a new type of banking account that pays out over 4k prizes totaling $50k each month from a guaranteed prize pool! Get a 10% bonus on all your prizes by using my referral link. My referral code is Y658E or click this link

If you like this video and content like this please subscribe, hit the bell notification and you will be notified when I post future videos….(read more)

LEARN MORE ABOUT: IRA Accounts

TRANSFER IRA TO GOLD: Gold IRA Account

TRANSFER IRA TO SILVER: Silver IRA Account

REVEALED: Best Gold Backed IRA

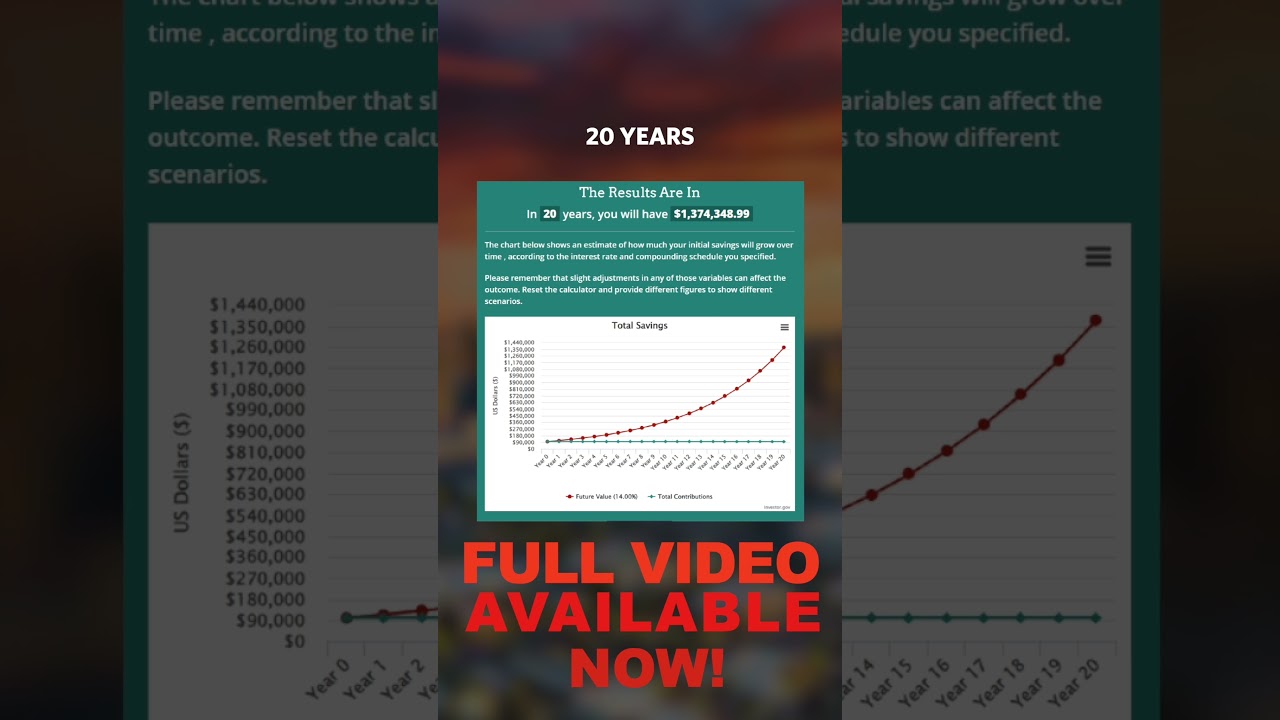

If you’re looking for a way to diversify your retirement portfolio, private lending through a Self-Directed Individual retirement account (SDIRA) might be a worthwhile option to investigate. With the potential to earn a steady stream of passive income, private lending can offer a low-risk investment opportunity for those looking to invest in real estate.

To get started, it’s important to understand what a SDIRA is and how it works. Essentially, a SDIRA allows you to invest in alternative assets such as real estate, private equity, or private lending. Unlike standard IRA accounts, which usually only allow for traditional investments such as stocks or bonds, a SDIRA gives you the flexibility to invest in a wider range of options.

When it comes to private lending through a SDIRA, there are a few key steps you’ll need to follow. First, you’ll need to set up a SDIRA account with a custodian who specializes in alternative investments. Once you’ve funded your account, you can begin looking for private lending opportunities.

One potential option for private lending is through peer-to-peer (P2P) lending platforms, which allow investors to lend money directly to borrowers. These platforms can provide a streamlined process for finding and investing in private lending opportunities, but it’s important to thoroughly research any platform before investing to ensure that it is reputable and trustworthy.

Another option is to work with a private lender directly, such as a real estate investor or developer. You can negotiate terms with the borrower, including the interest rate and length of the loan, and then fund the loan using your SDIRA funds.

It’s important to note that with private lending through a SDIRA, there are limitations on how involved you can be in managing the investment. For example, you can’t personally guarantee the loan or provide any services to the borrower that could be perceived as a conflict of interest.

Overall, private lending through a SDIRA can be a lucrative and low-risk option for supplementing your retirement income. By diversifying your portfolio, you can potentially increase your overall returns and secure your financial future. If you’re interested in exploring this option, do your research and consult with a financial advisor to determine if it’s right for you.

0 Comments